BERA Tanks as Berachain Activity Dries Up—Another ’Stable’ Coin Bites the Dust?

Berachain’s native token BERA just got rug-pulled by reality—transactions and stablecoin volumes are in freefall. Guess the ’web3 supercycle’ forgot to check the charts.

Here’s the autopsy: Network activity flatlined, ’stable’ assets proved anything but, and now traders are left holding the bag. Classic crypto.

Silver lining? At least the crash was faster than a VC dumping their seed round tokens. That’s efficiency, folks.

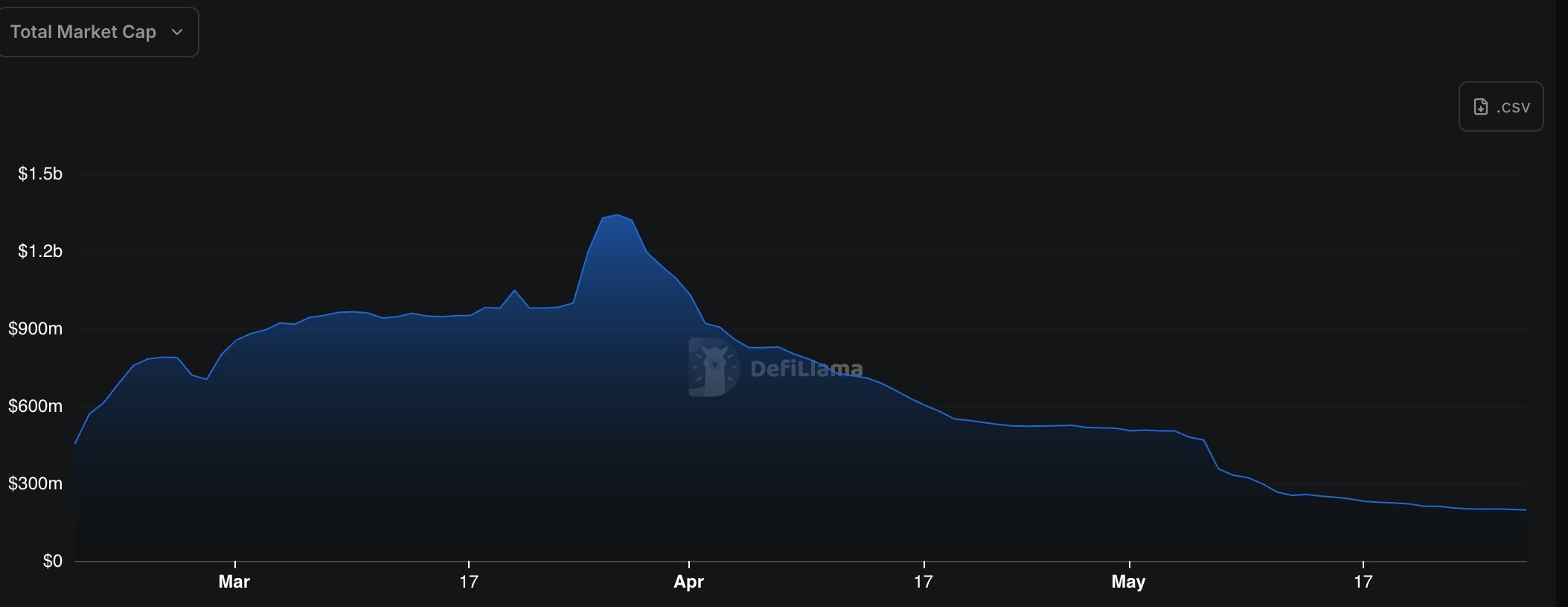

Berachain stablecoin supply has dropped | Source: DeFi Llama

Berachain stablecoin supply has dropped | Source: DeFi Llama

Worse, Berachain has had outflows of US dollars into its ecosystem for all days since March 27. The total value locked in its platform has dropped by 50% in the last 30 days to $2.92 billion.

These figures indicate that Berachain is rapidly losing traction, marking one of the steepest downfalls in the crypto industry this year.

BERA price technical analysis

Berachain has been in a strong downtrend since hitting its post-airdrop high of $9.1823 on March 2.

The eight-hour chart shows that BERA price is hovering NEAR its all-time low of $2.70, forming a double-bottom pattern. A double bottom is one of the most bullish reversal signs in technical analysis.

However, BERA remains below its 50-period and 100-period moving averages. While the double-bottom pattern may suggest a potential relief rally, a drop below $2.7021 WOULD invalidate the bullish case and could open the door to further downside, potentially targeting the psychological level of $2.50.