Cardano ADA Surges as Whale Accumulation Meets Retail FOMO - Rebound Rally Underway

Cardano's native token ADA is staging a powerful comeback as institutional whales and retail traders pile in simultaneously.

The Perfect Storm

Massive wallet movements show deep-pocketed investors accumulating ADA at current levels while social sentiment metrics reveal growing retail excitement. This rare alignment of whale and retail interest creates explosive upside potential.

Technical Breakout Confirmed

ADA smashed through key resistance levels with volume spiking 47% in the past 24 hours. The momentum suggests this isn't just a dead cat bounce but the start of a sustained recovery phase.

Market Psychology Shifts

After months of sideways action, the sudden bullish momentum caught short sellers off guard. The fear of missing out is becoming palpable across crypto forums and trading desks.

Just when traditional finance was writing crypto's obituary, Cardano reminds everyone why decentralized assets continue to capture imagination and capital—sometimes in that order.

Whales Accumulate More ADA Amid Price Decline

In the face of ADA’s recent market crash, which saw a drop of nearly 20% in 24 hours, whales have been increasing their holdings. According to Santiment data, wallets holding between 10 million to 100 million ADA grew their combined holdings from 13.06 billion ADA on October 10 to 13.20 billion ADA by October 12. This increase of 140 million ADA, worth approximately $89.6 million, occurred despite the sharp price decline.

Whales appear to be holding onto their positions, with many continuing to accumulate during the dip rather than selling. The fact that this accumulation trend started before the crash and has persisted suggests that these large holders are anticipating a market recovery or a period of price stability. Their consistent support of ADA through a market-wide selloff hints at a belief in its long-term value.

Retail Traders Show Strong Buying Interest

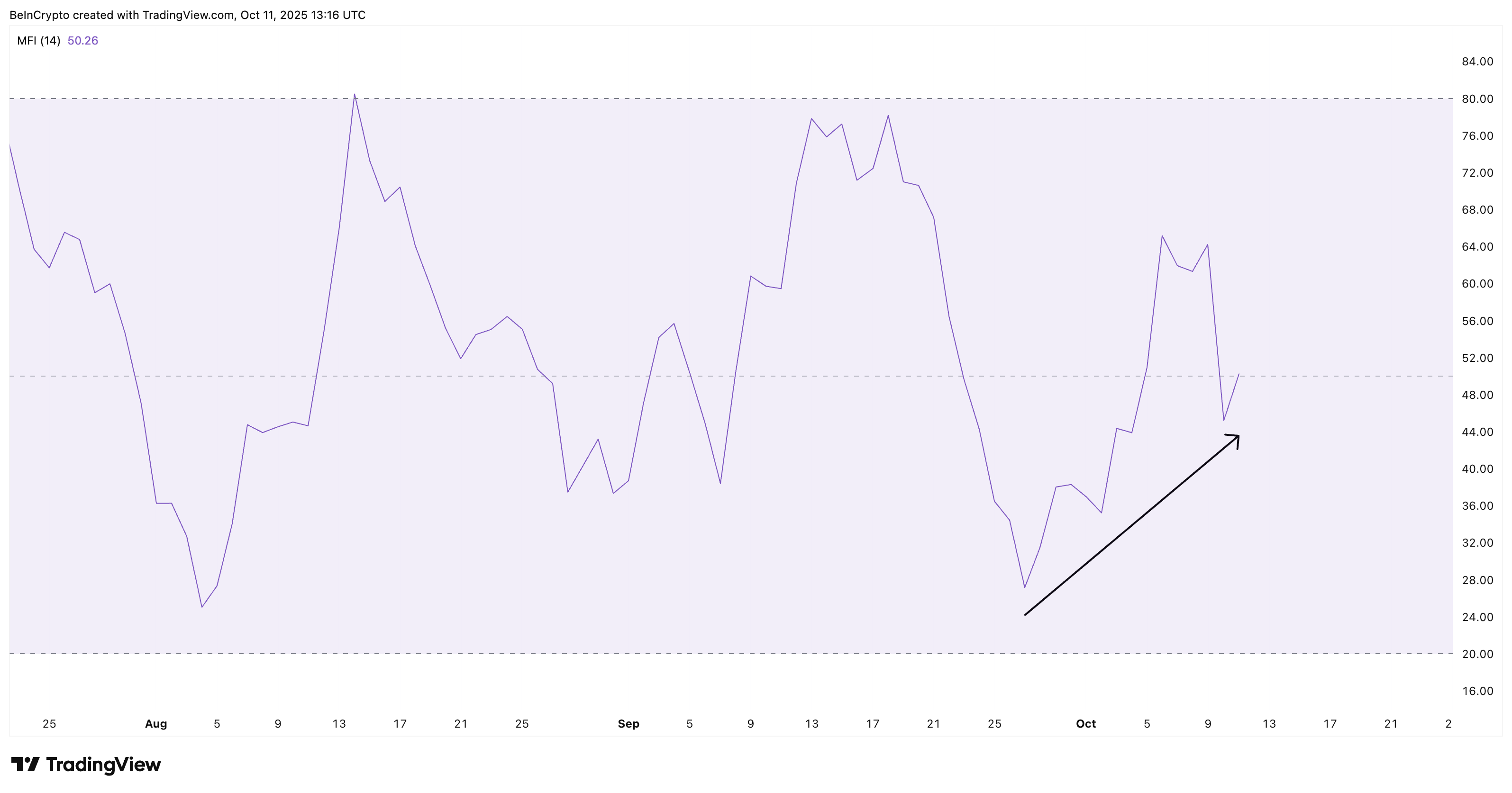

In addition to whale activity, retail traders seem to be joining in, further supporting the potential for a Cardano price rebound. The Money Flow Index (MFI), a tool that tracks capital inflows and outflows based on price and volume, has formed a higher low, indicating that buying interest remains strong even as the price of ADA declines. This behavior aligns with data suggesting that retail traders are becoming more active in the market.

While whales continue to build their positions, retail traders are also contributing to the buy-side momentum. This collective buying behavior could provide the necessary support for a gradual recovery in ADA’s price. However, the effectiveness of this accumulation will depend on the ability of buyers to maintain pressure and sustain higher closes, as the broader market remains volatile.

Technical Indicators Pose Risks for Cardano Price

Despite the growing support from whales and retail traders, the technical outlook for ADA presents some risks. The Smart Money Index (SMI), which tracks the positioning of professional traders, has shown a sharp decline and remains weak.

While it has slightly recovered, this uptick is not yet strong enough to indicate a sustained recovery. Furthermore, the Relative Strength Index (RSI) shows no bullish divergence, meaning that while ADA’s price has reached a lower low, momentum has not yet reversed.

A key technical pattern also remains a concern for ADA’s short-term price action. A descending triangle pattern is forming on the daily chart, which typically signals a bearish trend. Without a bullish RSI divergence to counter this pattern, the price of ADA may face further downside risk. Traders will need to see sustained higher closes for a more confident rebound to take place.

ADA’s Price Action and Key Levels to Watch

Currently, ADA is trading near $0.64, after reaching a low during the crash. A daily close above $0.68 WOULD signal a potential short-term recovery toward resistance levels at $0.76 and $0.89.

However, a break below the $0.61 mark could push the price down further, potentially reaching as low as $0.55. Given the mixed signals from both accumulation data and technical indicators, Cardano’s price remains in a fragile state, with its next moves highly dependent on whether buyers can maintain control in the market.

In conclusion, while cardano shows promising signs of support from both whales and retail traders, the technical risks are still present. A rebound will require careful monitoring of buying momentum and the resolution of bearish patterns in the price chart.