The Dollar’s Decline: Traders Flock to Crypto as Fiat Weakens

The USD’s slow-motion crash just got a new chapter—analysts now see Bitcoin and altcoins as the lifeboats.

Fiat’s funeral march plays on

While traditional markets cling to outdated forex metrics, crypto traders are already pricing in dollar devaluation. No surprise—when the Fed’s printer goes brrr, digital assets historically moon.

Bonus cynicism: Wall Street still thinks ’stablecoins’ need USD backing. Cute.

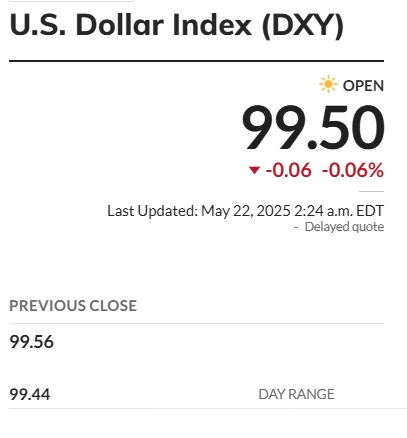

Source: MarketWatch

Source: MarketWatch

said George Vessey to Reuters, lead FX and Macro Strategist at payments firm Convera. The TRUMP administration’s US exceptionalism is making other countries cut ties with the dollar-backed assets. Many countries are diversifying their reserves with gold and other leading currencies by offloading US financial assets.

The long-term fiscal debt is also concerning many nations as it reached $36.2 trillion in 2025. Keeping the US dollar in central bank reserves is now a risky affair if the American economy enters a recession. Other nations will have to bear the brunt of the declining American economy, making their respective GDPs plunge. Holding American assets is now considered risky, but was once the bedrock of all global finances.

Currency: US Dollar Has More Room For Depreciation

Leading financial strategists from global banks remain bearish on the US dollar’s prospects. They are concerned about the fiscal picture of the American economy and the direction it is headed.said Steve Englander, the Global Head of FX Research at Standard Chartered.

The diminishing appetite for the US-backed financial assets and the dollar could shake the American economy next. In addition, the rigid process of making trade policies with the Trump administration will add to the burden. Other analysts claim that Trump is deliberately trying to crash the US markets, read here to know why.