The Dollar’s Dominance Cracks: How the US Currency Became Its Own Worst Enemy

The almighty greenback—once the bedrock of global finance—now threatens to undermine America’s economic hegemony. The so-called ’88% rule’ (that mythical threshold where dollar supremacy goes unchallenged) isn’t just wobbling—it’s flashing red.

For decades, the world danced to the dollar’s tune. Now? Central banks diversify. Bitcoin hits ATHs. Even gold bugs are gloating. The weaponization of SWIFT didn’t help—turns out countries don’t enjoy financial blackmail with their morning coffee.

And let’s not pretend the Fed’s ’soft landing’ narrative fooled anyone. You can’t print 40% of all USD in existence since 2020 and expect the world to keep playing along. De-dollarization isn’t some fringe conspiracy—it’s basic risk management now.

Here’s the cynical kicker: Wall Street still charges 2% fees to ’manage’ this slow-motion currency crisis. Some things never change.

How De-Dollarization, Tariffs, And Global Shifts Threaten Stability

The US dollar liability crisis stems from Trump’s aggressive tariff strategy that was meant to protect dollar dominance but has accelerated the very process it aimed to prevent. At the time of writing, financial markets are experiencing what Deutsche Bank calls unprecedented dysfunction, and analysts are genuinely concerned about what this means for America’s economic future.

George Saravelos from Deutsche Bank was clear about the fact that:

Market Collapse Shows US Dollar Liability Growing

The US dollar liability becomes evident as traditional market relationships break down completely. Normally, when stocks fall, bonds rally as SAFE havens – it’s been this way for decades. Right now, both asset classes are falling simultaneously, and this phenomenon signals deep structural problems that experts didn’t anticipate.

Saravelos also noted:

This rapid de-dollarization represents a fundamental shift where investors actively sell USD assets rather than seeking dollar liquidity during crisis periods, and this trend is accelerating faster than many predicted.

China Leads Global De-Dollarization Efforts

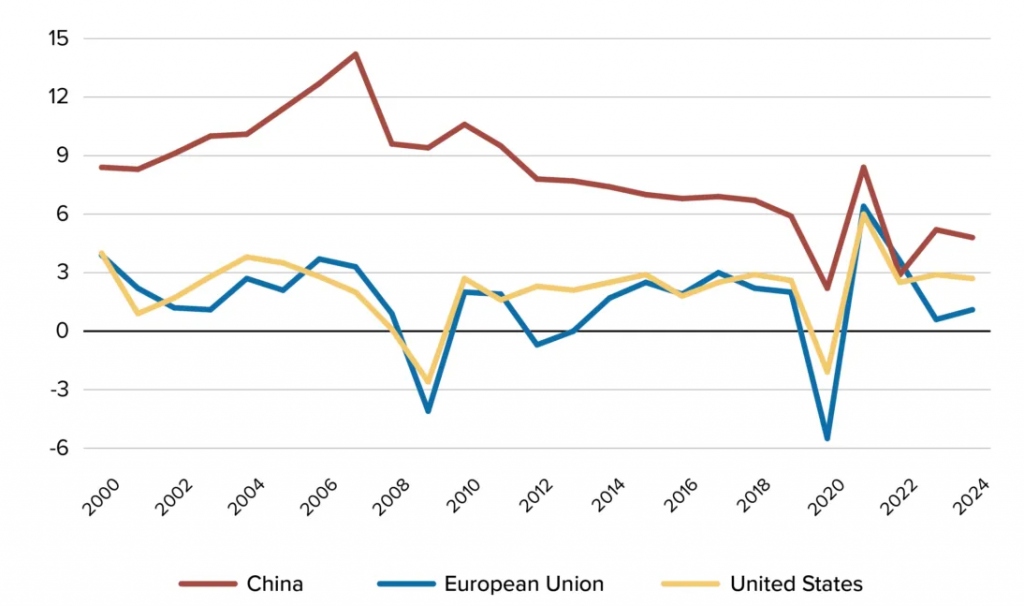

China’s response to escalating Trump tariffs has been swift and decisive, and Beijing isn’t waiting around to see what happens next. The country reduced its US Treasury holdings by more than 27% from January 2022 to December 2024, accelerating its sell USD strategy significantly faster than previous years.

