The Altseason Signal Traders Have Been Waiting For Just Flipped Active

It's here. The indicator that separates hype from genuine rotation just triggered. Forget the noise—this is the signal that historically precedes massive capital flows out of Bitcoin and into the altcoin universe.

The Domino Effect Is Real

Bitcoin's dominance chart isn't just a line on a screen; it's a pressure gauge. When it breaks a key level—like it just did—it releases a torrent of sidelined capital. Suddenly, every major portfolio manager is forced to rebalance. They're not buying the dip; they're chasing the pump in assets with smaller market caps and, theoretically, higher ceilings. It's the institutional version of FOMO, dressed up in a suit.

Narratives Over Fundamentals (For Now)

This phase isn't for the faint of heart. Rational analysis takes a backseat to momentum. AI-driven tokens, re-staking protocols, and the latest DeFi 3.0 buzzword will see parabolic moves that make no logical sense. The trick isn't to understand the tech—it's to ride the wave and get out before the music stops. Remember, in a bull market, even the most dubious project can find a narrative to hitch a ride on.

A Cynical Nod to Tradition

Watching crypto traders pile into altcoins based on a technical signal is like watching traditional finance guys finally buy the stock after the CEO appears on CNBC—the smart money is already halfway to the exit. The signal is active. The greed cycle is primed. Your move.

Major Altseason Trigger

In simple terms, Altseason can be defined as a phase where capital shifts from bitcoin to other altcoins, giving them time to soar and unleash their true potential in terms of price values and spikes. The investors have long been waiting for altseason to arrive soon, with expert Ash Crypto already putting out bullish predictions about the upcoming altcoin market phase.

Altseason happens when no one is prepared

2016: Breakout – retest

2017: Altcoin Parabolic run

2020: Breakout – retest

2021: Altcoin Parabolic run

2025: Breakout – retest

2026: Altcoin Parabolic run ?? pic.twitter.com/GQYfXIwZgR

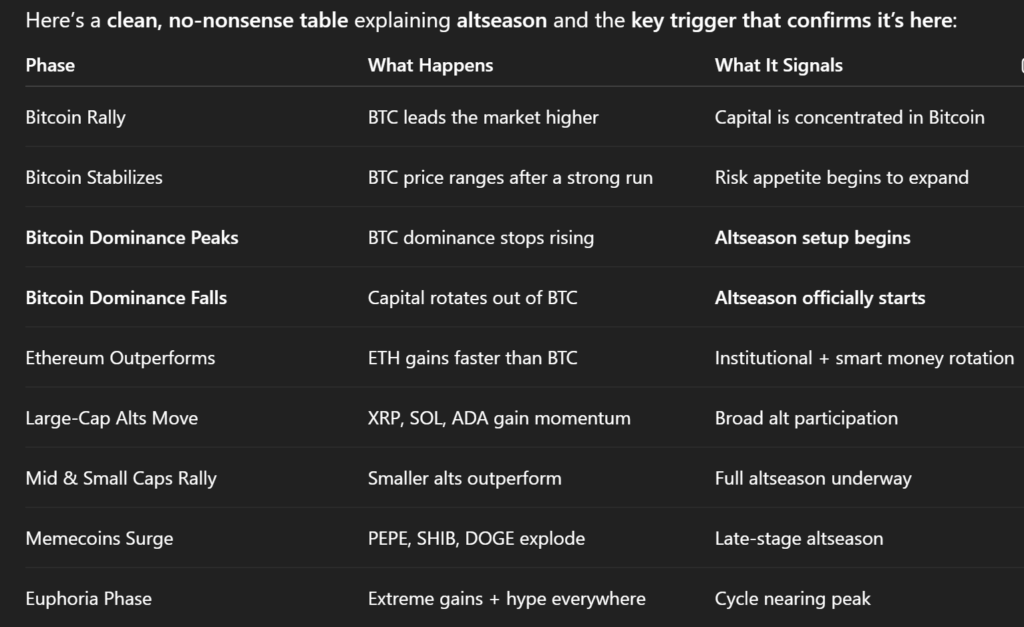

However, according to ChatGPT, one of the leading market triggers signalling the arrival of the altseason has already flipped green. This trigger is all about the recent capital shift, when Bitcoin dominance falls and money shifts to potential altcoins to truly turn the tables around for good. However, this signal is yet to catch pace, as the world awaits steady capital flow towards coins like ethereum and then mid- and small-cap altcoins.

More Triggers to Keep An Eye On

Per Ashley Crypto, a major crypto analyst, this phase is often marked by US Alts (Russell 2000) moving in sync with the Crypto Alts, which often signals the arrival of altcoin season.

Russell 2000 is the biggest indicator for Altseason, and it’s about to hit a new all-time high.

Same Cycle, Same Breakout Point

– Both Russell 2000 and ALTS MCAP peaked in Nov 2021, marking the cycle top.

– Both entered a long bear market (2022–2023).

– Now, Russell is… pic.twitter.com/deJeXVnj2v