Ethereum ETFs Smash Records: $1 Billion Floods In—Best Month Since Debut

Wall Street's crypto crush just got serious. Ethereum ETFs—once the underdogs of institutional investment—have raked in a jaw-dropping $1 billion surge. That’s not just growth; it’s a full-blown capital stampede.

Why the frenzy? TradFi finally woke up to ETH’s yield potential. Forget ‘slow and steady’—this is hedge funds front-running the next regulatory greenlight. (Because nothing moves money faster than FOMO wrapped in compliance paperwork.)

But here’s the kicker: liquidity begets liquidity. As inflows hit record highs, the ETH/BTC correlation is fraying. Decoupling narrative or just speculative froth? Either way, the smart money’s betting Ethereum’s infrastructure play outshines Bitcoin’s ‘digital gold’ schtick.

Of course, Wall Street still takes its cut—because 2% management fees on volatile crypto assets are the real ‘stablecoins’ in this equation.

Source: SoSoValue

Source: SoSoValue

Ethereum Dips Despite Record ETF Inflows

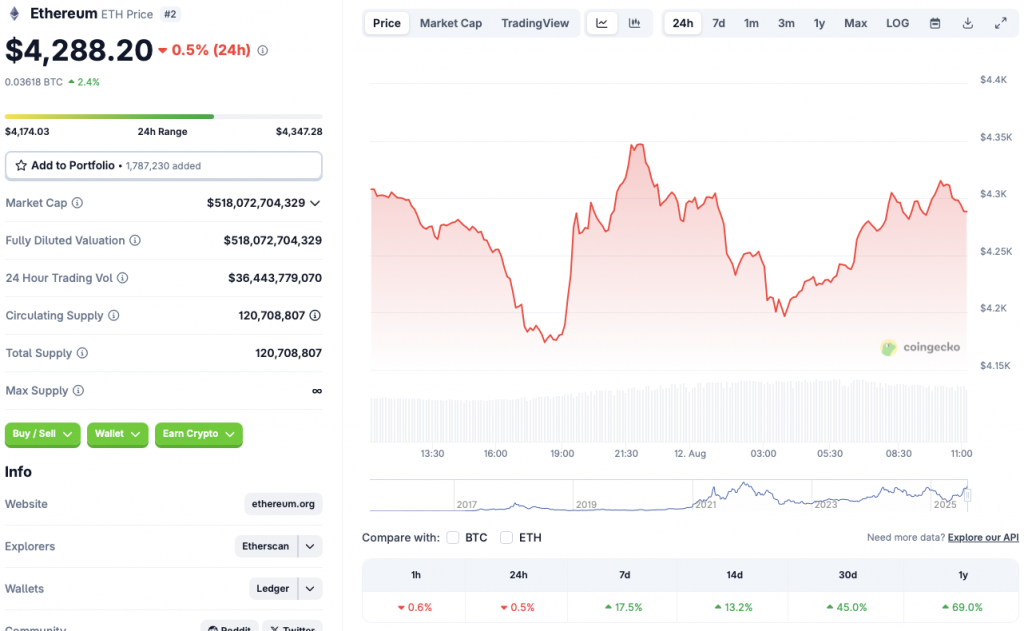

Ethereum (ETH) faced a 0.5% correction today, despite record ETF inflows on Aug. 11. While the asset is red in the daily charts, it continues to trade in the green zone in the other time frames. According to CoinGecko Ethereum data, ETH has rallied 17.5% in the weekly charts, 13.2% in the 14-day charts, 45% in the monthly charts, and 69% since August 2024. The second-largest crypto by market cap is currently down by 11.9% from its all-time high of $4,878.26.

ETH’s correction is likely due to a market-wide pattern. The cryptocurrency market seems to be reacting to the Consumer Price Index (CPI) data due later today. Many experts anticipate a slight increase in the CPI and Core CPI data. The CPI data will influence the Federal Reserve’s Jackson Hole meeting later this month. The figures will likely set the tone for what market participants can expect from the monetary policy in September.

Ethereum’s (ETH) and the larger market correction may have been further amplified by global trade wars and economic uncertainty. President Trump’s tariff spree has had substantial consequences on global economics.

There is a high chance that the Federal Reserve will cut interest rates in September. A rate cut could lead to increased risky investments. Such a scenario could lead to Ethereum (ETH) climbing to a new all-time high.