SEC Eyes Groundbreaking Staked Injective ETF from Canary in Watershed Crypto Moment

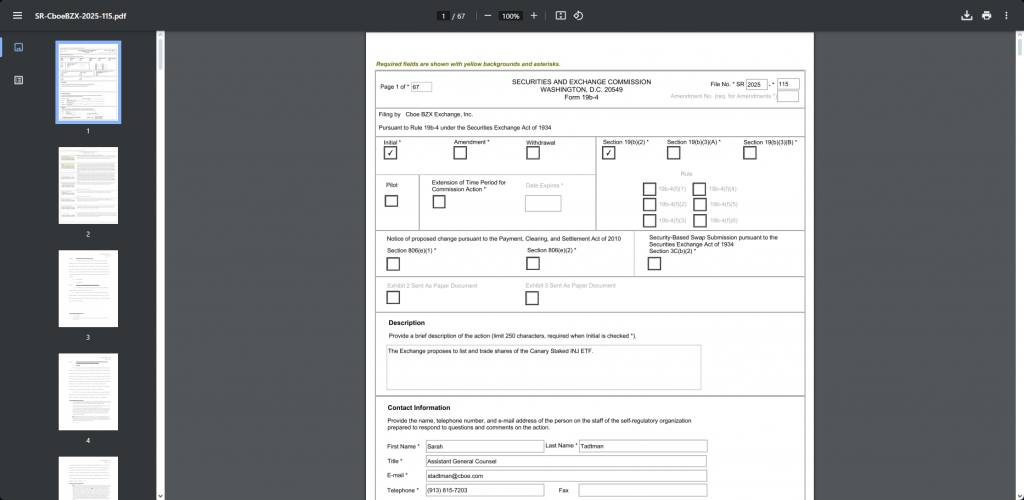

The SEC just opened its review of Canary's revolutionary staked Injective ETF—the first-ever product of its kind to hit regulators' desks. This isn't just another filing; it's a potential game-changer for crypto accessibility.

Why This ETF Stands Apart

Unlike traditional ETFs, this one incorporates staking rewards directly into the fund structure. That means investors get exposure to INJ's price action plus yield—all wrapped in a familiar stock ticker. Canary's proposal effectively bridges DeFi mechanics with mainstream finance.

The Regulatory Hurdle

The SEC's scrutiny will focus on structure, custody, and yield distribution. Approval could flood institutional capital into staking protocols—rejection would signal yet another cautious delay from an agency that still views innovation as inherently suspicious. Because who needs progress when you've got paperwork?

What’s Really at Stake

This decision could set precedent for an entire asset class. Win approval, and a wave of staked crypto ETFs will follow. Get rejected, and innovators face yet another 'wait-and-see' cycle—because nothing says 'financial evolution' like clinging to last century's rulebook.

Staked Injective ETF: Canary’s Groundbreaking Opportunity for Institutional Yield

The SEC public comment ETF process represents a breakthrough for the staked Injective ETF category, even though the approval isn’t guaranteed at this point. Canary’s proposal demonstrates how institutional access to staking can actually work within regulated frameworks, along with the fund actively staking INJ holdings to generate rewards for shareholders.

The exchange stated:

Regulatory Path for Staked Injective ETF

The staked Injective ETF benefits from some recent SEC guidance that clarified most proof-of-stake features don’t fall under securities laws. This regulatory clarity enables Canary’s staked INJ fund to operate within compliance frameworks while delivering institutional access to staking yields, though the process is still being reviewed.

Market Impact and What’s Next

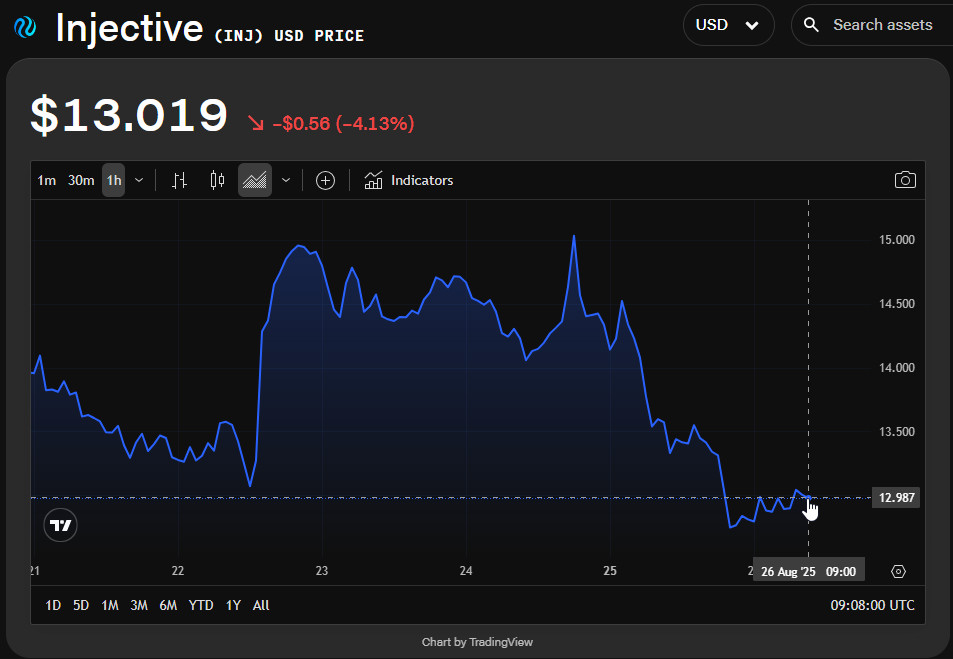

The staked Injective ETF proposal comes as INJ trades at $13.007 with a $1.3 billion market cap, and the token has been facing some pressure recently. The SEC has up to 90 days to decide on Canary’s staked INJ fund following the comment period that’s happening right now.

If the SEC approves it, the Canary staked INJ fund will trade on Cboe BZX Exchange, establishing a precedent for staking crypto ETF approval products. This represents a significant step toward bringing institutional access to staking rewards through regulated investment vehicles, even as the crypto market continues evolving.