Ethereum ICO Whale Cashes Out: $6,200 Turned to $85M – Exit Strategy Begins

A prescient Ethereum ICO participant just flipped crypto’s ultimate jackpot—turning a $6,200 bet into an $85 million windfall. Now, the sell-off starts.

From garage gamble to generational wealth

The anonymous whale’s 2015 investment—roughly the price of a used Honda Civic—now rivals the GDP of a small island nation. ETH’s 13,700x surge proves even broken clocks get rich twice in crypto.

Exit signs flashing

On-chain data shows the first major moves to liquidate positions, sparking chatter about market timing. Traders are torn: Is this a savvy top signal or just another ‘dumb money’ legend overstaying their welcome?

Bonus jab: Wall Street fund managers who dismissed ETH at $10 are now pitching ‘blockchain exposure’ funds with 2% annual fees—progress!

They originally received 20,000 $ETH for $6,200 at GENESIS and still holds 1,623 $ETH ($6.99M). pic.twitter.com/of5BVWBzde — Cointelegraph (@Cointelegraph) August 11, 2025

Will ETH Fall After Ethereum Millionaire Begins Selling?

ETH has seen an incredible rally over the last few months. The asset struggled to gain momentum after the 2021 bull run. Things finally seem to be falling into place with ETH.

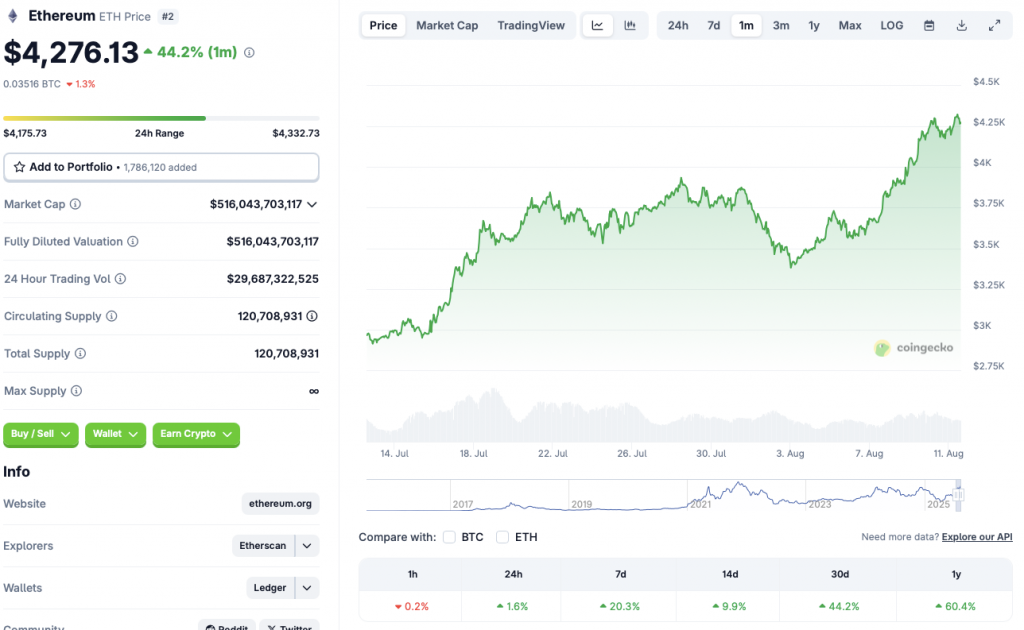

ETH began its upward momentum after its Pectra upgrade in May 2025. It made a big ascent before facing a correction in June. Ethereum (ETH) has once again breached the $4000 mark, a level last traded at in December of last year. Despite the Ethereum millionaire selling 2300 coins, ETH is green across the board. The asset has rallied 1.6% in the daily charts, 20.3% in the weekly charts, 9.9% in the 14-day charts, 44.2% over the previous month, and 60.4% since August 2024, according to CoinCodex ETH data.

ETH’s rally could be due to several reasons. The general market bullishness is one likely factor. Bitcoin (BTC) has reclaimed the $122,000 price point today. The original crypto seems to be moments away from hitting a new all-time high.

Another reason is likely due to consistent ETF inflows from financial institutions. ETF inflows have had one of the most significant impacts in the current cycle. Corporate treasuries have also begun hoarding crypto assets. ETH seems to be part of the corporate treasury appetite.

Another reason for ETH’s rally could be President Trump’s decision to allow 401(k) retirement funds to invest in crypto. Investors may be anticipating retirement funds to increase their Ethereum exposure.