Ethereum Price Forecast: $7K to $12,000 Still in Play as ETF Flows Reshape Market Dynamics

Ethereum's bull run defies gravity as institutional money floods in through newly approved ETFs. The $7,000 to $12,000 price target that seemed ambitious just months ago now appears increasingly plausible.

ETF Revolution Reshapes Capital Flows

Wall Street's embrace of Ethereum ETFs marks a seismic shift in digital asset adoption. Traditional finance giants are finally catching up to what crypto natives knew years ago—Ethereum's smart contract dominance isn't just technological superiority, it's economic inevitability.

Market Mechanics Favor Bulls

With ETF inflows consistently outpacing new supply, basic economics suggests upward pressure on prices. The $7,000 threshold now serves as a psychological battleground, while $12,000 represents the next major resistance zone that could trigger another wave of institutional FOMO.

Of course, traditional finance always arrives fashionably late to the party—just in time to claim they discovered the DJ.

Tom Lee’s Bold Ethereum Forecast

At Korea Blockchain Week 2025, Tom Lee, co-founder of Fundstrat and chairman of BitMine, predicted that ethereum could hit $7,000 to $12,000 by year-end. He also sees a possible extension to $15,000. He framed this as part of what he called a new multi-year “super cycle” for ETH, lasting more than a decade.

Lee connected Ethereum’s rise to two major themes: artificial intelligence and finance. He argued that a future machine-driven economy would likely use Ethereum as its base layer due to its neutrality and scalability.

He also pointed to Wall Street and policymakers leaning on Ethereum as a trusted network, with stablecoins and real-world assets reinforcing its use case.

Supporting his view, BitMine has turned itself into an Ethereum-focused treasury firm, now holding 2.41 million ETH valued at over $10 billion. According to Lee, this positions Ethereum not only as a cryptocurrency but also as a core financial asset that could eventually be included in equity indices.

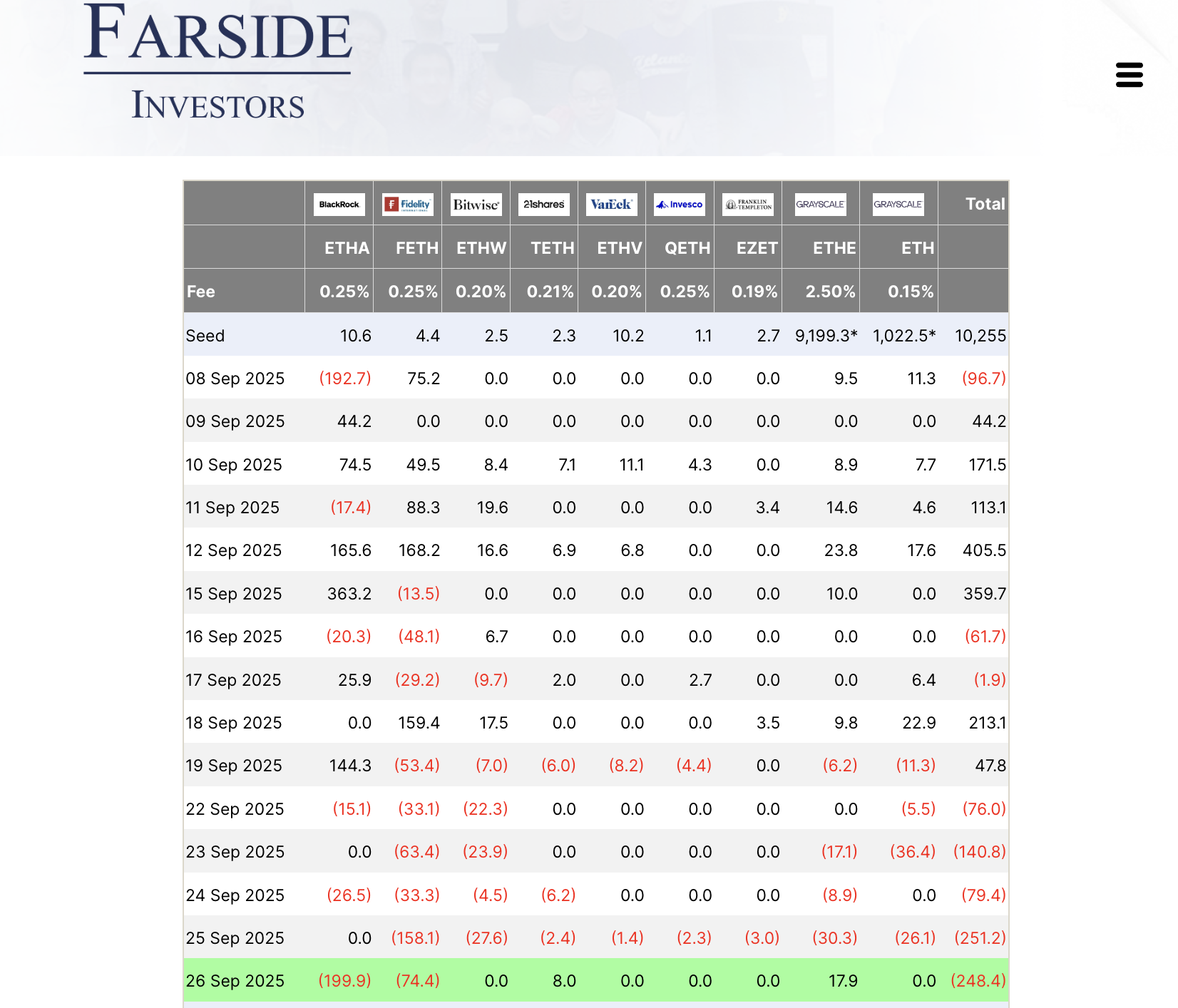

ETF Outflows Challenge Short-Term Sentiment

Despite Lee’s bullish outlook, Ethereum’s spot ETFs recorded $795.8 million in outflows over five days, raising doubts in the short term. Data showed that BlackRock’s Ethereum fund sold ETH thrice within a week, adding to the concerns.

On September 24 and 25 alone, more than $315 million exited Ethereum ETFs. Fidelity, Grayscale, and Bitwise also saw large withdrawals, which dragged the ETH price under $4,000 before a mild recovery.

Still, on-chain data tells another story. Around 420,000 ETH were withdrawn from exchanges, pushing balances to nine-year lows. This suggests some large holders may be buying quietly despite the ETF exits. Analysts note that such withdrawals often hint at long-term holding strategies, even as traders react nervously in the short term.

MAGACOIN FINANCE: Another Coin to Watch

Alongside Ethereum’s moves, many analysts are putting MAGACOIN FINANCE on their watchlist as an undervalued altcoin. Over 18,000 investors are already on board, and whales have been spotted taking early positions.

Some analysts describe it as one of the best altcoins to buy in 2025, useful both as a hedge and as a way to diversify during uncertain ethereum price swings. This growing interest has sparked curiosity among those seeking fresh opportunities beyond the larger names.

How Traders Can Position

Ethereum remains in the spotlight with forecasts as high as $12,000, but ETF outflows remind traders that the path may not be smooth. A balanced approach could involve holding ETH while also exploring undervalued altcoins like MAGACOIN FINANCE. Those curious can visit the official site to learn more and act early:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance