WLFI Explodes: Whale Accumulation Meets USD1 Stablecoin Surge

Whales are circling WLFI as the token rockets upward—just as USD1 stablecoin growth hits escape velocity.

The Whale Effect

Massive buy orders from crypto's biggest players are fueling WLFI's parabolic move. These deep-pocketed investors aren't just dipping toes—they're diving in headfirst.

Stablecoin Rocket Fuel

USD1's explosive expansion creates the perfect storm. More stablecoin liquidity means more dry powder for speculative assets—and WLFI's catching every bit of that momentum.

When whales move and stablecoins multiply, altcoins dance. Just remember—in crypto, what the whales giveth, they can taketh away faster than you can say 'risk management.'

Whales are buying the World Liberty Financial token

World Liberty Financial (WLFI) jumped to a high of $0.1455, up 100% from its lowest level on Friday when most tokens plunged in the biggest meltdown of the year.

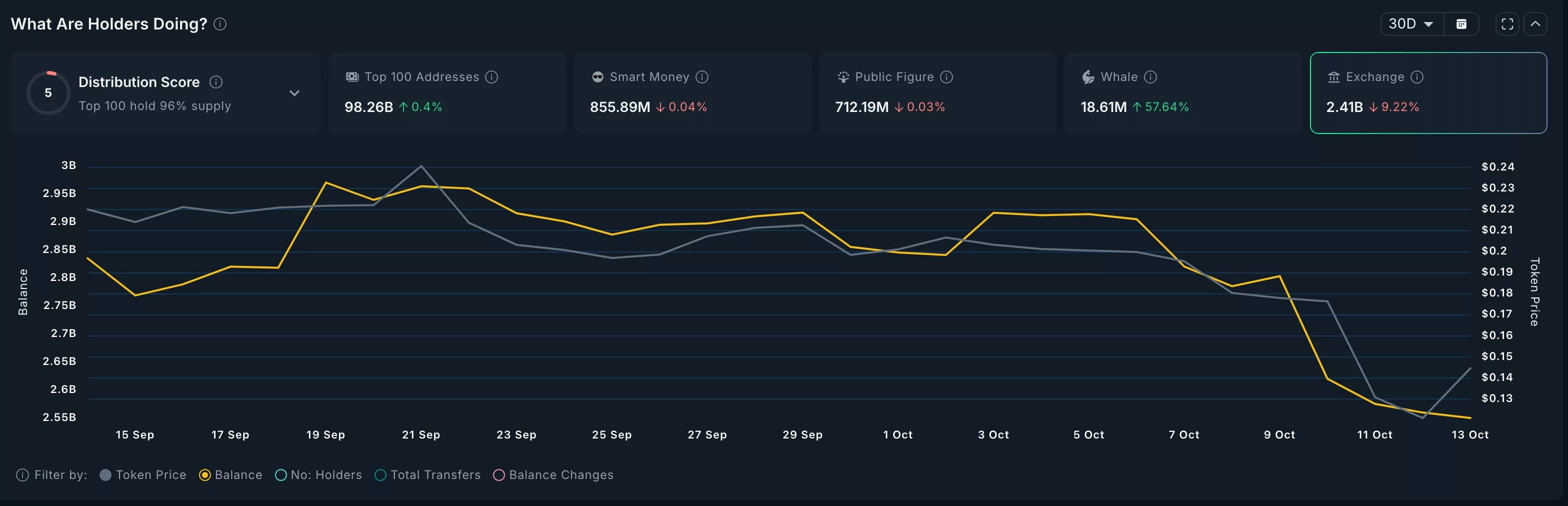

On-chain data show that whales have boosted their positions in the token in the past few weeks. These investors now hold 18.61 million tokens, a 57% monthly increase. They have bought over 400,000 tokens since Friday when the crypto market crashedNotably, World Liberty Financial bought WLFI worth $10 million during the last crash.

While others panic, we stack. 🦅

Today we bought $10 million worth of $WLFI — and this won’t be the last time.

We know how the game is played.https://t.co/do3wPuiuZc

Another notable metric is that the number of WLFI tokens on exchanges has plunged in the past few months. There are now 2.41 billion coins, down from 2.97 billion in September. Tumbling exchange balances are a sign that investors anticipate the price to jump.

Meanwhile, the USD1 stablecoin is seeing modest growth this month. Data compiled by Artemis show that the supply has jumped 1.79% in the last 30 days to $2.7 billion. Most of this supply stems from the $2 billion investment by Abu Dhabi’s MGX into Binance.

USD1’s holders have jumped almost 40% in the last 30 days to 524,000, while monthly transactions doubled to over 31 million. The adjusted transaction volume ROSE to almost $10 billion.

WLFI price technical analysis

The four-hour chart shows that WLFI bottomed at $0.0718 on Friday and then bounced back to the current $0.1470. On the four-hour chart, it has hit resistance at the 25-period exponential moving average.

WLFI has formed a small bullish flag pattern, which often leads to a breakout. It also remains along the strong pivot reverse point of the Murrey Math Lines.

Therefore, the token will likely continue rising as bulls target the major S/R pivot point at $0.200. A drop below support at $0.1200 will invalidate the bullish forecast.