Uniswap (UNI) Defends Critical Support as Traders Eye Major Trend Reversal

Uniswap's UNI token stands firm at crucial support levels while market participants position for potential upside breakout.

The Support Battle Heats Up

Traders watch closely as UNI defends key technical levels that could determine its next major move. The decentralized exchange token shows resilience despite broader market volatility.

Technical Setup Favors Bulls

Chart patterns suggest accumulation near current levels. Trading volume patterns indicate growing institutional interest in the DeFi pioneer.

Market Sentiment Shifts

Options flow and funding rates point to changing market dynamics. The smart money appears to be building long positions while retail remains skeptical—classic Wall Street behavior, just with more caffeine and less suits.

All eyes on whether UNI can capitalize on this technical positioning and deliver the breakout traders anticipate.

TLDR

- Uniswap forms higher lows at key support zone, signaling potential recovery.

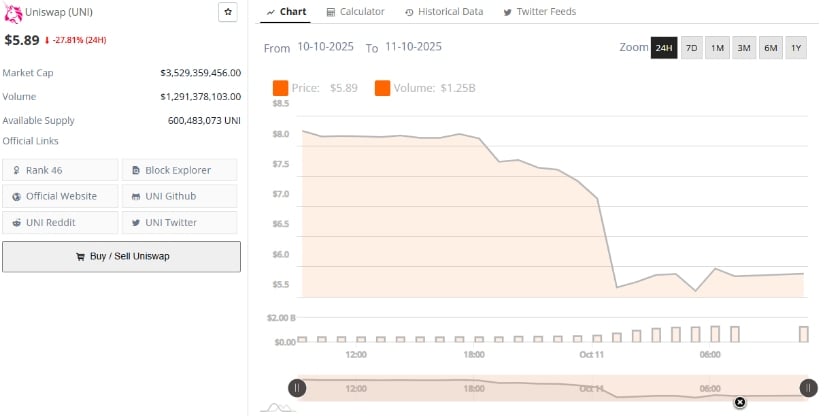

- UNI price drops 27.8% in 24 hours but remains resilient with strong liquidity.

- Open interest for UNI drops to $168M, clearing overleveraged positions.

- UNI holds $3.52B market cap, showing ongoing DeFi ecosystem strength.

Uniswap (UNI) has recently shown signs of stabilization after a sharp decline in its price, which saw it drop from over $8 to near $4. As the token consolidates within a key support zone, traders are closely watching for signals of a potential trend reversal. While the market has faced considerable volatility, Uniswap’s ability to maintain support levels offers cautious Optimism for its next moves in the coming weeks.

Uniswap Finds Stability at Critical Support Zone

After a notable price drop, Uniswap has started to stabilize within a major demand zone. This area has historically acted as a strong support level, which has caught the attention of traders and investors. The coin’s ability to hold above this critical level despite continued market fluctuations suggests that a potential trend reversal may be in progress.

Analyst Yakov recently shared insights on X, noting that their dollar-cost-averaged (DCA) entry was made around $7.90. This price point aligns closely with the support zone where UNI has begun to FORM a series of higher lows and higher highs. These subtle patterns typically suggest that buying pressure may be picking up, offsetting the prior selling momentum. If this pattern persists, it could lay the groundwork for a more sustained recovery.

Market Activity Reflects Rebuilding Sentiment

Despite recent price volatility, Uniswap’s market activity has shown signs of resilience. At the time of writing, the token’s price was recorded at approximately $5.89, reflecting a 27.8% drop over the past 24 hours. This decline was driven in part by broader market stress and heavy liquidations. However, the overall market capitalization remains strong at $3.52 billion, with daily trading volumes of $1.29 billion.

This data suggests that liquidity and trading participation remain intact despite the volatility. The coin continues to play a vital role in the decentralized finance (DeFi) space as the native token of the Uniswap protocol. This resilience provides a solid foundation for future growth, as the platform’s usage and fee generation remain stable even amidst uncertain market conditions.

Open Interest Drop Indicates Market Reset

Open interest data for Uniswap has seen a substantial reduction, dropping to about $168 million in recent days. This decrease is viewed as a natural “cleansing phase” following the sharp market correction. The reduction in leverage suggests that overleveraged positions have been cleared, which can create a healthier market structure.

The drop in open interest also signals that speculative excess has been removed from the market, reducing the risk of further liquidations in case of volatility. With less leverage in play, traders are hopeful that price movements will be driven by organic demand and trading volumes, rather than by short-term speculative bets.

Outlook for Uniswap (UNI) in the Coming Weeks

As Uniswap stabilizes at key support levels, the attention now shifts to whether the price will maintain these levels or experience further declines. The coin’s ability to hold its ground amidst current market conditions offers hope for a possible trend reversal in the NEAR future. If the pattern of higher lows continues, traders may view this as a signal that the market is ready for recovery.

Given the reduction in open interest and the ongoing consolidation at support levels, Uniswap could see more stable price action in the coming weeks. With key factors like liquidity, governance participation, and DeFi activity continuing to anchor its value, UNI may be positioned for gradual recovery if the broader market conditions stabilize.