Unlocking the $450 Billion Robotics Revolution: Should You Buy Serve Robotics Stock Today?

Robots are taking over the streets—and Wall Street wants a cut.

The delivery robotics sector hits a staggering $450 billion valuation threshold as Serve Robotics positions itself at the forefront. While legacy automakers struggle with electric transitions, Serve's sidewalk-navigating bots already bypass traffic, cut delivery costs, and operate around the clock.

Why This Isn't Just Another Tech Bubble

Serve's autonomous fleets demonstrate real-world scalability most AI companies only PowerPoint about. Their units actually generate revenue per delivery—a novel concept in tech investing.

The Regulatory Hurdle Every Investor Misses

Municipal approvals remain the bottleneck. Cities control sidewalk access, and not all welcome our robot overlords equally. Serve's first-mover deals with major delivery platforms give it regulatory leverage competitors lack.

When Wall Street analysts get excited about 'disruption,' check their portfolio allocations. The same firms pushing robotics stocks still derive 80% of revenue from fossil fuel investments. Serve either represents the logistics future or becomes another case study in speculative hype—either way, the ride promises volatility.

Image source: Getty Images.

Serve has a blockbuster deal with Uber Eats

Serve Robotics believes existing last-mile logistics networks are incredibly inefficient because they rely on humans and cars to handle small commercial deliveries from restaurants and retail stores. The company thinks autonomous robots and drones are better suited to these workloads, and it says a shift to these solutions could create a $450 billion opportunity by 2030.

Serve's latest Gen3 robots have achieved Level 4 autonomy, so they can safely travel on footpaths without any human intervention, which makes them perfect for completing local deliveries coming from various restaurants and retailers. Their autonomous capabilities are powered by Nvidia's Jetson Orin platform, which provides all of the necessary hardware and software.

Since Serve launched its first pilot program in 2022, its robots have made over 100,000 deliveries on behalf of 2,500 restaurants. When the company achieves scale, it believes it can drive the cost-per-delivery down to just $1, making its robots significantly cheaper than human-driven solutions.

Serve currently deploys 2,000 of its Gen3 robots under a deal with' (UBER -0.19%) Uber Eats platform, which is a great start. Around 400 were already live at the end of the second quarter of 2025 (which ended June 30), and 400 more were slated to roll out during the current third quarter, which ends Sept. 30.

Serve's robots are now active in Los Angeles, Miami, Dallas, and Atlanta, with Chicago in the pipeline.

Serve's revenue could soar, but there's a catch

Serve is bringing in very little revenue right now. In fact, just $642,000 came through the door during the second quarter, which is unusual for a publicly traded company valued at around $800 million.

However, Serve's business could scale extremely fast, generating substantial top-line growth along the way. According to Yahoo! Finance, Wall Street analysts expect the company to deliver $3.6 million in total revenue this year, which WOULD be up 99% compared to 2024. But it gets even better, because management believes revenue could surge to $80 million once all 2,000 Gen3 robots are operating, which is expected to happen sometime next year.

But here's the catch: Serve is losing piles of money on the road to commercialization. It burned $33.7 million during the first half of 2025 on a generally accepted accounting principles (GAAP) basis, which followed a net loss of $39.2 million in 2024.

Serve had $183 million in cash on hand at the end of Q2, which will provide enough runway for the next couple of years, but if it doesn't achieve profitability by then, it will have to find additional funding. Existing shareholders will be diluted if the company resorts to a capital raise, denting their potential returns. This is something to keep in mind before investing.

Is Serve stock a buy right now?

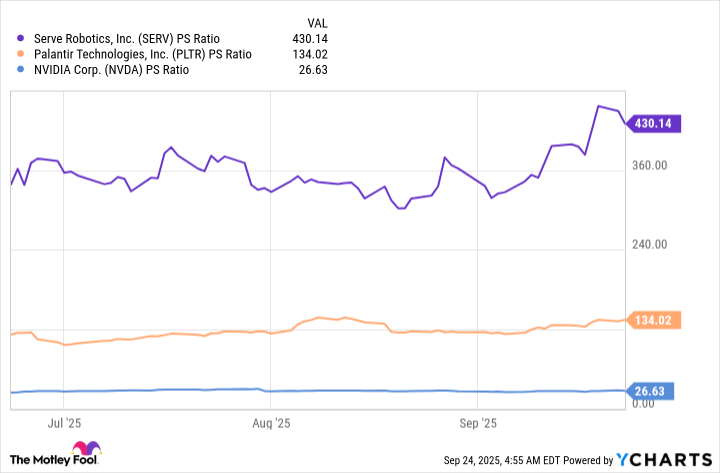

Serve's valuation poses another risk to investors. Its stock is trading at an eye-popping price-to-sales (P/S) ratio of 429 as I write this, making it one of the most expensive names in the entire AI space.

For some perspective, Serve is a whopping 16 times more expensive than Nvidia, which trades at a P/S ratio of just 26. It even makes' sky-high P/S ratio of 133 seem a little less absurd.

Data by YCharts

With all of that said, Serve stock might actually be cheap today if investors believe management's guidance. If we assume the company will eventually generate $80 million in annual revenue, that places its forward P/S ratio at around 10, which is actually quite attractive, especially if it happens within the next couple of years.

Moreover, if Serve's addressable market really does grow to $450 billion by 2030, then $80 million in annual revenue would be a drop in the bucket compared to the opportunity at hand. In other words, the company would have a very long runway for growth, making its stock appear even cheaper on a forward basis.

However, corporate guidance isn't always reliable, so investors who buy Serve stock today are very much taking a leap of faith. Therefore, it might be safer to wait until next year to see how well the Gen3 robots scale, because that will ultimately determine whether management's forecasts become reality.