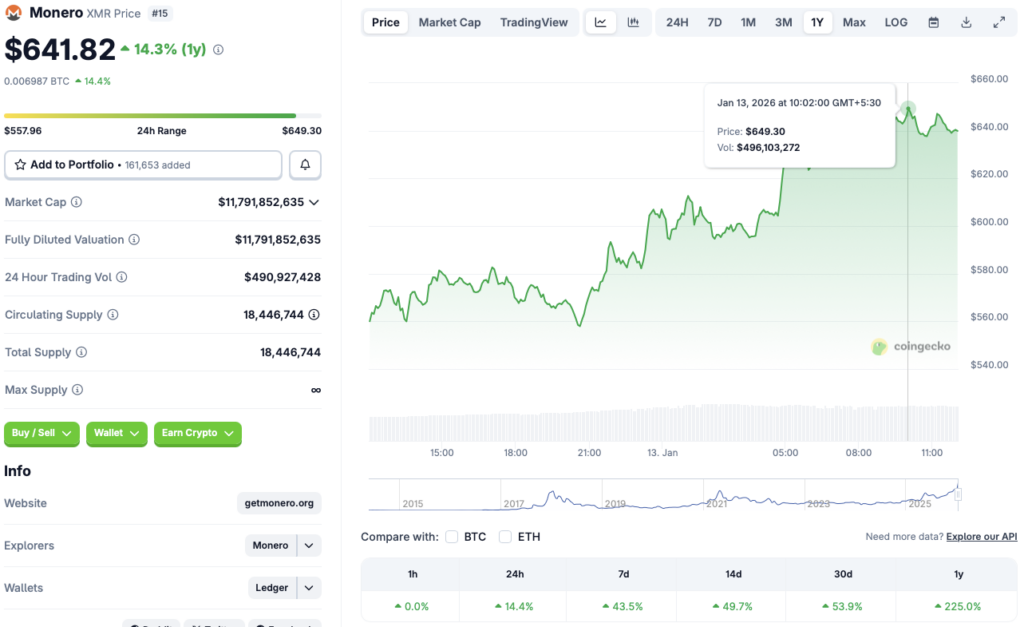

Monero Shatters Records: Enters Top 15 Cryptocurrencies as Price Soars to Historic $640

Privacy isn't just a feature—it's a market force. Monero, the digital asset built on anonymity, just bulldozed its way into the crypto elite's top 15, hitting a staggering $640 for the first time ever. Forget whispers; this is a roar from the shadows.

The Stealth Ascent

While regulators scribble new rules and TradFi banks scramble for their own 'permissioned' blockchains, Monero's engine just keeps humming. It bypasses the surveillance-heavy models of its transparent competitors, offering a digital bearer asset that actually works like cash. No public ledger snooping. No address clustering. Just pure, peer-to-peer value transfer. Turns out, demand for financial privacy isn't a niche—it's a multi-billion dollar market.

What The Charts Are Screaming

That $640 price tag isn't just a number; it's a statement. It represents a total valuation that now sits firmly among the industry's giants. This surge cuts directly against the grain of increasing KYC/AML dragnets across the ecosystem. Investors aren't just betting on tech; they're betting on a principle. And right now, that principle is paying off handsomely, proving that in the digital age, opacity can be just as valuable as transparency—sometimes more.

The Inevitable Backlash & The Road Ahead

Expect fireworks. This kind of growth will draw more regulatory scowls than a hedge fund manager at a tax audit. The very features that fuel its adoption make it a target. Every central banker's nightmare is an asset they can't track. Yet, that resistance only fuels the fervor of its proponents, creating a classic crypto feedback loop: pressure from above breeds conviction from below.

Monero's breakthrough is a middle finger to financial surveillance and a masterclass in market timing. It turns out that when you build a vault, people will pay a premium to use it—especially when everyone else is living in a glass house. The king of privacy coins just claimed its throne. Let's see how long the old guard lets it sit there.

Source: CoinGecko

Source: CoinGecko

Will Monero Continue Hitting New All-Time Highs, Or Will It Face A Big Price Dip?

Monero (XMR) entered a bullish phase in late 2025. The asset registered big gains while other assets were seeing price corrections. XMR’s 2025 rally came amid a surge in other privacy-focused coins as well. However, XMR’s latest price rally is likely due to the ongoing concerns at Zcash (ZEC). ZEC’s core development team, Electric Coin Company (ECC), recently quite en masse after a period of internal conflict. The development may have pulled investors out of ZEC, and pushed them into XMR. Investors may have also fallen prey to FOMO (Fear Of Missing Out), leading to increased inflows.

Given the larger bear market, there is a chance that Monero (XMR) will face a price correction soon. Moreover, FOMO may die out and inflows may dip. Investors could begin to book profits, leading to further price corrections. XMR’s rally is quite anomalous, and could see a sharp decline at any moment.

However, considering Monero’s (XMR) divergent performance during the late 2025 market crash, there is also a possibility that the asset will continue to surge over the coming days. How things pan out is yet to be seen.