This Unstoppable AI Stock Could Skyrocket 325% by 2036 - Here’s Why

Artificial intelligence isn't just transforming industries—it's creating investment opportunities that defy traditional valuation metrics.

The Growth Engine Nobody Saw Coming

While Wall Street analysts debate quarterly earnings, this AI pioneer quietly builds infrastructure that could redefine entire sectors. Its technology stack cuts through legacy systems like a hot knife through butter.

Market Disruption on the Horizon

Forget incremental improvements—we're talking about platforms that bypass human limitations entirely. The 325% projection by 2036 might actually prove conservative when you consider the compounding effect of machine learning advancements.

Why Traditional Investors Miss the Boat

Finance veterans still measuring P/E ratios while this company eats their lunch. Their algorithms can't quantify paradigm shifts—but your portfolio certainly will feel them.

The bottom line? Sometimes the most unstoppable force isn't a bull market—it's a company that actually deserves the hype.

Image source: Getty Images.

Themes like agentic AI could fuel astronomical revenue growth by 2036

CrowdStrike says AI-powered deepfakes and malware are helping hackers mount successful attacks on businesses in as little as seconds, whereas it would have taken them days or even weeks in the past. But organizations that are using AI are also creating entirely new attack surfaces for hackers to exploit, and this must be addressed.

Take agentic AI, for example. Gone are the days when a human employee would have one identity within their corporate network, because they are now using dozens of AI agents to accelerate their workflows, which require their own security permissions. In fact, CrowdStrike says more than half of companies it surveyed are planning for a 20% increase in non-human identities in the next year alone.

These agents have access to the organization's most valuable digital assets, so safeguards must be in place to ensure hackers can't impersonate non-human identities to gain access. As a result, CrowdStrike launched Falcon Next-Gen Identity Security, which includes a suite of powerful features to protect all identities, whether human or digital.

Next-Gen Identity Security uses CrowdStrike's industry-leading threat intelligence to authenticate trusted identities and flag unusual behavior. It also uses a "zero standing privileges" approach, meaning no identity has access to a specific asset all the time. Falcon grants them access when required, and automatically revokes that permission afterward. Therefore, even in the event of a successful breach, the hacker's access will be extremely limited in both time and scope.

CrowdStrike thinks agentic AI alone presents a $150 billion opportunity for the cybersecurity industry. It's one of the reasons management thinks the company's annual recurring revenue (ARR) could reach $20 billion by fiscal 2036, which would be an eye-popping 325% increase from $4.7 billion today.

CrowdStrike could soar 325% by 2036, but there's a catch

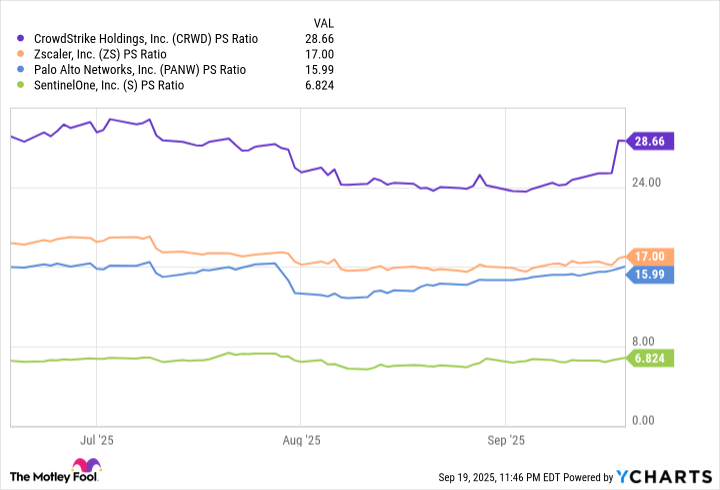

CrowdStrike stock is trading at a price-to-sales (P/S) ratio of 28.6 as I write this. It's the most expensive stock in the cybersecurity space based on that metric, which could limit its upside in the short term.

CRWD PS Ratio data by YCharts

However, let's assume for a moment that CrowdStrike's P/S ratio remains constant over the long run. If the company's ARR really does grow 325% to $20 billion by fiscal 2036, then its stock would rise by a similar amount over the next 10 years -- a great return for investors who buy it today.

But here's the catch: I don't think CrowdStrike can maintain its lofty P/S ratio for much longer. Although ARR growth of 325% by fiscal 2036 sounds impressive at face value, it actually translates to a compound annual increase of just 14.1%. That would be a significant slowdown compared to the company's ARR growth of 42.6% over the last five years.

Investors typically pay high valuations for rapidly growing companies, but the reverse is also true, so decelerating revenue growth could result in a lower P/S ratio for CrowdStrike. The reason is simple; a company that doubles its revenue each year will grow into a premium valuation much faster than a company that increases its revenue by just 10% annually, making it a more attractive investment even if it appears "expensive" in the short term.

That doesn't mean CrowdStrike stock has to crash from here, but it could face a lengthy period of low, or potentially even flat returns. For example, let's assume a fair P/S ratio is 16, which aligns with the valuation of its key rival. If CrowdStrike's revenue grows at a compound annual rate of 14.1%, its stock would have to stay exactly where it is for the next four years to get there from its current P/S ratio of 28.6. That isn't a great deal for investors.

As a result, while it's certainly possible that CrowdStrike stock soars by 325% over the next decade, it's important for investors to manage their expectations.