Bitwise Files Game-Changing Chainlink ETF Application With SEC

Wall Street's crypto embrace hits new heights as Bitwise makes its move.

BREAKING: Institutional adoption just got another major boost. Asset management firm Bitwise has officially submitted paperwork to the SEC for a Chainlink-focused exchange-traded fund. This isn't just another filing—it's a strategic play that signals deepening institutional confidence in oracle networks and real-world data integration.

Why This Matters Beyond the Hype

Chainlink's oracle technology serves as critical infrastructure—feeding reliable external data to smart contracts across blockchains. An ETF would give traditional investors exposure without the technical hurdles of direct ownership. Bitwise's track record with crypto ETFs adds weight to this application, suggesting they've identified substantial institutional demand.

The Regulatory Gauntlet Ahead

SEC approval remains the elephant in the room. The commission's historically cautious stance on crypto ETFs means this application enters a complex review process. Yet the very attempt reflects growing pressure from traditional finance to access crypto-native infrastructure—not just bitcoin and ether.

Another step toward legitimizing crypto's plumbing—because nothing says 'mainstream' like wrapping it in a traditional finance product and charging management fees.

Will The SEC Approve Bitwise’s Chainlink ETF Application?

The SEC is currently reviewing several crypto-based ETFs. The agency made history last year when it approved Bitcoin (BTC) and ethereum (ETH) ETFs for the US market. Bitcoin and Ethereum hit new all-time highs earlier this month, largely due to high ETF inflows.

The SEC is now led by Paul Atkins, a pro-cryptocurrency candidate. There is a high chance that the SEC will approve most of the ETF applications they have received, given that there aren’t any issues with the applications. The Chainlink (LINK) ETF could be one of many to be approved by the SEC.

Will LINK Rise To a New All-Time High?

An ETF approval will likely lead to a surge in institutional money for LINK. Institutional funds are key to an asset’s price movements. BTC has hit never-before-seen price levels after its ETF approval. A similar pattern could emerge for LINK as well.

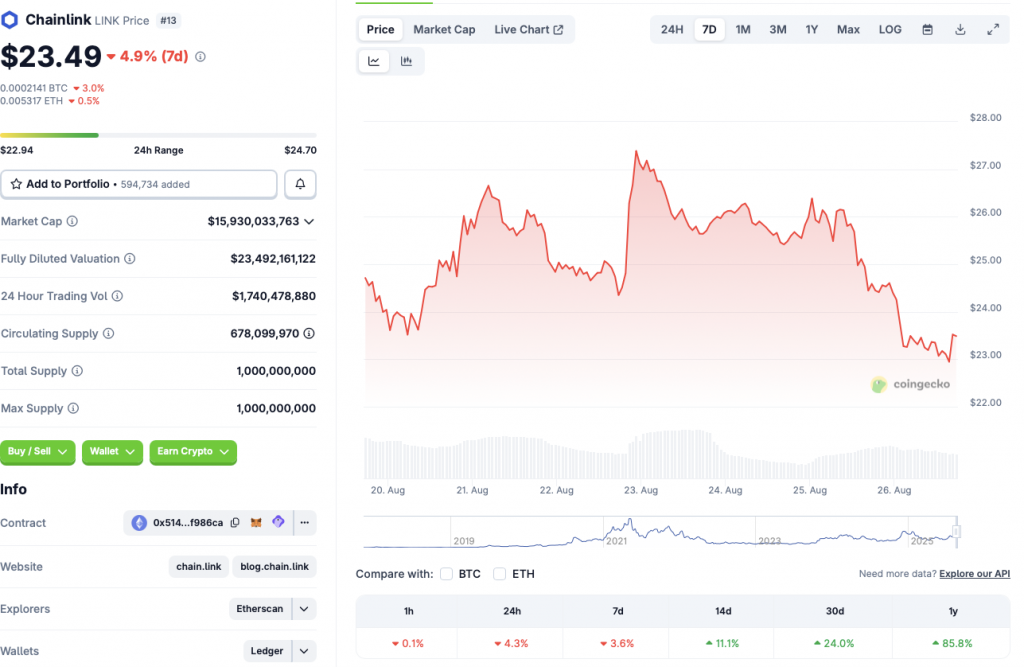

Chainlink has faced quite a correction over the last few days. According to CoinGecko’s LINK data, the asset is down 4.3% in the daily charts and 3.6% over the previous week. LINK’s price is also down by 55.6% from its all-time high of $52.70. LINK hit its peak in May 2021, more than four years ago.

It is still unclear if and when the SEC will approve Bitwise’s Chainlink ETF. President Trump has stated that he wants the crypto industry in the US to thrive. ETFs may be one of the ways in which the US dominates the crypto space. How things unfold are yet to be seen.