Digital Yuan Dominates $986B CBDC Arms Race as 134 Countries Challenge Dollar Hegemony

The world’s central banks are locked in a high-stakes tech sprint—and China’s digital renminbi is lapping the field.

With $986 billion already in play, 134 nations are scrambling to deploy sovereign digital currencies. The goal? To dethrone the USD as the backbone of global finance. Beijing’s first-mover advantage looks increasingly like a checkmate move.

Wall Street’s legacy players? Still trying to figure out if blockchain is a stock ticker or a new type of bicycle chain.

Digital Yuan, CBDC Expansion, and the Global Push to Kill the USD

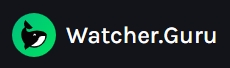

The scale of this CBDC battle is unprecedented, and the numbers tell the story quite clearly. Currently, 134 countries and currency unions representing 98% of global GDP are exploring central bank digital currencies, up from just 35 countries in May 2020. Every G20 nation is now involved in CBDC development, with 19 countries in advanced exploration phases, and also 13 countries already in the pilot stage.

Josh Lipsky from the Atlantic Council had this to say:

The digital yuan leads this transformation, and it’s not even close to being matched. China’s e-CNY remains the world’s largest CBDC pilot, operating across 17 provincial regions in sectors including education, healthcare, tourism, and also other key areas. This massive deployment demonstrates how the CBDC battle is moving beyond testing into real-world implementation.

Lu Lei, deputy governor of China’s central bank, stated:

Currency Substitution Accelerates Rapidly

The CBDC battle is driving rapid currency substitution globally, and the implications are staggering for traditional finance. China’s digital RMB cross-border settlement system connects ten ASEAN nations and six Middle Eastern countries, enabling 38% of global trade to bypass the dollar-dominated SWIFT network. This represents the largest coordinated effort to kill USD dominance in modern history, and also a strategic MOVE toward financial independence.

As of March 2024, Chinese payers settled over half (52.9%) of payments in RMB and used U.S. dollars for 42.8%. This shift demonstrates how the digital yuan is facilitating practical currency substitution, reducing reliance on traditional dollar-based systems, and also creating new pathways for international trade.

BRICS Strategy to Kill USD Gains Momentum

Coordinated digital currency projects by BRICS have sharpened their fight for CBDCs and their plan is becoming more visible every day. In March 2024, Yury Ushakov made known that an inter-BRICS blockchain payment system called BRICS Bridge was being formed. CBDC payments by member states will be made using the platform’s payment gateways which avoids being controlled by western networks.

Russian President Vladimir Putin stated:

The BRICS strategy extends beyond individual CBDCs, and it’s comprehensive in scope. Original member states Brazil, Russia, India, China, and South Africa are actively piloting digital currencies as part of a broader strategy to develop alternative payment systems that reduce USD dependency, and also strengthen economic ties among member nations.

