Is Fluor Stock Your Golden Ticket to Millionaire Status in 2025?

Engineering giant Fluor sits at a critical crossroads—while traditional infrastructure plays face headwinds, this contractor's global footprint positions it for the coming reconstruction boom.

The Green Energy Gambit

Fluor's pivot toward sustainable projects isn't just PR—it's survival. The company's betting big on carbon capture and hydrogen infrastructure as governments worldwide throw trillions at climate initiatives.

Risk Versus Reward Calculus

Fixed-price contracts continue to haunt Fluor's balance sheet, but new leadership appears determined to tighten bidding processes. The stock's volatility reflects Wall Street's schizophrenia about whether this is a value trap or turnaround story.

Millionaire-Maker Math

For Fluor to deliver life-changing returns, it needs to execute flawlessly on mega-projects while avoiding the cost overruns that crushed margins during the pandemic era. The thesis hinges on infrastructure spending actually materializing—something politicians love promising but rarely deliver efficiently.

Bottom line: Fluor could be your ticket to wealth if global infrastructure spending accelerates and management stops leaving money on the table. But as any seasoned investor knows, 'if' is the most expensive word in finance.

Two things to know about Fluor's operating history

At its core, Fluor is an engineering and construction company. It serves a variety of sectors, everything from oil and gas to mining and power generation. When big infrastructure projects need planning and building, many companies call on Fluor to handle nearly the entire process.

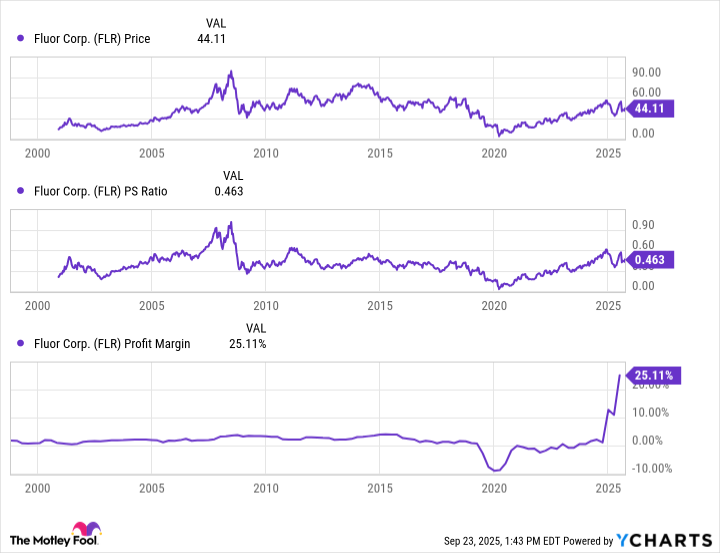

The last five years have been incredible for Fluor's stock price. But the financials tell a slightly different story. Since 2020, company revenue has increased by just 6.6%. Gross profits, meanwhile, have increased by just 36% over that time period. The stock's price-to-sales ratio is the clear outlier, moving from 0.07 to 0.47 since 2020 -- a rise of nearly 480%.

From this perspective, most of Fluor's stock price appreciation over the last five years has stemmed from a massive increase in its valuation multiple, not improvements to revenue or gross profits. A big reason for this was the company's flip to profitability last year. From 2020 to 2024, Fluor averaged a profit margin of roughly 0%. Over the last 12 months, however, its profit margin has reached 25%. The company is managing its costs, contracts, and execution better today than it has in years. But the biggest mover has been the company's realized and unrealized profits on its position in a small modular rector business that has seen its share price soar. We'll talk more about that position in the next segment, but these two factors contribute to the first thing investors should understand about Fluor's recent operating history: The company has gone from a money-loser to a fairly profitable business in under five years, causing a sharp rerating of the stock.

When you zoom out, you'll see that this type of rerating has happened many times over Fluor's operating history. Engineering and construction can be a cyclical business with huge ups and downs. Cost overruns, meanwhile, can crash the company's financials even when demand is strong. This means that the market has occasionally rerated the stock sharply in both directions -- both up and down.

FLR data by YCharts

Over the decades, Fluor stock has seen several extreme ups and downs. A big reason for the latest spike has been the company's interest in(SMR 0.66%). Beginning in 2011, Fluor began investing hundreds of millions of dollars in designing small reactor technology. It consolidated this interest into NuScale Power, which went public as a separate entity in 2022. Because Fluor still owns a majority of shares, the results are consolidated into Fluor's financials, having an outsize effect on the company's bottom line. Shares held or sold at a profit, for example, will cause Fluor's profits to spike.

This is the second thing to understand about Fluor's operating history: The performance in recent years has been fueled by new business ventures that didn't exist in years past.

Image source: Getty Images.

Does this make Fluor stock a sell?

Fluor's stock has performed very well in recent years. But over the decades, the company has largely been a disappointment for investors. The ups and downs of engineering and construction are wild, and have largely left patient investors lagging the overall market. Recent outperformance, meanwhile, has had more to do with NuScale's success and a rerating of the stock versus a dramatic shift in conditions for the Core company.

Does this make shares a sell? Not necessarily. Many investors specialize in cyclical stocks. But you need to understand when conditions are suitable, getting out before these favorable conditions change. NuScale's opportunity in small modular reactors, however, could be an opportunity with decades of growth ahead. If Fluor is on your radar for its strong recent performance, you might actually be better off digging into NuScale.