Yu Yongding, former member of China’s Monetary Policy Committee, warned about Trump advisor Stephen Miran’s proposed “Mar-a-Lago Accord”:

The proposal WOULD force foreign countries to exchange Treasury holdings for 100-year bonds with no interest payments, which Chinese economists consider equivalent to debt default and a growing US dollar liability that could reshape global finance.

Trump Tariffs Accelerate Global Dollar Dominance Decline

Japan’s Finance Minister Katsunobu Kato has suggested Tokyo could sell USD Treasury securities as leverage in trade negotiations, highlighting how Trump tariffs are pushing even longtime allies away from dollar assets. This is particularly concerning because Japan holds $1.13 trillion in US Treasury securities, making it the largest foreign investor.

The global dollar dominance faces coordinated challenges as BRICS nations representing 42% of global GDP actively pursue alternatives to dollar-based trade settlement. This de-dollarization trend has gained unprecedented momentum under current trade policies, and there’s no sign of it slowing down.

US Dollar Liability Threatens Military Superiority

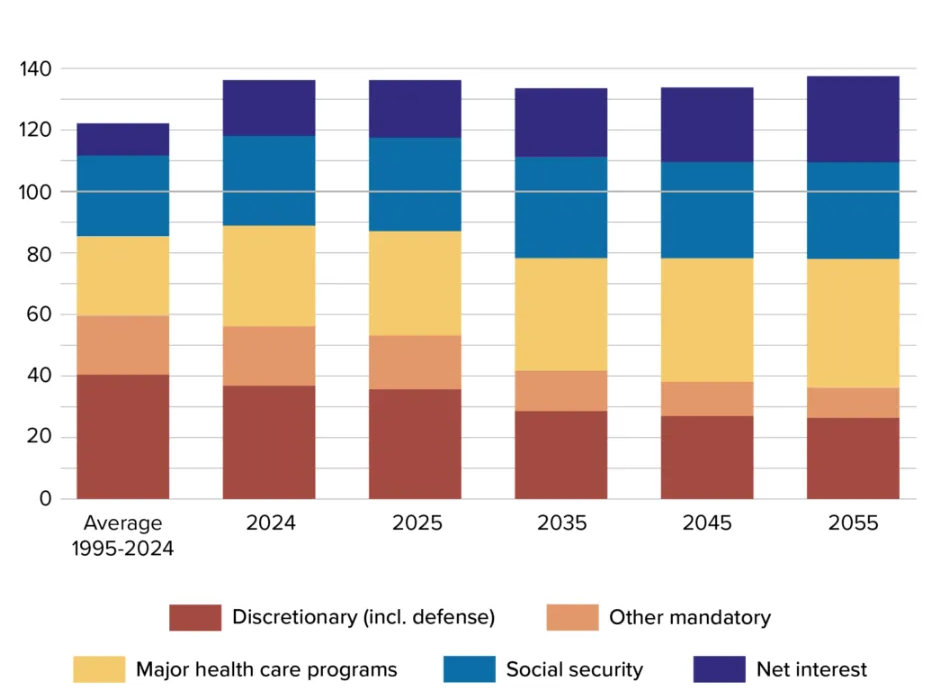

The US dollar liability extends beyond financial markets to America’s ability to maintain military dominance, and this connection is more critical than many realize. Fiscal constraints increasingly limit defense spending as the Congressional Budget Office projects deficits above 6% of GDP with government debt rising from 98% of GDP in 2024 to 118% by 2035.

Martin Mühleisen and Valbona Zeneli from the Atlantic Council warned:

US net foreign liabilities have reached 70% of GDP, exceeded only by Greece, Ireland, and Portugal among developed nations. This debt burden severely constrains America’s response to military challenges while the global dollar dominance continues eroding at an alarming pace.

The transformation of America’s greatest asset into the US dollar liability reflects fundamental shifts in global economic power that are happening right now. Loss of currency dominance would force impossible choices between military budgets, social programs, and debt service – decisions that could reshape the post-World War II order as countries continue efforts to sell USD assets and pursue de-dollarization strategies in response to Trump tariffs and declining confidence in American financial stability.