Trump Auto Tariffs: JPMorgan Chief Warns These Stocks Could Crash!

Trump auto tariffs are sending shockwaves through Wall Street right now as President Trump announced Wednesday a 25% tariff on imported vehicles and car parts. The stock market impact has been immediate and quite dramatic. Several major automakers are seeing significant drops in premarket trading. JPMorgan analysts are already warning investors about potentially devastating consequences for certain automotive stocks. The implications could be far-reaching.

Wall Street Reaction: How Trump’s 25% Auto Tariffs Hit Car Prices

The announcement of Trump’s new auto tariffs has been met with concern and even alarm from industry experts and analysts alike. Car prices are expected to increase significantly. Some estimates suggest jumps of $5,000 to $10,000 per vehicle, depending on make and model, among other factors.

Car Companies See Stocks Drop Quickly

The Big Three US automakers were hit hard in Thursday’s premarket trading. General Motors shares dropped 7%, while Ford fell about 3%. Stellantis, which has significant European operations, saw a 2% decline. Japanese manufacturers such as Toyota and Honda each slid about 2% in US-listed trading as well.

JPMorgan’s head of Japan equity research, Akira Kishimoto, analyzed the potential damage:

Tesla Bucks the Trend Amid Industry Turmoil

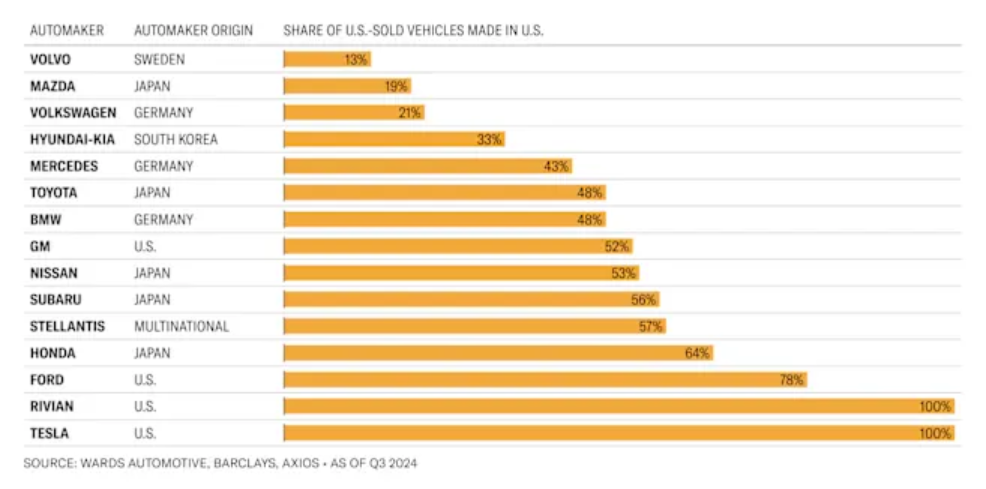

Interestingly, at the moment Tesla stock gained 1% following the announcement. The electric vehicle maker, led by Trump’s DOGE leader Elon Musk, produces most of its vehicles within the United States. This may potentially insulate it from the worst effects of the tariffs and give it an advantage over competitors.

noted RBC Capital Markets autos analyst Tom Narayan in his recent assessment.

German Manufacturers May Face Severe Impacts

European automakers are expected to be particularly vulnerable to the new tariffs. RBC Capital Markets warned that

The analysis continued,which suggests a cascading effect throughout the industry.

JPMorgan Slashes Price Targets for Major Stocks

JPMorgan autos analyst Ryan Brinkman has taken immediate action by reducing price targets for several automotive companies.Brinkman stated in a recent note to investors.

The price target reductions were made due to

At the time of writing, the full impact of Trump auto tariffs on the stock market and car prices remains uncertain and quite fluid. Wedbush tech analyst Dan Ives described the situation as

Industry Leaders Seek Immediate Talks

Industry response has been swift and decisive. According to auto journalist Jamie Butters, Ford executive chairman Bill Ford and GM CEO Mary Barra are scheduled to meet with Trump within the week to discuss the new tariffs. Such high-level meetings suggest the auto industry is taking the threat seriously and seeking to mitigate potential damage as soon as possible.

The tariffs are scheduled to take effect on the date of April the 3rd. This gives the automakers and investors just little time to prepare for what could be a major revamp of the automotive market landscape in the next few months.