Ethereum’s July 2025 Showdown: Can ETH Defy the Odds and Smash $3K Again?

Ethereum bulls are back in the ring—but will July 2025 deliver the knockout punch to reclaim $3,000?

The stage is set for a high-stakes crypto rematch. After weathering bear markets, regulatory storms, and the occasional 'Ethereum killer' hype train, ETH faces its ultimate test: a return to glory at the $3K psychological threshold.

Market whispers suggest institutional money might finally be ready to play—assuming they can tear themselves away from their 'safe' 2% bond yields. Meanwhile, retail traders are dusting off old wallets, half-remembering promises of 'the flippening.'

Technical indicators flash conflicting signals. The merge is ancient history now, but layer-2 adoption hits record highs—even if gas fees still spike whenever someone sneezes 'NFT' too loudly.

One thing's certain: if ETH punches through $3K this summer, Wall Street will suddenly 'discover' blockchain again—just in time for their Q3 bonuses.

ETF Inflows Aren’t Helping Price?

Bitcoin (BTC) and ethereum (ETH) ETFs have seen constant inflows over the last few days. ETH ETFs saw around $31.8 million inflows on July 1. While BTC is experiencing a price surge due to the ETF buys, ETH does not follow the same pattern.

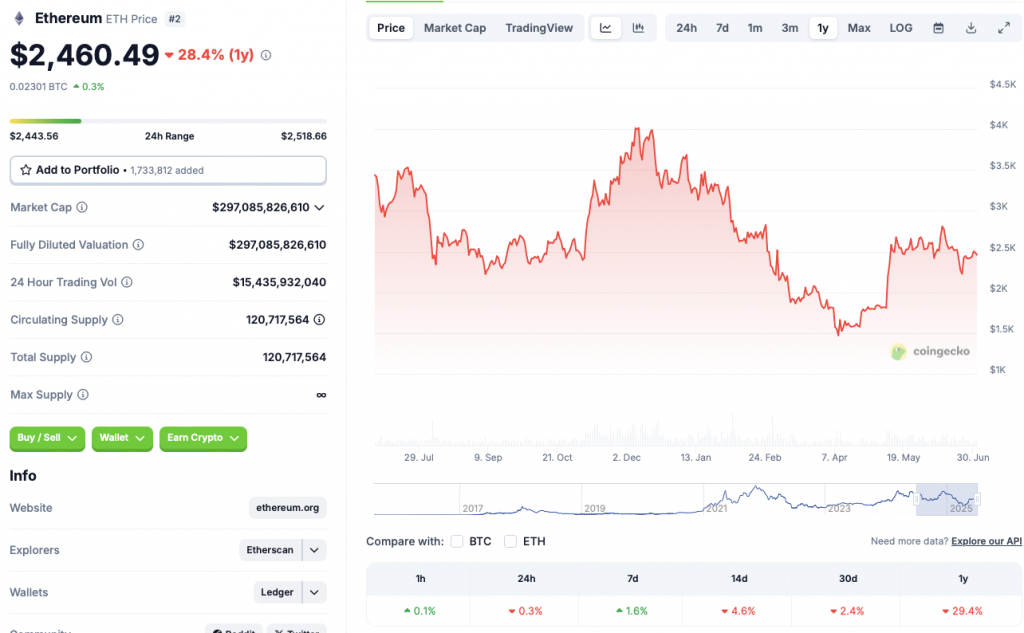

Ethereum (ETH) is down 0.3% in the daily charts, 4.6% in the 14-day charts, 2.4% in the monthly charts, and 29.4% since July 2024. The second-largest crypto by market cap has maintained some gains over the last week. ETH’s price has rallied by 1.6% in the weekly charts.

Tom Lee Claims Ethereum Is The Next Bitcoin

According to Fundstrat’s Tom Lee, Ethereum (ETH) could be the new Bitcoin (BTC). Lee believes so because of the recent rise in stablecoin adoption. Lee highlights how stablecoins are built on the ETH network. He believes this aspect of the project makes it a solid consideration.

![]() TODAY: Tom Lee explains why he thinks Ethereum is the new Bitcoin. pic.twitter.com/4SVI3pmjla

TODAY: Tom Lee explains why he thinks Ethereum is the new Bitcoin. pic.twitter.com/4SVI3pmjla

ETH experienced a rally in May after the Pectra upgrade. The update brought back ETH burns. The rally, unfortunately, was short-lived. Market volatility and global geopolitical tensions led to a market-wide correction.

ETH’s current resistance is at the level of $2500. Any surpassing of this price point has the potential to catapult the asset to the $3000 mark. The question is whether ETH will be able to reach the mark of $3000 in July. The asset might possibly exceed the mark of $3000 in the event that the market situation improves. An interest rate cut from the Federal Reserve could also aid its rally.