Ether Machine Charges Toward Public Debut: Files S-4 for Dynamix Merger

BREAKING: Crypto infrastructure giant takes decisive step toward public markets—merger paperwork officially filed with SEC.

The SPAC Endgame

Ether Machine's S-4 filing cracks open the traditional IPO playbook—bypassing conventional routes through a reverse merger with blank-check company Dynamix. No waiting for bankers' blessings or roadshow circuses.

Market Mechanics Unleashed

The filing puts institutional investors on notice: blockchain infrastructure's going mainstream whether Wall Street's ready or not. Expect volatility—and serious volume—when this hits the Nasdaq ticker.

Just don't expect your financial advisor to understand it before the 10-K drops—some things never change in finance.

The Ether Machine’s ETH trove

Upon closing the deal and listing on Nasdaq, The Ether Machine is poised to become the largest Ethereum (ETH) treasury to go public.

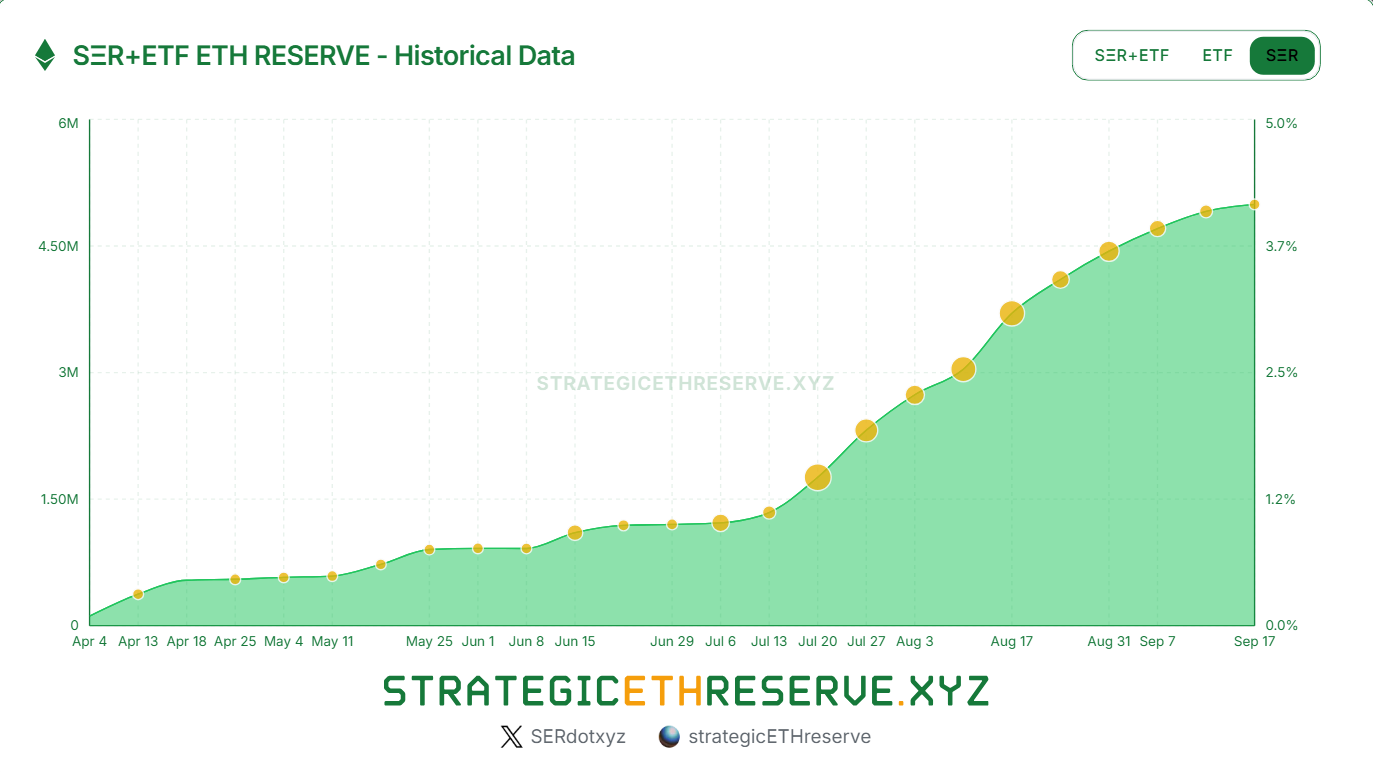

According to data from Strategic ETH Reserve, the firm is currently the third largest corporate ETH holder. The Ether Machine currently holds 495,360 ETH which is currently valued up to $2.24 billion based on current market prices.

Its holdings have surpassed that of the Ethereum Foundation, but is still behind ETH giants like Tom Lee’s BitMine Immersion and Sharplink Gaming. Though, if the Ether Machine manages to go public, it will be the largest ETH holder to do so. The firm has a market cap that sits at $178 million.

The Ether Machine’s Core strategy focuses on generating ETH-denominated yield through staking, restaking, and risk-managed participation in decentralized finance.

At press time, approximately 69 entities hold ETH in their balance sheets. The total amount of ETH held within corporate treasuries has nearly reached 5 million ETH or equal to $22.57 billion. This number represents around 4.13% of the total circulating ETH supply globally.