🚀 Don’t Miss Out: 2 Warren Buffett Stocks Primed to Explode Ahead of 13F Filing

Wall Street's waiting game is almost over—and these Buffett-backed plays could deliver fireworks.

The 13F countdown begins

With the SEC filing deadline looming, institutional whales are already positioning. Two Oracle-approved holdings show unusual activity that screams 'accumulation.'

Why these stocks could pop

Market makers hate surprises more than hedge funds hate transparency. When Berkshire's holdings get disclosed, the algos will chase whatever Buffett's been buying—as usual.

One cynical truth? The 'smart money' front-runs these filings so hard they might as well publish their 13Fs before trading the positions. But that would require Wall Street to play fair—and we all know how likely that is.

Discover Warren Buffett Stocks to Buy Amid Market Volatility and Dividend Growth

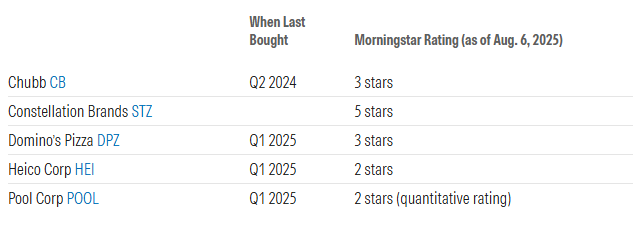

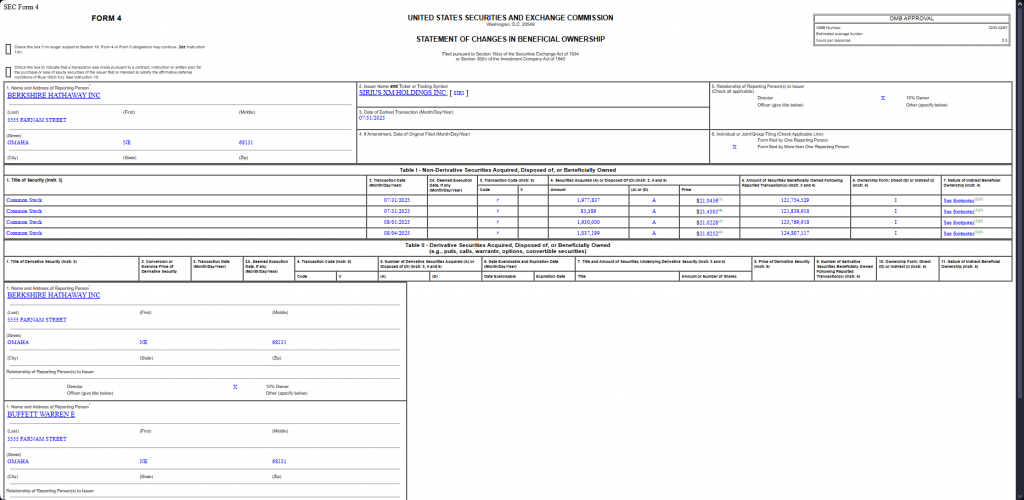

Even though they were net sellers, Buffett’s team actually identified some strategic Warren Buffett stocks to buy during that April selloff we all remember. The upcoming Berkshire Hathaway 13F filing is going to reveal the specific moves they made, but right now two holdings are standing out as really exceptional value investing stocks.

1. Occidental Petroleum – Buffett’s Big Energy Bet

Berkshire owns about 27% of Occidental Petroleum, which makes it one of the top Warren Buffett stocks to buy candidates out there. Trading 28% below its $59 fair value estimate, this represents a classic value investing stocks opportunity that’s hard to ignore.

Morningstar senior analyst Gregg Warren had this to say:

The company’s massive $55 billion Anadarko acquisition was partly financed through Berkshire’s $10 billion preferred investment, and it actually strengthened Occidental’s position among dividend growth stocks in the energy sector.

2. Kraft Heinz – The Contrarian Play That’s Actually Working

Despite taking a $3.8 billion write-down, Kraft Heinz remains compelling among Warren Buffett stocks to buy right now. Trading at a 47% discount to fair value, it really exemplifies value investing stocks principles during all this market volatility we’re seeing.

Morningstar director Erin Lash stated:

The company is targeting $2.5 billion in cost savings by 2027, which is supporting its position among dividend growth stocks that are worth watching.

At the time of writing, both stocks represent Warren Buffett stocks to buy before the Berkshire Hathaway 13F filing reveals additional insights into the value investing stocks strategy amid this ongoing market volatility.