AI Stock Showdown: Why Palantir vs Nvidia Is the Ultimate Tech Investment Decision

Two tech titans collide in the race for artificial intelligence dominance—but only one deserves your portfolio's prime real estate.

The Hardware Powerhouse

Nvidia's chips fuel everything from data centers to autonomous vehicles. Their GPUs became the unexpected workhorse of the AI revolution—processing complex algorithms faster than competitors imagined possible.

The Software Visionary

Palantir's platforms analyze massive datasets for governments and enterprises alike. They've pivoted from controversial beginnings to become AI infrastructure architects—transforming raw data into actionable intelligence.

Market Realities Bite

Both stocks trade at premiums that make traditional value investors shudder. Because nothing says 'solid investment' like paying 50 times revenue for companies that might be disrupted by next year's tech breakthrough.

The Verdict

One company sells picks during a gold rush—the other claims to know where the gold is buried. Choose wisely before the next algorithmic shift leaves yesterday's winners behind.

Image source: Getty Images.

Palantir's strengths

Palantir has been on an incredible run of rising revenue. The company's sales in the second quarter jumped 48% year over year to $1 billion, the first time quarterly revenue reached this level.

The result improved on Q1's 39% year-over-year revenue growth to $884 million, and enabled Palantir to raise 2025 full-year guidance to $4.1 billion, a significant increase from 2024's $2.9 billion.

This success is thanks to its Artificial Intelligence Platform (AIP). Like all AI, AIP relies on massive amounts of data to make decisions and execute tasks. This fact puts Palantir in a position of strength in the AI era.

The company specializes in data analytics, and so possesses plenty of fuel for its AI fire. In fact, Palantir's roots in analyzing data for government intelligence agencies give it a unique and unparalleled level of data expertise.

Now, Palantir is expanding into additional areas as it seeks to maintain its remarkable revenue growth. Its FedStart product leverages the company's long history working with the U.S. government to help other businesses with the complexities of federal compliance.

Additionally, its Warp Speed solution employs AI to modernize manufacturing systems. The U.S. Navy adopted it to aid in shipbuilding.

Nvidia's streak of success

Like Palantir, Nvidia experienced outsized sales growth thanks to AI. Its advanced semiconductor chips used to power AI systems propelled the company's revenue to $46.7 billion, a 56% year-over-year increase, in its fiscal Q2, ended July 27.

Despite government restrictions that blocked Nvidia from selling its chips to China, one of the world's largest AI markets, the company still expects fiscal Q3 sales of $54 billion. That sum blows away the Q3 record of $35.1 billion earned in the prior fiscal year, which included sales to China.

Nvidia's current AI chip, Blackwell, debuted last year as the platform designed specifically to power tech infrastructure for AI. Even so, Nvidia already has a successor, Vera Rubin, poised to launch in 2026. That's just the start of the AI semiconductor giant's moves to expand its business.

On Sept. 22, Nvidia announced a partnership with OpenAI, the creator of ChatGPT, which launched the current generative AI boom. The deal involves OpenAI adopting Vera Rubin to power a massive rollout of AI data centers, an initiative incorporating millions of Nvidia chips.

The implementation is so ambitious, Nvidia CEO Jensen Huang called it "the biggest AI infrastructure project in history."

But that's not all. Nvidia also announced a $5 billion investment inon Sept. 18. This partnership will see many Nvidia products integrated into Intel's AI data center and personal computing solutions, further expanding Nvidia's influence over major players in the AI space.

Choosing between AI giants Palantir and Nvidia

With both Palantir and Nvidia enjoying plenty of AI success, how can an investor choose between the pair? One factor to consider is share price valuation.

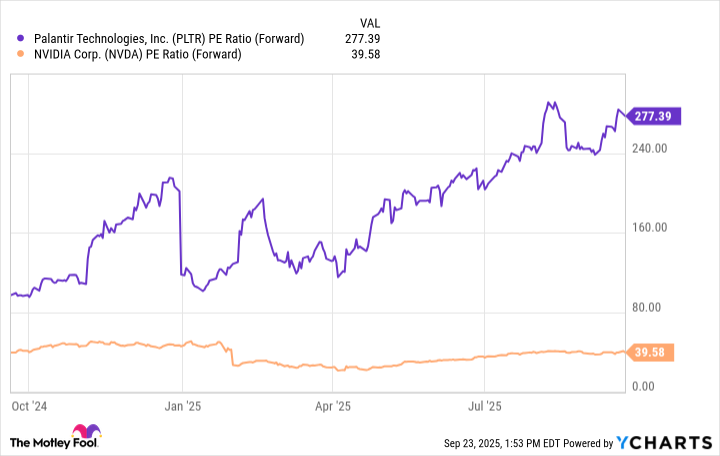

This can be assessed using the forward price-to-earnings (P/E) ratio, which tells you how much investors are willing to pay for a dollar's worth of earnings based on estimates for the next 12 months.

Data by YCharts.

Palantir's forward P/E multiple has steadily risen over the past few months, and is currently far above Nvidia's. This indicates Palantir shares are more expensive by a substantial margin.

Palantir stock's bloated valuation is hard to justify, considering Nvidia's strong position in AI chips, growing influence in the AI sector with investments in Intel and OpenAI, and ongoing sales growth despite exclusion from the China market.

Add to these strengths its superior valuation, and Nvidia wins out over Palantir as the better AI investment for the long haul.