Pi Network Price Prediction: Investors Eye 500x Returns for DeepSnitch AI by 2026

While established players dominate headlines, savvy crypto investors are turning attention to emerging AI tokens with explosive potential.

DeepSnitch AI captures market imagination with bullish predictions outpacing traditional crypto assets.

The 500x return projection reflects growing institutional interest in AI-blockchain convergence projects.

Market analysts note these predictions often overlook regulatory hurdles—but since when has that stopped crypto speculation?

WisdomTree unveils tokenized private credits

WisdomTree has unveiled a new digital fund aimed at tracking the Gapstow Private Credit and Alternative Income Index (GLACI). On September 12, Wisdom Tree announced the launch of its Tokenizeid Private Credit and Alternative Income Digital (CRDT).

The fund is available to institutional and retail traders via the WisdomTree Prime and WisdomTree Connect platforms.

Additionally, it will bring private credit through a transparent, tokenized fund structure, offering access to crypto-native investors and institutions. Furthermore, the fund will come with a minimum investment of $25 and will be tokenized on ethereum and Stellar.

Bringing private credit facilities to blockchain networks shows the growing demand for crypto technologies. It also shows that more institutional players are willing to dabble in crypto services, a trend that has been bolstered by the increase in favorable crypto regulations.

Additionally, launching this fund could benefit new crypto assets, as investors can access more credit facilities, which can then be used to buy digital coins. Already, many investors say new tokens with strong return potential will receive a significant boost from these funds.

Could demand for AI services make DeepSnitch 100x?

DeepSnitch AI’s presale is shaping up to be one of the most compelling entry points in the AI crypto space. Stage 1 is already close to selling out, showing strong demand before the project even hits exchanges.

What makes DeepSnitch AI different is its Core functionality. The platform uses AI agents to track whale movements, scan contracts for risks, and monitor on-chain transactions. This transforms overwhelming blockchain data into real-time alerts that traders can use to make faster, smarter decisions.

For retail investors, this is game-changing. Imagine spotting whale buys before they pump a token, or catching a rug pull before it collapses, that’s the level of intelligence DeepSnitch AI is putting into the hands of everyday users. It bridges the information gap that has long favoured whales and insiders.

Now LAYER that utility on top of crypto’s hype cycle. Meme coins like PEPE delivered 4000x gains with limited real-world utility. If DeepSnitch AI can capture even a fraction of that momentum while delivering real AI-driven value, the potential returns become shocking. At $0.01634, a $200 stake secures about 12,200 tokens, which would be worth $12,200 if DSNT reaches just $1.

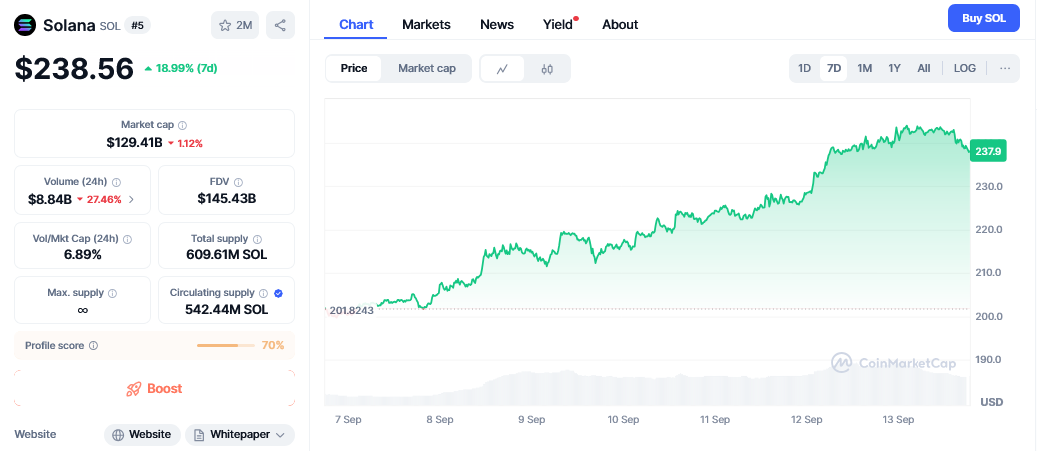

Solana becomes the 5th largest token by market cap

The crypto market is now in bullish spirits following a sharp increase for many tokens. While Bitcoin led the way via its price growth, many altcoins have followed. In particular, Solana has risen since the start of September. This continued rise has now pushed Solana’s market capitalization to around $129 billion, making it the 5th largest cryptocurrency.

