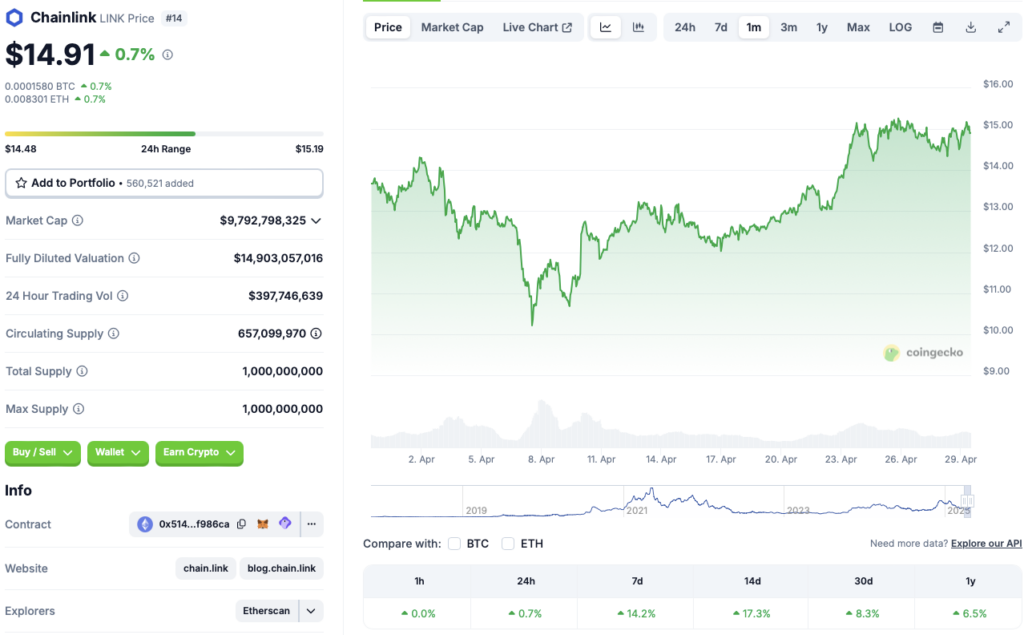

Chainlink Surges 17% in 14 Days—Is $17 the Next Stop?

Chainlink (LINK) bulls are back in charge—the oracle network’s token just ripped past resistance, clocking a 17% gain since mid-April. Traders now eye the $17 mark, a level last seen before the ’great crypto winter’ of 2022.

Why the rally? Real-world asset tokenization deals and fresh institutional interest lit the fuse. Of course, Wall Street’s suddenly ’bullish’—nothing like a price pump to make bankers remember blockchain exists.

Key hurdles ahead: LINK must hold above $15.50 and dodge the usual ’buy the rumor, sell the news’ circus. One hedge fund analyst muttered, ’We’ve seen this movie before—but hey, maybe this time the sequel doesn’t flop.’

Source: CoinGecko

Source: CoinGecko

Cryptocurrencies Hold Steady Amid Bullish Developments

Chainlink’s (LINK) latest rally comes amid a larger market-wide resurgence. The cryptocurrency market faced a substantial price dip earlier this month. Bitcoin’s (BTC) price fell to below $75,000. The market has made significant gains over the last few days. BTC has reclaimed the $94,000 price point. The global crypto market cap has hit $3.06 trillion after its recent dip to $2.5 trillion.

Other bullish developments include Arizona passing two bills that could allow the state to create a Bitcoin (BTC) reserve. The move may have led to a spike in investor confidence. LINK may have also benefited from the rise in investor sentiment.

Can Chainlink Hit $17 This Week?

According to CoinCodex analysts, LINK could continue its bullish trajectory over the coming days. The platform anticipates the asset to breach the $17 mark on May 5. CoinCodex further predicts LINK to trade at $19.49 on May 11. LINK’s price will rally by 30.72% if it hits the $19.49 target.

CoinCodex does not anticipate Chainlink’s (LINK) price to hold at $19. The platform expects a correction to $10.12 on May 24. Falling to $10.12 from current price levels will entail a correction of about 32.13%.

There is also a possibility that Chainlink (LINK) will not face a correction as predicted. The Federal Reserve may announce an interest rate cut soon. A rate cut could lead to a surge in risky asset investments.