The Latest Bitcoin Crash: Who’s Really to Blame?

Bitcoin's brutal plunge sends shockwaves through crypto markets—again. The digital gold narrative tarnishes as volatility reasserts its throne.

Market Mechanics or Manipulation?

Leveraged positions got liquidated faster than you can say 'block reward.' Massive sell orders flooded exchanges, triggering cascading effects that even the most hardened HODLers felt. Whale movements preceding the drop suggest coordinated action—or just smart money exiting before the storm.

Regulatory Ghosts Haunting the Market

Rumors of impending crackdowns circulated faster than blockchain confirmations. Whether it's FSA whispers or SEC saber-rattling, regulators remain the convenient villain for every crypto downturn. Traditional finance critics couldn't resist their 'I told you so' moment—as if their quarterly earnings reports are paragons of stability.

The Eternal Cycle Repeats

Bull markets get overleveraged, corrections become inevitable, and everyone looks for someone to blame. Truth is—markets do what markets do. They overshoot, they correct, and they leave bagholders complaining while smart money accumulates. Maybe the real villain is the mirror. Now if you'll excuse me—my cold wallet isn't going to fill itself.

Bitcoin Crashes to $110K: Here’s What Happened.

Occasionally, there are instances that even the markets cannot predict in the long run. These instances are never planned and are as organic as they come, but end up changing the market course from time to time. In one such instance, a noteworthy BTC whale ended up dumping nearly 24000 BTC tokens, causing the markets to experience volatility at their best. This massive token dump led the markets to witness a sharp correction, with Bitcoin falling back to $110K. At press time, the token has regained some of its value, sitting at $112 at press time.

Ethereum, on the other hand, has also plunged, compelled to change its price pace, as the token was about to move towards the $5K mark. The token is sitting at $4716 at press time after hitting a new ATH of $4900 before the whale incident took hold of the market dynamics. As per notable crypto analyst Jacob King, the whale had reportedly dumped BTC for Ethereum, dumping coins that have not been moved in about five years.

.

JUST IN: #Bitcoin flash crash today, which wiped out $310M in long positions, has been traced to a SINGLE bitcoin whale dumping BTC for ETH.

The whale sold 24,000+ BTC, including coins that hadn’t moved in 5+ years, sending 12,000+ #BTC today alone to the Hyperunite trading… pic.twitter.com/h5jEt92Sys

What’s Next for the Asset?

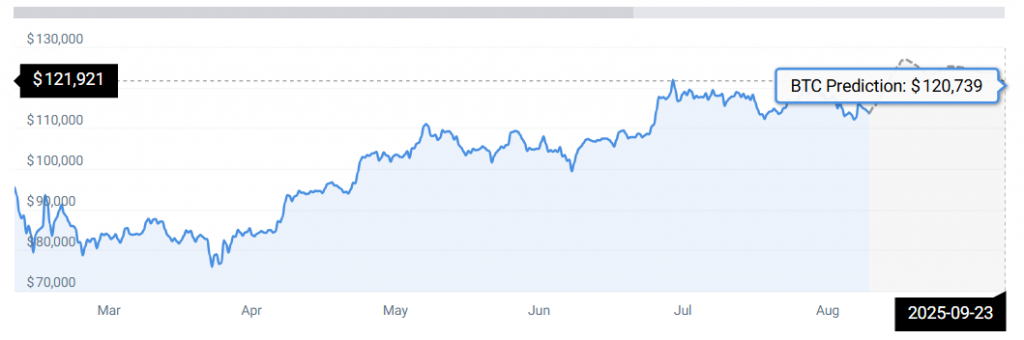

As per CoinCodex BTC data, Bitcoin is still willing to explore the green lines, wanting to explore the slightly corrected price of $120K by September 2025.

.