BigBear.ai: The Millionaire-Maker Stock You Can’t Ignore in 2025

AI meets defense contracts—and your portfolio might never be the same.

BigBear.ai just landed a Pentagon deal that sent algorithms buzzing. The defense sector's hunger for predictive analytics fuels this stock's rocket trajectory.

Why analysts are whispering 'moonshot'

Their proprietary tech cuts through data noise like a hot knife through butter. Military planners bypass traditional intel bottlenecks using their cognitive computing stack. Supply chain logistics get optimized in real-time—no human team could match this speed.

The bear case nobody's talking about

Government contracts come with red tape that could strangle growth. One budget cut slices their revenue pipeline overnight. Remember—this isn't some decentralized crypto project immune to bureaucratic meddling.

Wall Street's sleeping on AI's frontlines while chasing crypto pumps—typical finance shortsightedness. BigBear.ai either becomes your retirement ticket or a cautionary tale about betting on the machine-learning arms race.

Image source: Getty Images.

BigBear.ai holds a key U.S. Army contract

BigBear.ai specializes in providing custom AI solutions to government clients. While it has other clients (like airports that utilize its software to process international travelers through customs), its biggest contract is with the U.S. Army.

BigBear.ai holds a five-year, $165 million contract to provide a Global Force Information Management (GFIM) system. It was awarded this contract about a year ago, so it still has plenty of revenue to realize from this contract. The goal of this job is to provide the Army with AI-powered software to "ensure that the Army is properly manned, equipped, trained, and resourced" for any mission it finds itself on.

These kinds of contracts can open the door for more if BigBear.ai does a great job, but it has run into some headwinds. Various government efficiency efforts have stalled some of this spending, which caused BigBear.ai to report negative revenue growth during Q2. With how large a trend AI is throughout the broader market, a company that specializes in AI reporting negative revenue growth is a huge red flag. Now is the time for companies like BigBear.ai to shine, especially when competitors like, which has a large government contract business, are seeing increased government spending.

Unfortunately, that's not the only red flag for BigBear.ai.

BigBear.ai's margins are rather low for a software company

Part of the reason that Nvidia, or even Palantir, has grown into the sizable businesses that they are today is that they offered a base product that was widely adopted by multiple industries. BigBear.ai doesn't have that. Instead, it's developing custom solutions for each customer. This limits BigBear.ai's upside, as it won't be able to rapidly deploy its AI solutions to the use cases its customers require without a significant number of employees to process the work.

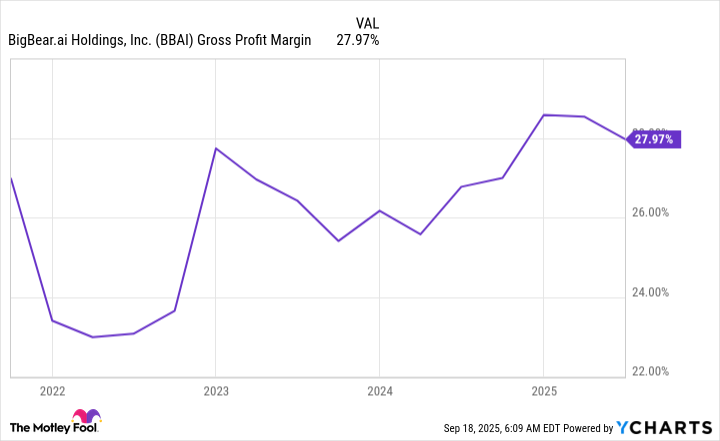

This drags on gross margins, which are quite poor compared to most software companies.

BBAI Gross Profit Margin data by YCharts

BigBear.ai's gross profit margins are consistently in the 20% range, which is far from the 70% to 90% gross profit margins that most software companies produce. Instead, I think it WOULD be better to think of BigBear.ai as a consulting firm that employs a ton of people to develop custom solutions for its clients.

With BigBear.ai's lack of success in the AI arms race, combined with its consulting-like business model, I doubt BigBear.ai has the potential to become a millionaire-maker stock. Instead, investors should turn to some other AI stocks that have massive upside, as there are plenty of them in this sector.