Tesla Stock: Smart Buy Before October 2nd? Here’s What You Need to Know

Tesla's October Catalyst Looms - Time to Position?

The Clock Is Ticking

With October 2nd approaching faster than a Plaid Model S, Tesla investors face a critical decision point. Market whispers suggest something big is brewing - though whether it's another Elon masterstroke or another 'funding secured' moment remains unclear.

Historical Patterns Don't Lie

Tesla's Q4 performance typically separates the bulls from the bears. The company has consistently delivered either spectacular breakthroughs or spectacular excuses - rarely anything in between. This binary outcome makes pre-announcement positioning particularly treacherous.

The EV Reality Check

While legacy automakers struggle with their electric transitions, Tesla continues eating market share. Production numbers tell the story: growth persists even as traditional manufacturers scale back their electrification timelines. The gap between Tesla and 'everyone else' keeps widening.

Timing the Tesla Trade

October announcements have historically moved TSLA by double-digit percentages. The smart money positions early, the desperate money chases the news, and the Wall Street analysts? They'll just revise their price targets after the fact - as usual.

Final Verdict: High Risk, Higher Reward Potential

Tesla remains the ultimate conviction trade in a market full of hedge fund groupthink. Either you believe in the electrification revolution, or you don't. Just remember: when investing in Musk's vision, you're not buying a car company - you're buying a ticket to Mars with occasional stopovers in regulatory purgatory.

Image source: Tesla.

Tesla's EV deliveries likely shrank yet again

Tesla delivered 720,803 EVs during the first half of 2025, which was down 13% from the same period last year. This led to a 14% decline in the company's revenue and a 31% crash in its earnings during the same period, which is concerning because the EV business supplies the cash FLOW to develop new products like the Cybercab and Optimus.

Competition is the main reason for Tesla's sluggish sales. In Europe, for example, the company's sales plunged by 36% year over year during August, despite EV sales growing by 30% in the region overall. In other words, Tesla is rapidly losing market share to other brands.

China-basedis one of those brands. Its sales tripled across Europe during August, as its low-cost EVs resonated with consumers who are increasingly budget conscious.

Wall Street's consensus estimate suggests Tesla delivered around 445,000 EVs worldwide during Q3, which WOULD be down 3.9% from the year-ago period. While that is a shallower decline than the company experienced in the previous two quarters, it's mainly because analysts predict American consumers were front-running the end of the $7,500 EV tax credit, which expires on Oct. 1.

In other words, some of Tesla's third-quarter sales might have been pulled forward from the fourth quarter, which could lead to a much weaker result to close out the year.

It's still early days for Tesla's new products

Investors who are banking on the success of Tesla's other product platforms might be waiting a while. The company's full self-driving (FSD) software isn't approved for unsupervised use anywhere in the U.S. right now, and without clearing that hurdle, the Cybercab robotaxi won't be hauling any passengers when it hits the road next year.

In the meantime, Tesla is scaling up its autonomous robotaxi business using its passenger EVs. These cars are fitted with a supervised version of FSD, which requires a human safety officer in the passenger seat who can take control if necessary. This places Tesla behind competitors like's Waymo, which is already completing over 250,000 paid, fully autonomous trips every week across five U.S. cities.

Moving onto the Optimus humanoid robot, Musk predicts this product platform will bring in a staggering $10 trillion in revenue for Tesla over the long term. He thinks humanoids could outnumber humans by 2040, because of their versatility in both business and household settings.

However, like the Cybercab, Optimus is still a while away from making a real contribution to Tesla's financial results. Musk expects production to start next year, but he says it could take five years to reach the company's target output of 1 million units annually.

Should you buy Tesla stock before Oct. 2?

Declining EV deliveries aside, I think there is an even bigger reason to be cautious about Tesla stock ahead of Oct. 2: its valuation.

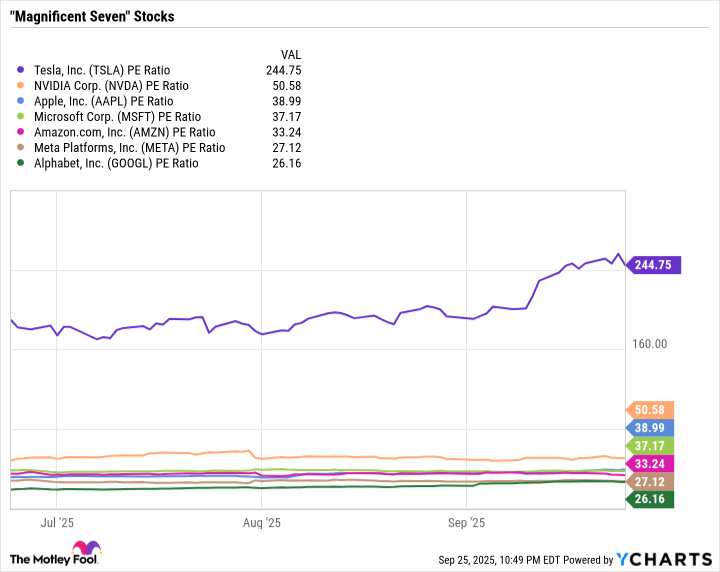

The stock trades at a sky-high price-to-earnings (P/E) ratio of 244, making it 7 times more expensive than thetechnology index, which trades at a P/E ratio of 32.6. It also makes Tesla the priciest stock in the "Magnificent Seven," which is a group of tech giants leading various segments of the artificial intelligence (AI) boom:

TSLA PE Ratio data by YCharts

High valuations are typically reserved for companies generating significant growth. Since Tesla's earnings are currently shrinking, its premium to the Magnificent Seven is extremely difficult to justify. In my opinion, this leaves the stock open to a significant potential decline in the future, especially if there are bumps along the way to commercializing the Cybercab and Optimus.

Therefore, it probably isn't a wise decision to buy Tesla stock ahead of Oct. 2, and it might be best to avoid it until those new products are officially generating revenue.