Plug Power Skyrockets 82%—Is a 100% Surge Next for This Penny Stock?

Plug Power just pulled off an 82% moonshot—now traders are betting it'll double. Here's why this hydrogen high-flier has Wall Street buzzing.

The green energy gamble paying off (for now)

While legacy automakers fumble with EV transitions, Plug's hydrogen fuel cells are suddenly the shiny object in the room. Never mind that most investors couldn't explain how the tech works if their yacht depended on it.

Penny stock or powerhouse?

That 82% surge came from retail traders piling in like it's 2021 again. The real question: can Plug sustain momentum when institutional sharks start circling these waters?

One hedge fund manager quipped, 'We'll know it's time to sell when CNBC starts doing live segments from hydrogen fueling stations.' Until then—buckle up.

Source: Google

Source: Google

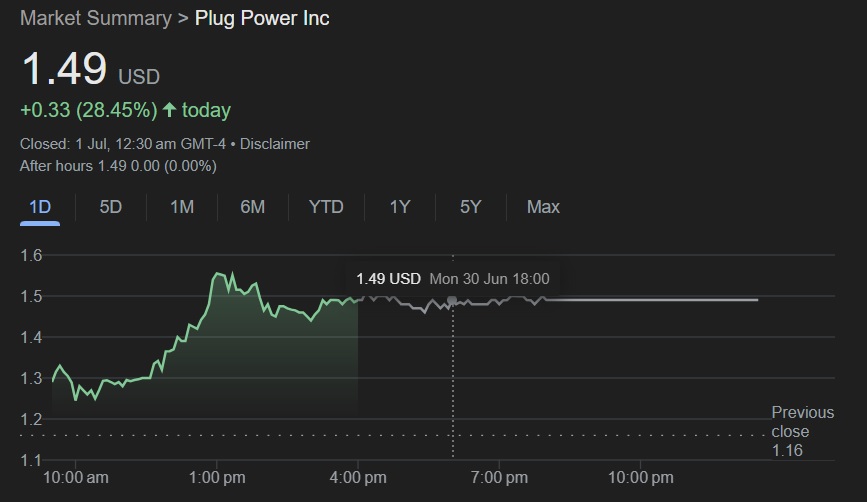

In the last 30 days, Plug Power has surged close to 82% going from a penny stock to above $1. PLUG was at $0.80 and dramatically hit $1.5 in just a months time. Traders who held on for a month have made 80% returns making PLUG among the top gainers in the markets.

Why Is Plug Power Stock Rising?

Plug Power Inc deals with developing hydrogen-based clean energy technology and received a boost after the Senate wrote the ‘Big, Beautiful Bill‘. Trump’s bill is currently being worked on in Congress and it includes a version where tax credits will be extended to the hydrogen manufacturing industry. The details of the bill sent hydrogen-based manufacturing companies see their stock prices soar across the board.

Will It Double in Price Again?

PLUG is a risky bet as the company’s sales and revenues are not promising. It is struggling to expand its business and is operating at a loss and burning cash to survive. Only investors with high-risk tolerance can bet on Plug Power stock and ride the rally if the momentum continues.

The recent surge in value is only temporary due to the Big, Beautiful Bill making its way into the Senate. Once the bill is passed and made law and the dust settles, Plug Power stock will get back to normalcy. While the extension of tax credit is only a lifeline, that does not mean its sales and revenues will increase. Chances of filing for bankruptcy remain high as losses pile up for the company.