Prediction: Buying High-Yield Schwab U.S. Dividend Equity ETF Today Could Set You Up for Life

Dividend Dominance: How One ETF Rewrites Retirement Rules

The Yield Revolution Quietly Transforming Portfolios

Forget chasing meme stocks and crypto hype cycles—Schwab's dividend powerhouse delivers old-school wealth building with modern efficiency. This ETF doesn't just pay dividends; it prints financial freedom through systematic compounding.

Why Dividend Aristocrats Outperform Flashy Alternatives

While Wall Street pushes complex derivatives and algorithmic trading strategies, dividend equities continue their steady march upward. The ETF's methodology targets established companies with proven cash flow—the kind that survives market downturns and economic uncertainty.

The Compound Effect: Turning Time Into Money

Reinvested dividends act as silent portfolio accelerants. Each distribution buys more shares, which generate more dividends—creating a wealth snowball that grows exponentially while you sleep. It's the ultimate 'set it and forget it' strategy in a world obsessed with minute-by-minute portfolio checking.

Retirement Readiness Without the Stress

This approach bypasses the emotional rollercoaster of market timing. Instead of praying for the next bull run, investors collect quarterly payments from blue-chip companies that have paid dividends through recessions, pandemics, and geopolitical crises.

Because nothing says financial sophistication like getting paid while ignoring your broker's latest 'groundbreaking' investment idea.

What does Schwab U.S. Dividend Equity ETF do?

Schwab U.S. Dividend Equity ETF is an index-tracking exchange-traded fund, so, technically, it doesn't really do much of anything. Whatever the index buys, the ETF buys. The real story here is the index, which is the. You may never have heard of this index, which isn't surprising, because it was specifically created so an ETF could track it.

Image source: Getty Images.

The first thing the Dow Jones U.S. Dividend 100 Index does is to exclude all stocks that have fewer than 10 consecutive annual dividend increases from consideration. It also excludes real estate investment trusts (REITs). The remaining list is the pool from which the index selects the 100 stocks it holds.

Each of the stocks that passes the first screen gets a composite score. That score looks at cash FLOW to total debt, return on equity, dividend yield, and a company's five-year dividend growth rate. Without getting into the details of each metric, the index is basically trying to identify financially strong companies that have growth appeal, attractive yields, and a history of rewarding investors with dividend increases. That is a pretty good summary of what most dividend investors are looking for when they buy stocks.

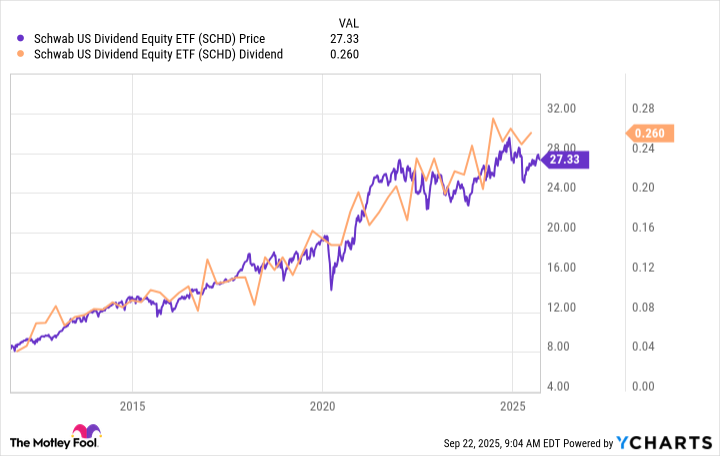

Data by YCharts.

After each company gets a score, the 100 companies with the highest scores get included in the index. A market cap weighting is used, so the largest stocks have the biggest impact on performance. That's what you get when you buy Schwab U.S. Dividend Equity ETF, which just tracks the Dow Jones U.S. Dividend 100 Index. The cost, meanwhile, is very modest, given the ETF's 0.06% expense ratio.

An attractive combination of features

Schwab U.S. Dividend Equity ETF is not going to provide you with the highest yield. Nor will it provide you with the best growth in capital. However, it does offer a good combination of the two. As the chart above highlights, the dividend has generally grown over time, and so has the ETF's share price.

That makes this something of a foundational investment for dividend investors who don't want to go through the effort of picking stocks. Or it could be a quick and easy way to diversify your dividend portfolio, allowing you to focus on picking a smaller number of stocks for which you have high conviction. Pair it up with a bond ETF, and you'd have created your own personal balanced fund. You could even add other dividend ETFs to the mix, either dividend growth-focused or yield-focused, to ensure you have a well-structured portfolio that doesn't lean too far toward yield or growth. Schwab U.S. Dividend Equity ETF can be a powerful tool in your portfolio in multiple ways.

Built for a lifetime of reliable income

The big story here is that Schwab U.S. Dividend Equity ETF has a unique, though fairly complex, approach to selecting dividend stocks. That approach is probably similar to what you WOULD do if you were buying individual stocks. And that sets up this ETF to provide you with a reliable income stream for the rest of your life, which you can use in many different ways to tailor your investment approach to your own specific needs.