As of September 13, the SOL price of $242.25 came with a 19.62% jump over the past 7 days. Solana’s 30-day chart also showed a 17% increase, indicating stable growth.

Additionally, solana has been bolstered by talks of a new treasury by Galaxy Digital. Already, over 16 Solana treasuries hold about 1.7% of SOL’s total supply. This figure could grow significantly as more institutional players might be willing to join Solana if it gets a spot ETF approval.

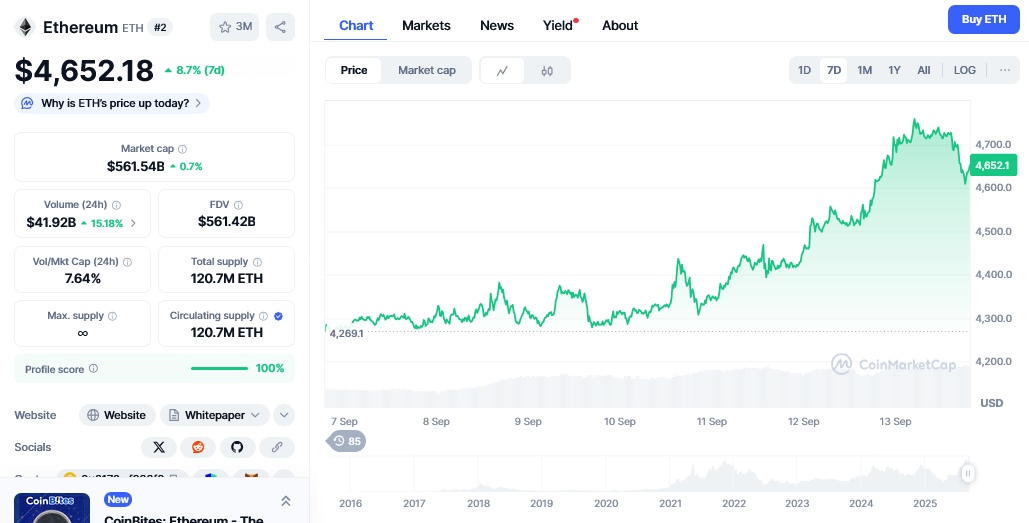

Ethereum inflows rebound in mid-September

Ethereum spot ETFs are rising again, a factor that reflects growing investor confidence. Since September 9, Ethereum spot ETFs have been rising daily. On September 12, Ethereum’s ETFs raked in $406 million, marking a fourth consecutive day of positive flows.

Fidelity’s FETH ETF brought $168 million in inflows while BlackRock’s ETHA ETF raked in $165 million. The new figures took the cumulative net inflow for all Ethereum spot ETFs to $13.36 billion.

Many analysts say these figures represent growing demand for Ethereum, especially among institutional traders. If this trend continues, Ethereum’s price could set a new ATH. ETH was trading at $4,442 as of September 13. However, this figure is expected to rise over the coming weeks.

Conclusion

With the final quarter of the year only a few weeks away, many investors are eagerly searching for tokens that can take a $100 investment to over $10,000. Despite the growth of established tokens like Solana and Ethereum, many investors say the potential for asymmetric returns lies with new projects like DeepSnitch AI.

This project features a robust technology stack, low price, and asymmetric growth potential that could make it one of the best tokens to buy. Already, AI tokens like Bittensor are up by over 1000% from the all-time low.

So, a 500x growth by next year could be on the table, given its technology stack and growing hype.

Visit the official website to buy into the DeepSnitch AI presale now.

Frequently asked questions

Which coin is best to buy now?

Due to the surging demand for machine learning tokens, many investors believe DeepSnitch AI could be the best new token to buy.

Can the Pi network reach $100?

While Pi network has strong predictions, there is little to suggest that it could go as high as $100.

Is the Pi network launched?

Yes, it launched in February 2025.