Ethereum Quietly Smashes $4.9K All-Time High – Is ETH Becoming the Undisputed Crypto King?

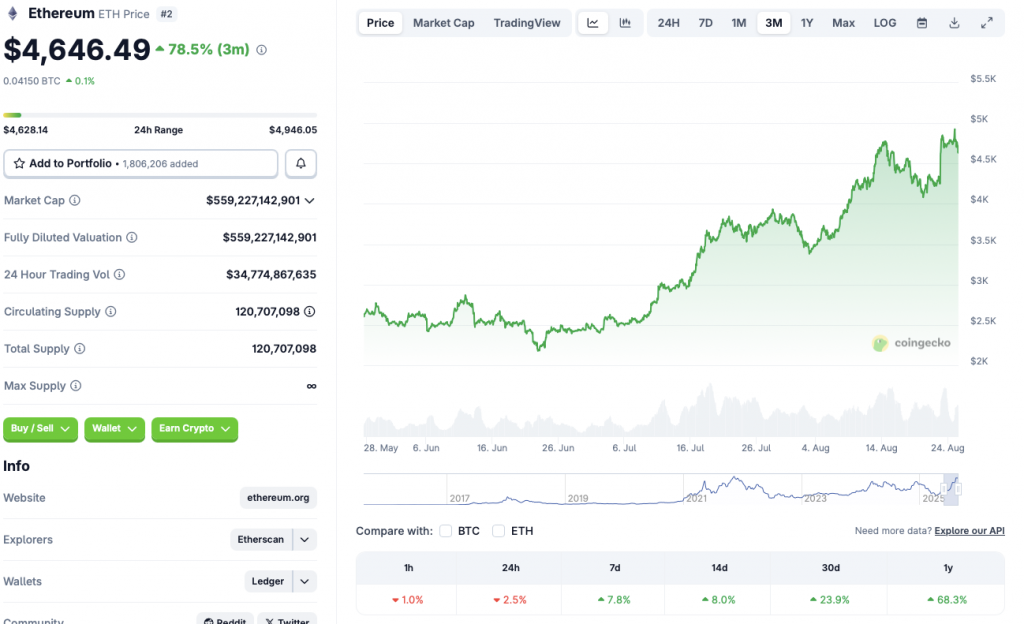

Ethereum just shattered records with a stealthy surge to $4,900—no fanfare, no circus, just pure institutional momentum building beneath the surface.

Beyond the Hype: What's Really Driving ETH?

While retail traders were busy chasing memecoins, smart money piled into Ethereum’s infrastructure—staking yields, layer-2 adoption, and real-world asset tokenization are pulling in capital like a black hole. This isn’t speculative fever; it’s a fundamental recalibration.

The Kingmaker Metric No One’s Talking About

Network revenue. Developer activity. Protocol-owned liquidity. ETH isn’t just riding Bitcoin’s coattails—it’s writing its own playbook. And traditional finance? Still trying to figure out how to short it without getting burned.

Where Does It Go From Here?

Consolidation near ATH wouldn’t be surprising—healthy markets breathe, they don’t just scream upward. But with ETF whispers growing louder and deflationary mechanics kicking in, this might just be the warm-up.

So, is Ethereum the new crypto king? Let’s just say the crown’s looking less golden and more… digital. And Wall Street? Still trying to buy the dip with a fax machine.

Source: CoinGecko

Source: CoinGecko

Will Ethereum Continue Rallying After Hitting a New All-Time High?

Ethereum’s rise to an all-time high comes nearly four years after its previous peak. Bitcoin (BTC), on the other hand, has hit multiple all-time highs over the last year. ETH’s ascent to a new peak could be due to consistent ETF inflows over the last few months. ETh began an upward movement after its Pectra upgrade in May. The update, coupled with high ETF inflows, may have led to the asset climbing to a new all-time high.

According to CoinCodex’s ETH analysis, ethereum will continue to rally over the coming months. The platform anticipates the asset to hit a new all-time high of $8007.04 on Nov. 22. Hitting $8007.04 from current price levels will entail a rally of about 72.32%.

ETH’s price has faced a dip after hitting an all-time high. The correction could be due to investors booking profits. Holders who bought at the 2021 top may have sold to break even. Despite the correction in the last few hours, ETH is still in the green zone over the other time frames. The asset is up 7.8% in the weekly charts, 8% in the 14-day charts, 23.9% over the previous month, and 68.3% since August 2024.

Ethereum’s (ETH) price could continue to dip if the bearish market environment persists. September has historically been a bearish month for bitcoin (BTC).

If the market follows the historical pattern, ETH could face a prolonged dip. However, there is a chance that the Federal Reserve will announce an interest rate cut next month. A rate cut could provide some cushioning to any potential corrections.