The Smartest Dividend ETF to Buy With $1,000 Right Now (September 2025)

Forget picking stocks—this ETF does the heavy lifting while you collect checks.

Why This ETF Stands Out

Most dividend funds chase yield like retirees chasing early-bird specials. This strategy targets sustainable payouts from companies actually growing their businesses. The portfolio holds 50-100 positions across multiple sectors, spreading risk while maintaining focus on quality.

How It Works For Investors

The fund automatically reinvests dividends unless you specify otherwise. With $1,000, you get instant diversification that would normally require $50,000+ to replicate individually. Management fees sit at 0.35%—below the category average of 0.50%.

The Bottom Line

This isn't get-rich-quick crypto speculation. It's get-rich-slow compounding—the kind Wall Street prefers you ignore while pushing more exciting (and expensive) alternatives.

Image source: Getty Images.

SCHD has a criteria fit for high-quality companies

The saying "Everything that glitters ain't gold" also applies to dividend stocks. Just because a stock has a high dividend yield doesn't mean it's worth owning. In some cases, it could be a yield trap, where the dividend is only high because the stock price has dropped due to bad business performance.

Investing in SCHD removes much of the risk of a yield trap because of the criteria it takes to be included in the ETF. It tracks the, and to be included, a company must have the following:

- A strong balance sheet

- Consistent cash flow

- At least 10 years of dividend payouts

- Strong profitability metrics (such as return on equity)

These criteria is a good vetting tool for investors, removing some of the need to do more in-depth research on the companies within the ETF. Some notable dividend kings (companies with at least 50 consecutive years of dividend increases) in the ETF are,,,, and.

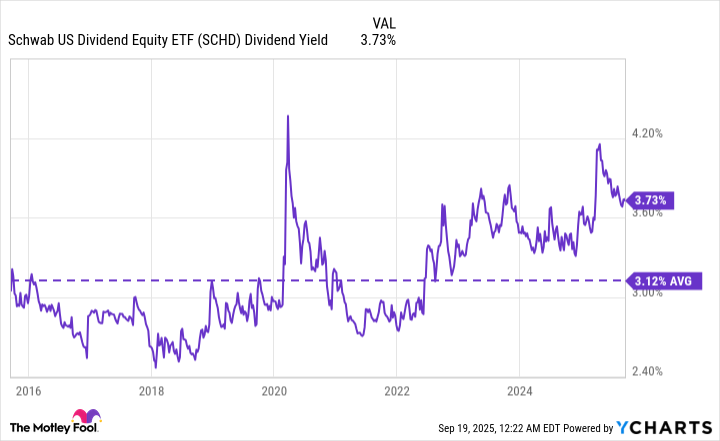

A sustained high dividend yield

You shouldn't solely focus on dividend yields because they fluctuate with stock price movements, but it's still worth paying attention to the dividend yield a dividend-focused ETF is able to sustain. At the time of this writing, SCHD's dividend yield is 3.7%. This is above its 3.1% average over the past decade, and around three times what the S&P 500 currently offers.

SCHD Dividend Yield data by YCharts

At its current dividend yield, a $1,000 investment WOULD pay around $37 annually. This isn't early retirement type money, but it can snowball into meaningful income, especially if you take advantage of your brokerage platform's dividend reinvestment plan (DRIP). With a DRIP, your broker will take the dividends SCHD pays you and automatically reinvest them to buy more shares of the ETF.

Add in the fact that SCHD has increased its payout by over 160% in the past decade and should continue to increase its payout over time, and you have a chance for a $1,000 investment to go a long way.

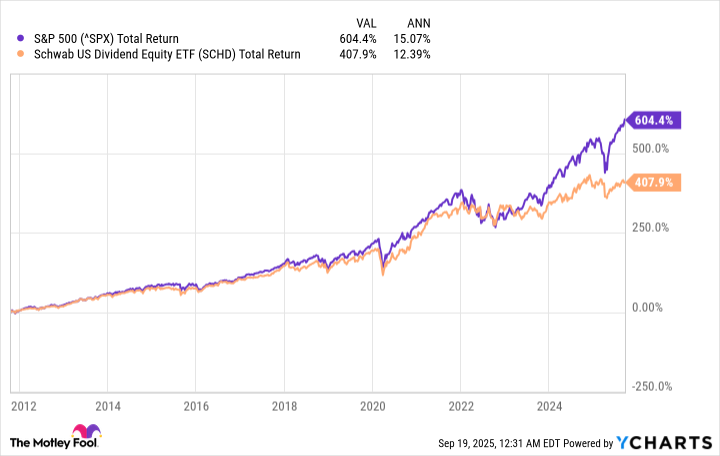

Don't expect explosive stock price growth

Since SCHD hit the market in October 2011, it has underperformed the S&P 500, averaging 12.4% annual total returns compared to the index's 15%. Despite the underperformance, those are returns that most investors would still be happy to receive.

^SPX data by YCharts

Past results don't guarantee future performance, but for the sake of illustration, let's assume the ETF continues to average 12% annual total returns. A single $1,000 investment today could grow to over $9,600 in 20 years. If you were to add just $100 monthly to the ETF, it would grow to over $96,000. And with a low 0.06% expense ratio, you can keep more of these gains in your pocket.