Trump’s World Liberty Makes $10M Ethereum Splash – ETH Soars Past $3300

Political megafund dives headfirst into crypto as Ethereum rallies.

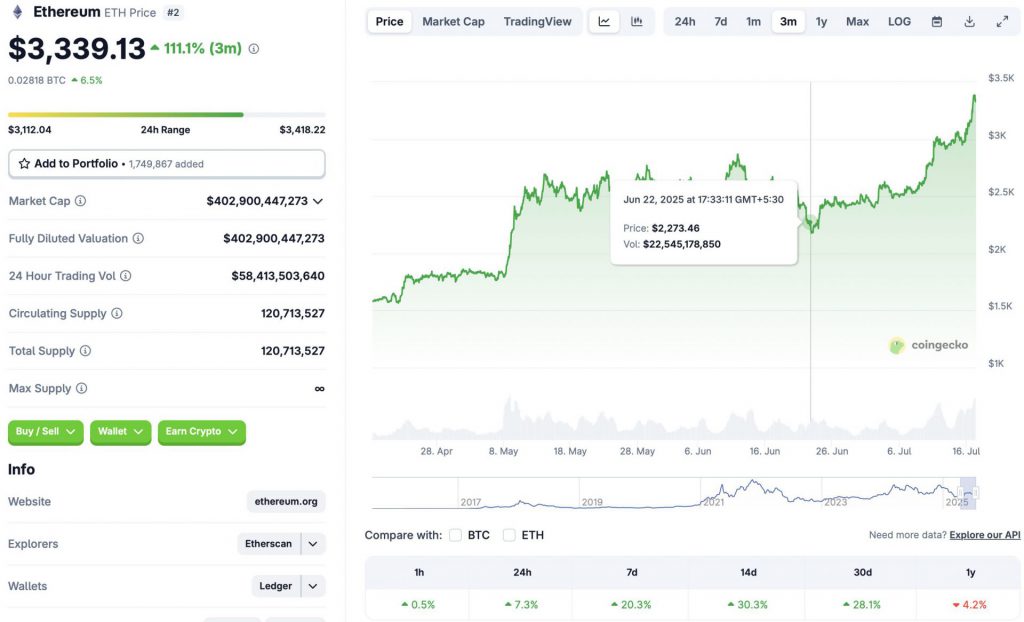

Trump’s World Liberty just dropped a cool $10 million into Ethereum – and the market noticed. ETH surged past $3300 within hours of the news breaking, proving once again that institutional money moves markets faster than a Twitter rumor.

Wall Street meets blockchain

The purchase signals growing crypto acceptance among traditional power players. While hedge funds have been flirting with digital assets for years, this move comes from a politically-charged investment vehicle – making it twice as controversial and three times as interesting.

Ethereum’s proving its staying power

At $3300, ETH continues its march toward reclaiming previous highs. The network’s post-Merge fundamentals appear to be winning over skeptics – even those who still think ‘gas fees’ refer to their last fill-up.

Another day, another whale making waves in crypto’s turbulent waters. Will this trigger a new institutional FOMO wave? Or just another round of ‘buy the rumor, sell the news’? Only your portfolio manager’s ulcer knows for sure.

Source: CoinGecko

Source: CoinGecko

Ethereum Moving Full Steam Ahead

ETH’s latest rally comes amid a market-wide resurgence. The cryptocurrency market broke out after Bitcoin (BTC) hit a new all-time high of $122,838 on July 14.

Ethereum (ETH) and Bitcoin (BTC) have seen constant institutional inflows over the last month. The surge in institutional inflows is the likely reason behind the latest market rally. Donald Trump-backed World Liberty Financial is not the only firm hoarding up on ETH. BlackRock purchased nearly $180 million worth of ETH on July 15.

Will the Asset Hit $4000 Next?

Ethereum (ETH) has not traded above the $4000 mark since December 2024. ETH’s December rally was followed by BTC hitting a new peak. We could see a similar pattern this time as well.

There is also a possibility that ETH will face a correction. The current cycle has seen a substantial decline in retail investors. The Federal Reserve’s decision not to cut interest rates may have pushed retail players into hibernation. The lack of retail players could lead to the rally slowing down.

If the Federal Reserve cuts interest rates after its next meeting, it could lead to a surge in retail investments. Such a development could further propel Ethereum’s (ETH) rally.