TaskOn & Genzio Forge Unstoppable Alliance to Revolutionize Web3 Community Growth

Web3's community landscape just got a seismic upgrade.

The Partnership Powerplay

TaskOn's collaboration with Genzio isn't just another handshake deal—it's rewriting the playbook for decentralized community expansion. These platforms are merging forces to tackle Web3's biggest bottleneck: scaling engaged communities without sacrificing decentralization.

Breaking Traditional Barriers

Forget the old models where community growth meant centralized control. This alliance cuts through legacy limitations, bypassing traditional marketing funnels that treat users as commodities rather than participants. The integration creates frictionless onboarding while maintaining the core Web3 principle of user sovereignty.

Community Mechanics Reimagined

They're building what established players dismissed as impossible—sustainable growth engines that actually reward participation rather than just extracting value. The architecture incentivizes organic expansion through transparent tokenomics and verifiable engagement metrics.

Because apparently in Web3, the only thing harder than building community is explaining to traditional VCs why you don't need their permission to do it.

Intel's new partnerships give some investors hope

Though Intel has seemingly missed the artificial intelligence (AI) gravy train so far, it remains a dominant player in the client and server central processing unit (CPU) markets. Of course, the company has been losing ground toin these markets, but its unit share of the overall CPU market still stands at just over 75%.

This probably explains why the likes of Nvidia,, and the Trump administration have opened their wallets for Intel. Nvidia announced a $5 billion investment in Intel last month. Both companies will "jointly develop multiple generations of custom data center and PC products that accelerate applications and workloads across hyperscale, enterprise and consumer markets."

Specifically, Intel is going to manufacture custom server CPUs based on the x86 architecture for Nvidia's AI chip systems. Additionally, Intel will integrate Nvidia's consumer graphics cards into its client system-on-chips (SoCs). This partnership could indeed be a fruitful one for Intel. After all, Nvidia is the leading player in the AI graphics processing unit (GPU) market, and it's easy to see why it has decided to invest in Intel.

Nvidia currently offers rack-scale server systems that integrate its Blackwell GPUs with its Grace server CPUs. However, the Grace chips are based on' architecture. Given that x86 chips are expected to account for 77% of the global AI server chip market in 2025, it's easy to see why Nvidia has decided to invest in Intel to further strengthen its position in AI chip systems.

This bodes well for Intel, considering that it has been losing ground in the server CPU market to AMD. Intel's server CPU unit share slipped by 3.2 percentage points year over year in the second quarter of 2025, while the fall in the revenue share was more prominent at 7.2 points. So, Nvidia's MOVE to integrate Intel's server processors is likely to give the latter's growth a boost going forward.

Additionally, Intel received a $2 billion investment from SoftBank, along with an $8.9 billion investment from the U.S. government. These two investments are likely to help Intel boost its manufacturing and research capabilities in the hopes that it can build a robust semiconductor supply chain in the U.S.

Investors WOULD do well to note that the U.S. is the biggest AI server market in the world, with an estimated revenue share of 62% for 2025. That's why Intel investors are now bullish about the company's prospects. They hope that it will now be able to make its presence felt in the AI infrastructure space, where it has been a bit-part player for the past three years.

But has the stock gone up too much, too soon?

The red-hot rally in Intel stock of late has made the stock expensive. It's now trading at 88 times trailing earnings and 56 times forward earnings. These multiples make it significantly more expensive compared to Nvidia, which delivered impressive revenue and earnings growth in recent years.

Intel reported flat revenue growth in the second quarter, along with a non-GAAP net loss of $0.10 per share, down from a profit of $0.02 per share in the year-ago period. The company's client computing group (CCG) and data center and AI (DCAI) business units, which account for the majority of its top line, were down by 1% from the year-ago quarter.

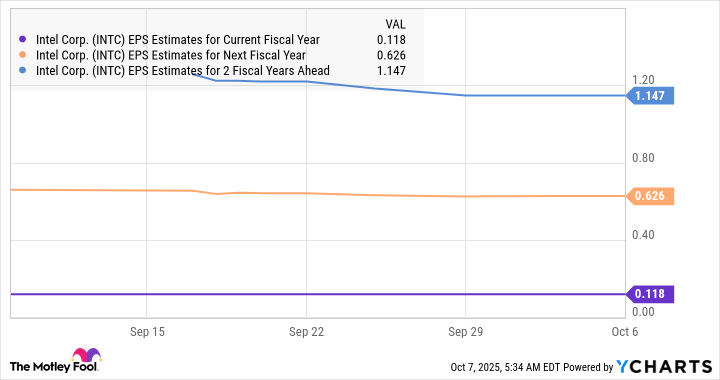

Intel has been taking steps to become a leaner company by reducing its workforce and by focusing on efficiency and cost-saving initiatives. This explains why analysts expect Intel to eventually end 2025 with an adjusted profit of $0.12 per share, compared to a loss of $0.13 per share last year. The good part is that its bottom line is expected to grow at an incredibly solid pace in the next couple of years.

Data by YCharts.

Intel's efficiency-focused moves and the potential improvement in sales thanks to the Nvidia partnership could eventually help it deliver the growth analysts are expecting. However, the stock's expensive valuation means that it would be better for investors to wait for tangible signs of a turnaround. Investors can buy chipmakers in much better health than Intel right now at cheaper valuations.

That seems to be the general consensus on Wall Street. Only 7% of the 45 analysts covering Intel suggest buying it now. Its 12-month median price target of $24 points toward a potential drop of 33% from current levels.

Intel's recent rally is built more on hope than on its financial performance. It will have to execute perfectly and show that its recent partnerships are capable of helping it accelerate its revenue growth once again. If that doesn't happen, it won't be surprising to see Intel give up its gains and head lower in the coming year.