CBDCs Crumble as Privacy Fears Push Stablecoins to Victory, CZ Says

Central bank digital currencies face mass rejection as users flee to privacy-preserving alternatives.

Stablecoins Surge Amid Surveillance Concerns

CZ's latest analysis reveals what crypto natives knew all along—people value financial sovereignty over government-controlled convenience. Privacy-focused stablecoins are eating CBDCs' lunch while regulators scramble to explain why their clunky, trackable solutions keep getting rejected.

The irony? Traditional finance spent years dismissing crypto as unstable—now their own digital offerings can't compete with decentralized alternatives. Maybe next time they'll focus on building what users actually want instead of what central bankers dream up in boardrooms.

Korean news headline about CZ’s CBDC outdated comments – Source: coinness.com

Korean news headline about CZ’s CBDC outdated comments – Source: coinness.com

Stablecoins Adoption Trends Surge While CBDC Decline Sparks Global Interest

The global shift toward stablecoins adoption trends became pretty evident during CZ’s recent Tokyo speech, where he emphasized how digital currencies are reshaping financial systems worldwide right now.

CZ said:

The Great CBDC Abandonment Actually Accelerates

, citing high costs along with lack of retail demand. The CBDC decline reflects growing concerns about government control and privacy issues that stablecoins adoption trends have addressed more effectively.

CZ is convinced about the fact that:

Regulatory Support Drives Fiat-Backed Stablecoins Growth

The GENIUS Act’s passage through Senate committee and Trump’s endorsement signal strong regulatory backing for fiat-backed stablecoins. Standard Chartered actually projects the stablecoin sector will reach $2 trillion, which WOULD require $1.6 trillion in additional Treasury reserves. This massive growth in stablecoins adoption trends demonstrates market preference for digital currencies with transparent backing.

Geoff Kendrick from Standard Chartered also said:

Even China, despite its crypto ban, is exploring yuan-backed digital currencies as CZ Zhao insights reveal global recognition of stablecoins’ dominance over traditional CBDC approaches. The CZ Zhao insights from his WebX conference appearance also highlight how some countries that were experimenting with CBDC projects as early as 2013 or 2014 have seen these initiatives fade into obscurity after stablecoins exploded in the market.

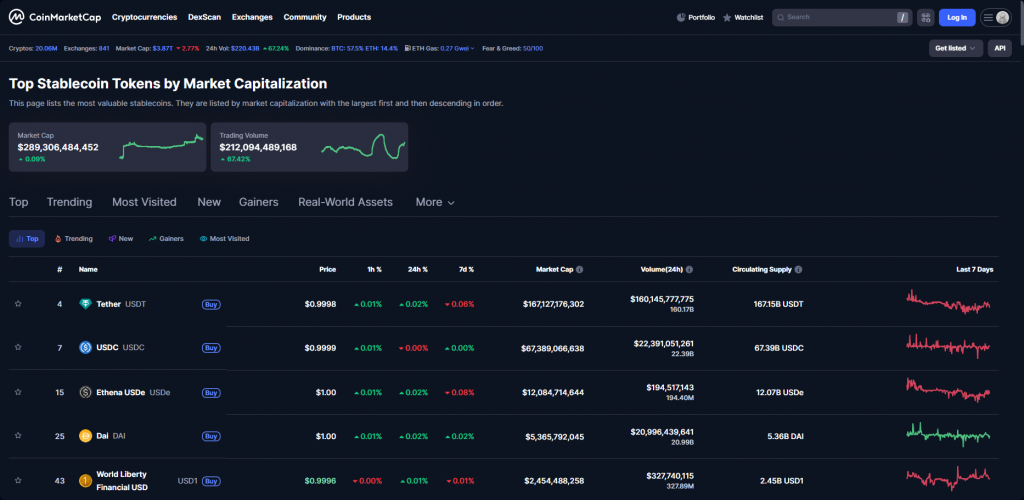

The stablecoins adoption trends reflect fundamental market demands that CBDC decline has failed to address, positioning fiat-backed stablecoins as the winning solution in the digital currencies race. At the time of writing, the stablecoin market sits at around $260 billion, and these CZ Zhao insights suggest that fiat-backed stablecoins will continue dominating as governments abandon their CBDC initiatives.