BNB Surges Back: Binance’s Native Token Eyes $1200 Return in 2026 Rally

Green candles flash across trading screens as Binance's BNB coin stages a bullish reversal—market watchers now whisper about that magic number again.

The Technical Reawakening

After weathering regulatory storms and market-wide volatility, BNB's chart structure is printing a classic recovery pattern. The move signals renewed institutional interest and retail FOMO creeping back into crypto portfolios. Technical analysts point to strengthening support levels that weren't holding just months ago.

The $1200 Psychological Magnet

That four-digit price target isn't just random—it represents BNB's previous all-time high territory, a psychological barrier that now acts as both memory and magnet. Reaching it again would validate the token's utility beyond mere exchange fuel, though skeptics might call it another round of 'hopeium' in the perpetual crypto casino.

Ecosystem Tailwinds

Binance Smart Chain activity is ticking upward, with decentralized applications seeing increased volume. The network effect—where more users attract more developers who attract more users—appears to be reengaging. Even traditional finance analysts who usually dismiss crypto are noting the correlation between BNB's price and platform adoption metrics.

The Regulatory Overhang

No discussion about Binance's native asset is complete without acknowledging the regulatory elephant in the room. Global watchdogs continue their scrutiny, but the market's reaction suggests either priced-in fatigue or genuine confidence in Binance's compliance evolution—take your pick based on your risk appetite.

Whether this surge represents sustainable growth or just another speculative bubble depends entirely on who you ask. But one thing's certain: in crypto, narratives move faster than fundamentals, and right now the narrative says 'up.' Just remember—past performance guarantees absolutely nothing, except maybe higher blood pressure for traders.

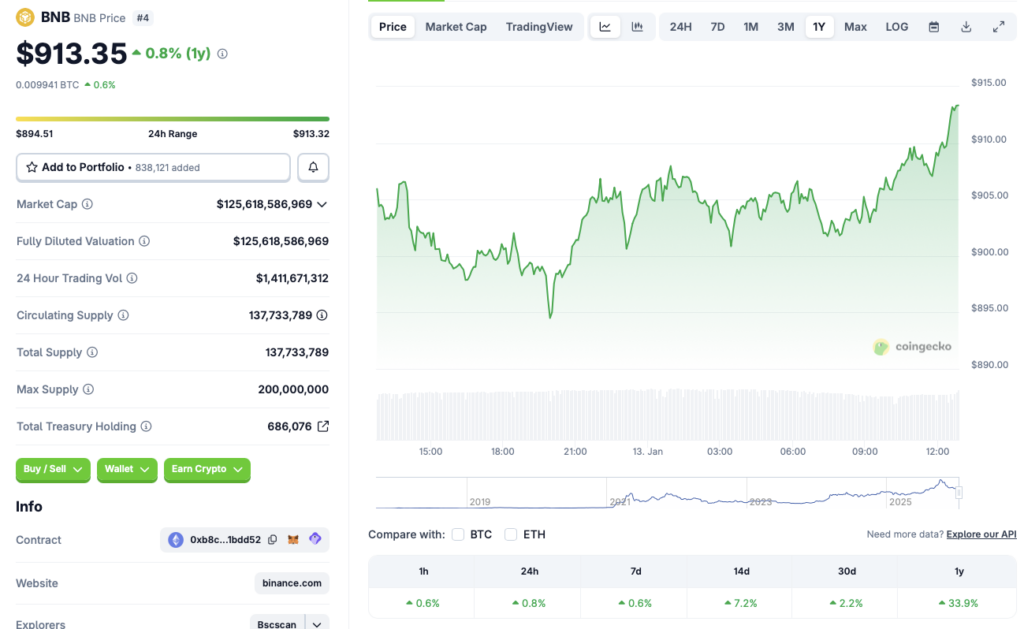

Source: CoinGecko

Source: CoinGecko

Binance’s BNB Coin Predicted To Hit $1200

According to CoinCodex analysts, BNB will continue its rally over the coming months. The platform anticipates the asset to reclaim the $1200 mark in April of this year, hitting $1261.24 on April 13, 2026. Hitting $1261.24 from current price levels will entail a rally of about 38%.

BNB’s current price surge could be due to Binance reporting strong volume figures for 2025. Binance is one of the most popular crypto exchanges in the world, and investor sentiment for its native token may have increased after the exchange’s strong 2025 performance.

BNB reclaiming the $1200 price level is also complimented by many experts anticipating a market-wide surge. In a recent report, Standard Chartered predicted a new all-time high for ethereum (ETH) in 2026. The financial institution anticipates ETH to breach the $7,500 mark sometime this year. Bitcoin (BTC) is also expected to hit a new peak in 2026. Bernstein and Grayscale expect the original crypto to climb to a new all-time high this year, citing that the asset follows a 5-year trajectory, and not a 4-year path. BTC and ETH hitting new peaks could lead to BNB experiencing a similar fate.

However, the crypto market is still recovering from its late 2025 losses. Investors are still keeping away from risky assets, evident from the fact that gold recent hit a new peak, breaching the $4,600 mark for the first time in history. The risk-off approach could lead to BNB facing challenges.