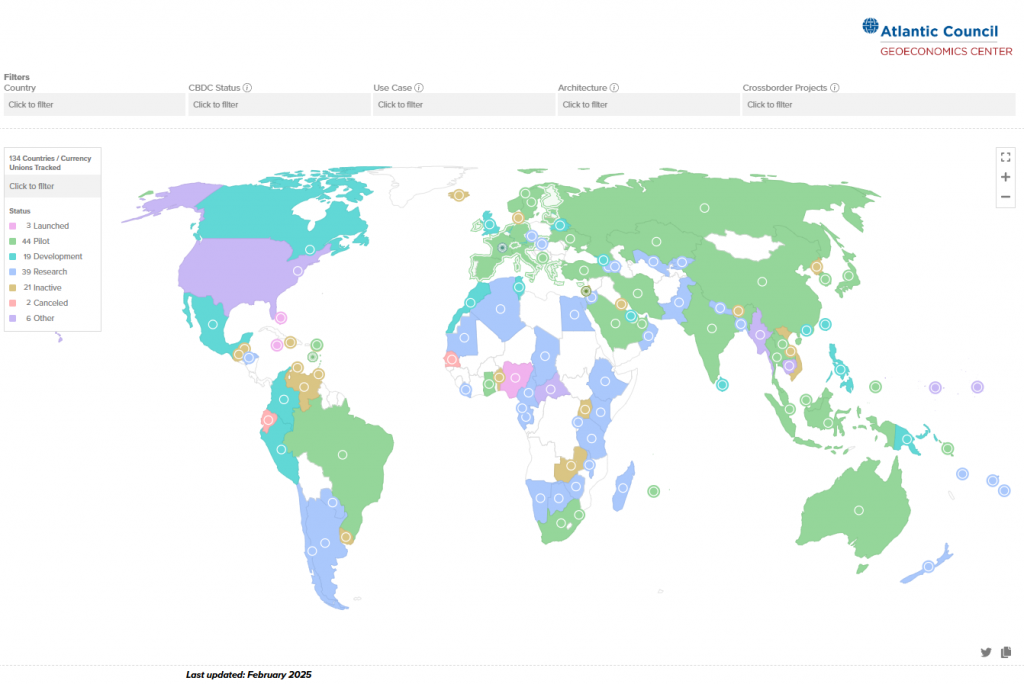

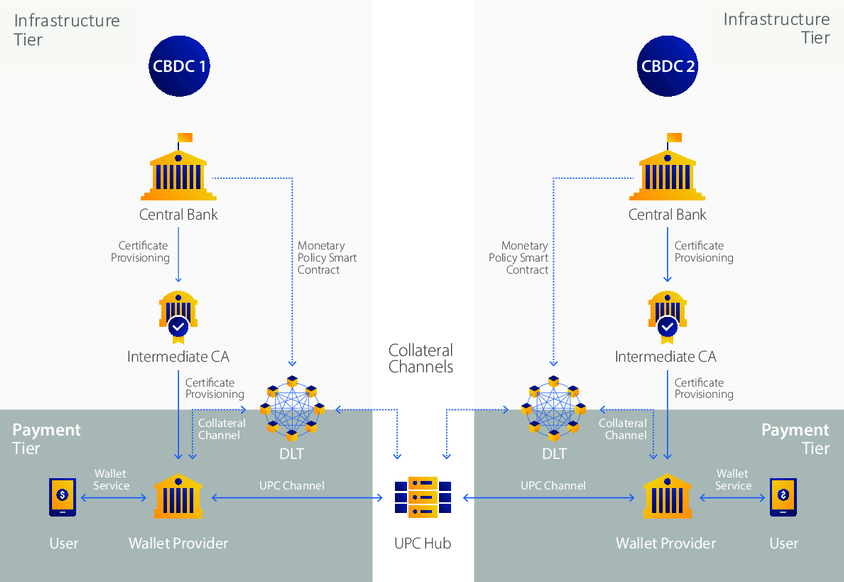

Cross-Border CBDC Revolution Changes Everything

The CBDC battle revolutionizes cross-border payments, delivering speeds far faster than traditional methods. Unlike SWIFT transactions that take 3-5 days, China’s digital currency processes payments in seconds. A pilot project between Hong Kong and Abu Dhabi achieved settlement in seven seconds with 98% lower fees, and also demonstrated the practical advantages of CBDC technology.

Because 87% of the world’s nations can use the digital RMB and cross-border transactions total $1.2 trillion, there’s strong momentum behind it. By linking financial institutions in China, Thailand, UAE, Hong Kong and Saudi Arabia, project mBridge creates alternative ways for banking and builds new paths for trade.

What Does The Future Hold?

CBDC competition will rise as more countries release their own digital currencies and right now, Bahamas, Jamaica and Nigeria have functioning CBDCs and 44 others are exploring them. Because these systems interact, they are supporting an independent financial system that does not depend on dollars as currency and also reducing the amount of traditional correspondent banking needed.