Still Obsessed with Domino’s Pizza Stock? This Restaurant Play Could Deliver Bigger Returns Today

Domino's loyalists might want to check the menu again—there's a fresh contender serving up better growth prospects.

The Hidden Gem That's Outperforming Pizza Chains

While everyone's busy tracking pizza delivery times, this restaurant stock is cooking up serious shareholder returns. Its expansion strategy bypasses traditional franchise models, cutting overhead while scaling faster than competitors.

Why Traditional Restaurant Metrics Don't Apply Here

Same-store sales growth? Check. Digital transformation? Double-check. But this player adds secret sauce with proprietary tech that actually works—unlike those blockchain solutions your cousin won't stop talking about.

Market Position That Actually Makes Sense

No vague promises about "disrupting the industry" or "Web3 integration." Just solid fundamentals, realistic expansion targets, and management that understands restaurants should primarily sell food.

Bottom line: Sometimes the smartest investment isn't the one everyone's talking about—it's the one quietly executing while Wall Street analysts debate whether pizza toppings affect stock performance.

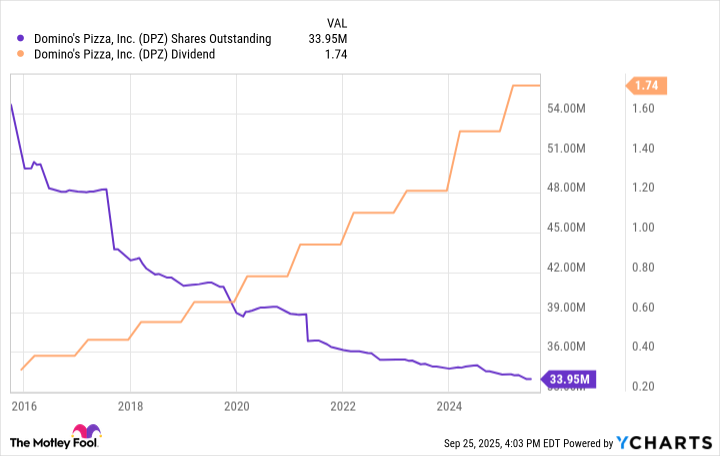

DPZ Shares Outstanding data by YCharts

There's a lot to like about Domino's but, as a business, Wingstop is equally attractive. And as an investment, this chicken-wing chain may have a key advantage over the pizza business.

How Wingstop makes money

Wingstop is nowhere NEAR as big as Domino's. But with more than 2,800 locations worldwide as of Q2 2025, it's still one of the largest restaurant chains in the world. Like Domino's, most Wingstop locations (98%) are owned and operated by franchisees, giving the company the same high-margin, asset-light business model.

Image source: Getty Images.

Unlike Domino's, Wingstop doesn't operate a supply chain business. But there's still red-hot demand from operators wanting to open new franchised locations. This is due to Wingstop's attractive unit economics.

To expound on the economics, Wingstop locations based in the U.S. generate $2.1 million in revenue annually on average -- that's a lot. Moreover, nearly three-quarters of sales are digital, meaning they come in through the app or online. Usually this is because the customer is making an order for either delivery or take-out. Since customers usually don't interact with a cashier and often don't eat in the restaurant, Wingstop locations can operate with fewer employees than comparably sized restaurants, making locations quite profitable.

The more profitable it is to operate a Wingstop, the more franchisees want to open more locations. That's leading the company to open more than 400 locations this year. And its pipeline for future openings is at an all-time high.

With its franchisees happy and clamoring for more, Wingstop is raking in consistent high-margin revenue, which it's using to reward shareholders as well. The share count is starting to drop with buybacks, the quarterly dividend is going up, and management has been known to pay a special dividend from time to time.

Why Wingstop stock might be better than Domino's

I won't beat around the bush: I believe Wingstop stock will outperform Domino's because of its superior growth opportunity.

Wingstop is opening new locations at a record pace but don't expect it to slow. The company has just over 2,400 locations in the U.S. but management believes it can grow that number to a whopping 6,000. And it believes that it can grow its average annual sales volume per location to $3 million. Considering it's increased its same-store sales for 21 consecutive years, it's not naive to believe that sales per location can increase long-term to reach this goal.

Keep in mind that this target for Wingstop doesn't even include the international opportunity, where it only has 400 locations, as of Q2.

In short, Domino's is growing revenue at a single-digit growth rate. Wingstop is growing at a double-digit rate and can sustain that for quite some time if things go right.

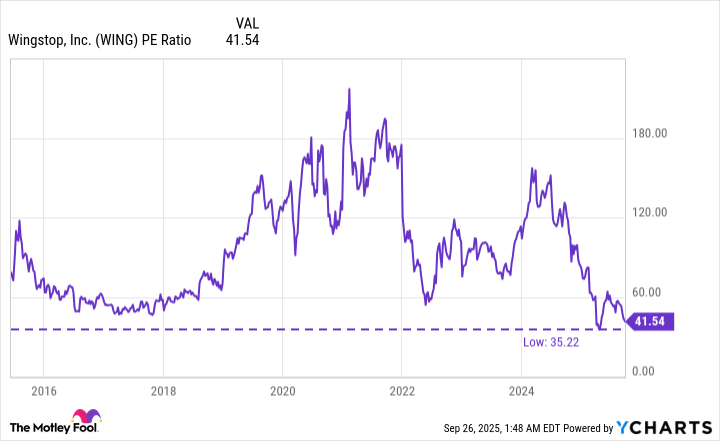

Restaurant stocks are generally down in 2025. When entire sections of the stock market sell off, that often provides timely opportunities in the best players -- they unjustly sell off with their peers. For its part, Wingstop stock is down more than 40% from highs. And as the chart below shows, it now trades at close to its lowest price-to-earnings (P/E) valuation ever.

WING PE Ratio data by YCharts

I've patiently waited for the last few years for a timely opportunity to invest in Wingstop. I'm happy to have finally taken my first bite of this chicken wing stock. And with a plan to dollar-cost average my position (increasing my stake little by little with future buys), hopefully I'll soon be back at the table for a second helping of what I believe will be a market-beating investment.