AI Stocks Bubble? This $7 Trillion Signal Reveals The Truth

Wall Street's latest obsession faces its ultimate reality check.

The $7 Trillion Question

That staggering figure represents the market cap swirling around artificial intelligence equities—a number so massive it either validates the revolution or screams bubble territory. Institutional money floods AI pipelines while retail investors chase the next NVIDIA.

Separation Anxiety

Real productivity gains separate sustainable plays from vaporware. Companies actually deploying AI at scale demonstrate measurable ROI—others just slide 'AI' into investor presentations and watch valuations double.

The Cynic's Take

Because nothing says 'sound investment' like hedge funds piling into companies that replace human workers with algorithms that still can't distinguish a cat from a carburetor.

Bottom Line

Follow the $7 trillion—it either leads to the next industrial revolution or the mother of all corrections. Smart money bets on infrastructure; gamblers chase headlines.

Data center capacity is just getting started

According to McKinsey's forecast, global data center capacity is set to nearly triple by 2030 -- climbing from 82 gigawatts today to 219 gigawatts at the start of the next decade.

Crucially, roughly 70% of this growth will be driven by AI workloads, while the remainder will be tied to traditional cloud and information technology (IT) applications.

In total, McKinsey projects that capital expenditures to fund this infrastructure expansion could approach $7 trillion over the next five years.

Image source: Getty Images.

Why do these trends matter for AI valuations?

During the dot-com bubble of the late 1990s, companies like Microsoft, Amazon, andtraded at peak price-to-sales (P/S) multiples between 30 and 40. Today, skeptics contend that some AI leaders are exhibiting similar signs of excess -- with some trading at elevated P/S and price-to-earnings (P/E) ratios relative to historic norms. Tesla and, in particular, stand out with valuations that may be stretched to unsustainable levels.

But the comparison to the dot-com era overlooks some critical differences. At the height of internet euphoria, many technology darlings had minimal sales traction, persistent cash burn, and valuations built on metrics such as clicks and user growth.

By contrast, AI already enjoys enterprise-grade adoption across industries ranging from cybersecurity and pharmaceutical research to autonomous systems, retail, and robotics.

What's more, McKinsey's data indicates that companies can count on continued cash FLOW as data center spending continues.

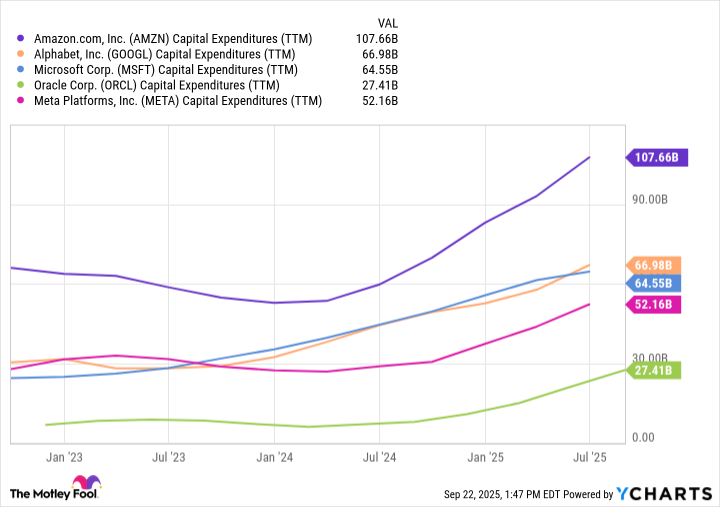

AMZN Capital Expenditures (TTM) data by YCharts

Put simply, as AI infrastructure continues to increase rapidly, the revenue and profits generated by companies powering this accelerated transformation are likely to translate into sustained premium valuations over time.

$7 trillion of opportunity suggests long-term upside

History's prior bubbles were primarily supported by hope, which can be fleeting. However, continuous spending on chips, servers, networking gear, and efficient energy systems is converging on the next generation of products and services that can be measured and benchmarked against financial growth.

Far from signaling a bubble, the upcoming $7 trillion investment marks the first wave of an infrastructure supercycle reshaping entire economies. In other words, this is the foundation for the next technology roadmap.

For investors, the takeaway is clear: Volatility is inevitable, but structural demand from AI is locked in. Semiconductor designers and manufacturers, cloud hyperscalers, and energy innovators sit at the center of this demand -- positioned to capture powerful secular tailwinds over the coming years.

Viewed in this context, today's investments represent early entries into a historic growth narrative that continues to expand. For long-term investors, megacap AI stocks remain some of the most compelling buy-and-hold opportunities in the modern AI infrastructure boom.