Could This AI Chipmaker Actually Surpass Nvidia by 2030?

The AI chip race just got interesting—and Nvidia might be looking over its shoulder.

New Challenger Emerges

While Nvidia dominates today's AI hardware landscape, several emerging players are positioning themselves to disrupt the status quo. These companies aren't just copying existing architectures—they're reinventing how chips process neural networks.

Architecture Advantages

Specialized processors targeting specific AI workloads could outperform general-purpose GPUs. Some designs already demonstrate significant efficiency gains in training and inference tasks. The question isn't whether competition will heat up—it's which approach will win.

Market Dynamics Shift

As AI applications diversify beyond large language models, demand for specialized hardware intensifies. Cloud providers and enterprises increasingly seek alternatives to avoid vendor lock-in—because nothing makes CFOs happier than paying 30% premiums for the same silicon wrapped in different marketing.

The 2030 Outlook

Surpassing Nvidia requires more than technical superiority—it demands ecosystem development, manufacturing scale, and developer adoption. The path remains steep, but the rewards could reshape the entire tech landscape. Maybe then we'll finally see some actual innovation instead of just rebranded mining chips.

Image source: Getty Images.

Soaring market value

This company, like Nvidia, has seen its market value soar in recent times -- in fact, it joined the "trillion dollar club" this year when its market capitalization reached $1 trillion for the first time ever. (The trillion dollar club isn't a real club, but instead a way of referring to companies that are valued $1 trillion or more.)

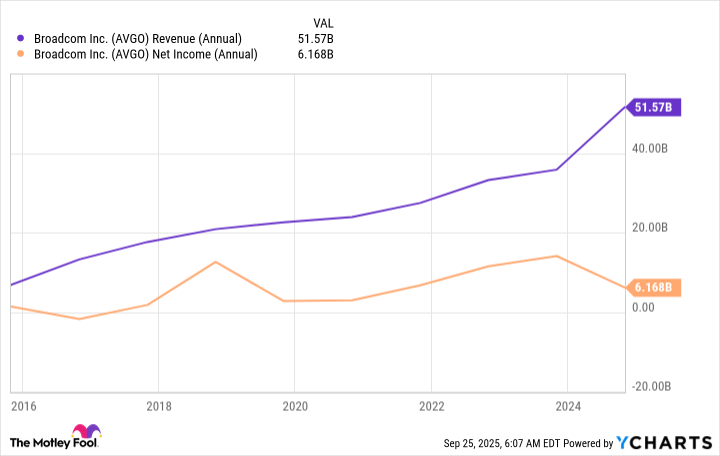

So, which company am I referring to?(AVGO -0.94%), a networking specialist that plays an integral part in powering everything from smartphones to data centers. The company makes thousands of products used across many environments and also sells enterprise software solutions -- in fact, Broadcom serves most of the Fortune 500 companies with its software. All of this has helped Broadcom increase earnings into the billions of dollars over time.

AVGO Revenue (Annual) data by YCharts

But what's truly been driving Broadcom's revenue in recent times has been its work in the AI market. Broadcom's top networking solutions -- such as Tomahawk switches and Jericho routers -- along with the company's AI chips, known as XPUs, have been gaining ground with big cloud service providers as they scale up their AI infrastructure.

Nvidia vs Broadcom

How do Nvidia's and Broadcom's AI chips compare? Nvidia's GPUs are the most powerful on the market and are general purpose, meaning they can supercharge any AI task. Broadcom designs XPUs to serve specific functions for customers, making them custom solutions. This clearly appeals to AI customers because Broadcom said the XPU business made up 65% of its AI revenue in the recent quarter and orders from three major customers continue to grow.

On top of this, Broadcom said it won a $10 billion order for AI racks based on its XPUs. The company didn't identify this new customer, but analysts have suggested it may be AI research lab OpenAI.

So, the advantage Broadcom offers customers is the ability to choose XPUs specific to particular tasks -- and these custom solutions may be cheaper than going exclusively for Nvidia's top GPUs.

Now, let's get back to our question: Could Broadcom surpass Nvidia by 2030? That's the year AI infrastructure spending may reach $4 trillion, according to Nvidia chief Jensen Huang. I think that Broadcom could see explosive growth by that time and clearly become a major AI player -- this should boost its stock performance and lead to gains in market value too.

Nvidia's expertise

But, even though Broadcom likely will carve out a leading market position, it's unlikely to unseat Nvidia. This is because Nvidia's general purpose expertise offers it a vast audience -- the company's GPUs and related products and services provide top performance and are able to supercharge any AI task, making them very versatile. That will appeal to many customers over time.

In fact, Nvidia's and Broadcom's chip offerings actually are complementary, and many customers may opt to integrate both in their data centers. The AI opportunity is an enormous one, and this is great news for these companies and investors because it indicates there will be many winners. Broadcom and Nvidia already have demonstrated this as they've reported skyrocketing earnings in recent years.

All of this means that even though Broadcom is unlikely to surpass Nvidia by 2030, the stock still makes a fantastic AI investment.