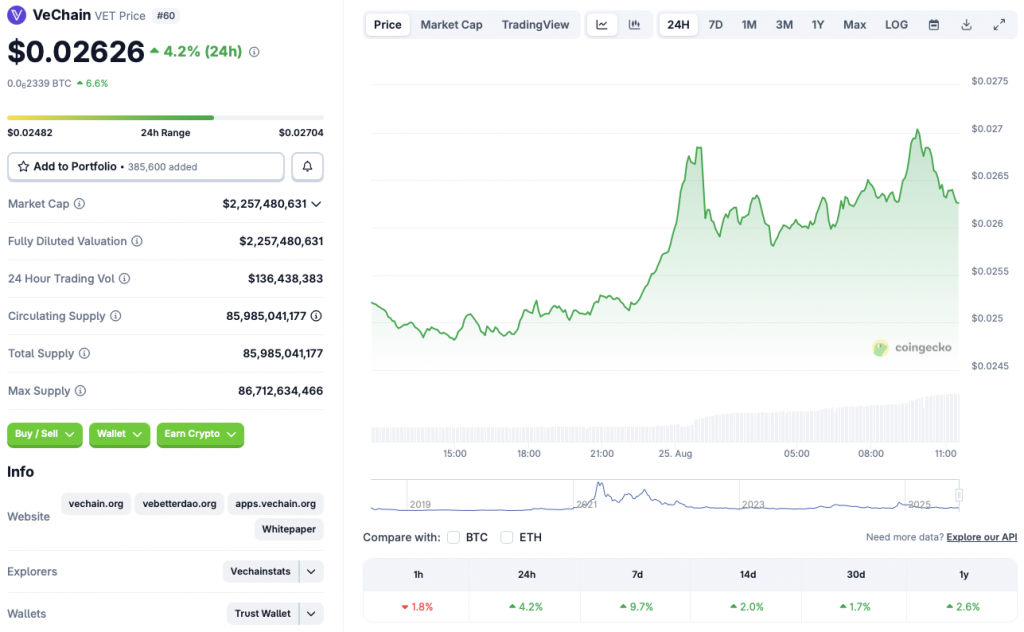

VeChain Defies Market Chaos with 9.7% Surge—Here’s Why It’s Outperforming

While red floods crypto portfolios, VeChain rockets against the tide—up nearly double digits while rivals bleed out. What’s fueling this rogue rally?

Supply Chain Tech Flex

VeChain’s real-world utility backbone—tracking everything from luxury goods to vaccine temps—is pulling institutional interest while speculative tokens flounder. Enterprises aren’t dumping; they’re accumulating.

Market Shock Absorber

When Bitcoin stumbles, alts usually crumble harder. Not VET. Its 9.7% jump signals investor confidence in use cases over hype—a rare dose of logic in a market drunk on leverage.

Partnership Momentum

Quietly stacking enterprise deals while meme coins trend on Twitter. Boring? Maybe. Profitable? Clearly. Real adoption beats influencer shills—even Wall Street’s starting to notice.

So, while crypto’s casino section burns, VeChain’s building fireproof vaults. Maybe—just maybe—utility still matters more than viral tweets. (But don’t tell the degens.)

Source: CoinGecko

Source: CoinGecko

What Is Behind VeChain’s Rally?

VeChain’s rally comes amid a market-wide correction. Bitcoin (BTC) faced a steep price dip to the $112,000 level after climbing to an all-time high of $124,128 earlier this month. Most other major cryptocurrencies are following BTC’s trajectory. VET, however, seems to be pivoting from the market trend.

The market dip could be due to increased profit-taking. The correction may have been further propelled by poor investor sentiment. President Trump’s tariffs have given life to new fears among market participants.

VeChain’s (VET) rally could be due to less profit-taking among investors since the asset has had a lackluster performance this year. It is also possible that investors are directing their funds into VET instead of other assets as they face price dips.

Will The Asset Continue Its Rally?

There is a high chance that VET will face a correction soon. BTC is the market leader, and other assets often follow its trajectory. With BTC in the red zone, it is highly likely that VET will eventually go down that path.

Moreover, September has historically been a bearish month for Bitcoin (BTC). VET’s chances of sustaining its rally are even more unlikely if BTC gives in to its historical pattern. However, there is a high chance of an interest rate cut in September. A rate cut could lead to BTC breaking its historical pattern. VeChain (VET) could potentially sustain its rally under such circumstances.