Bitcoin’s Next Move: Dollar Surge Threatens Crypto Liquidity - What Analysts See Coming

Global liquidity squeeze tightens its grip as dollar strength returns with a vengeance.

The Dollar's Revenge Tour

Analysts warn Bitcoin faces mounting pressure from resurgent greenback dominance. That old correlation between dollar strength and crypto weakness? It's back with renewed force.

Liquidity Drain Accelerates

Traditional finance's plumbing system shows strain as capital flows reverse course. Global markets face the classic 'risk-off' scenario that historically punishes speculative assets.

Bitcoin's Resilience Test

The digital gold narrative faces its toughest challenge since the last Fed tightening cycle. Market technicians point to critical support levels that must hold to prevent cascading liquidations.

Meanwhile, traditional finance types nod sagely about 'I told you so' moments while ignoring their own portfolios bleeding from rate hikes. Some things never change in the money game.

The coming weeks will separate crypto tourists from true believers as markets navigate the dollar's unexpected renaissance.

SoFi Technologies

Most traditional brick-and-mortar banks also offer online access to banking services these days. And customers are certainly using the option. said that 32.1 million people utilized its mobile app in Q2 of this year, for instance, whilereported a mobile banking headcount of 40.8 million for the same three-month stretch.

The year-over-year growth of both of these numbers is suspiciously slower than the progress being reported by younger rival(SOFI 1.55%), though. While the online bank's total customer headcount is much smaller than Wells Fargo's or Bank of America's at a little less than 11.8 million, that's 34% better than SoFi's year-ago tally of just under 8.8 million.

What gives? Where's all this growth coming from? It's not easy to say exactly why, but there are arguably two complementary dynamics at work here. The first is a general disinterest that younger generations may have in sticking with the brands and service providers that their parents used -- including banks. Younger generations are more likely to want something completely different.

That's SoFi, to be sure, which was only launched as the online-only bank it is today in 2022. That being said, it doesn't help that the Gen Z and Millennials are also just generally skeptical of any megasized legacy companies, which is exactly what most banks are these days.

And the other dynamic in play? Although it's impossible to quantify or even confirm, consider the possibility that it might be easier to build an app-based banking business from scratch than it is to reshape a brick-and-mortar bank brand into one that's equipped to serve online customers the way they want to be served.

Too many "old school" banks are maintaining a corporate culture and market presence that was created even before the advent of the internet, let alone smartphones capable of connecting to the web or running an app. It just doesn't work.

SoFi Technologies isn't the only so-called neobank serving U.S. consumers. It's one of the biggest and best ones, though, and as such is well-positioned to capture at least its fair share of the industry's growth ahead.

Upstart Holdings

In the early days of credit lines that required a look at prospective borrowers' payment histories, credit reporting agencies like,, and played their part well enough, providing information to to come up with your official FICO score.

As time and technology have marched on, however, limitations of what's possible have been erased. The credit-scoring business itself, however, hasn't evolved in step with these changes -- that is, until now.(UPST 1.24%) is doing what's surprising that someone didn't do sooner. In simplest terms, Upstart is a new kind of loan-approval platform, somewhat combining the roles of credit reporting and credit scoring.

Although it considers the usual information like an individual's payment history, employment, and current debt levels, its artificial intelligence-powered algorithm looks at more than 2,500 different variables that help determine that person's creditworthiness. Would-be lenders simply provide Upstart with a name, and in a matter of minutes, have everything they need to extend an appropriate loan offer to that individual.

And not only does it work, but this approach works better than the more conventional lending paradigm still largely in use today. Upstart reports that its tech allows for 43% more loan approvals compared to the traditional means of making these decisions without adding any additional defaults.

That doesn't mean Upstart's growth has been unfettered since launching all the way back in 2012. Although demand for its services soared during and because of the COVID-19 pandemic, the company ran into a significant headwind in 2022 when rising interest rates and soaring inflation crimped that demand -- weakness that lingered into 2024.

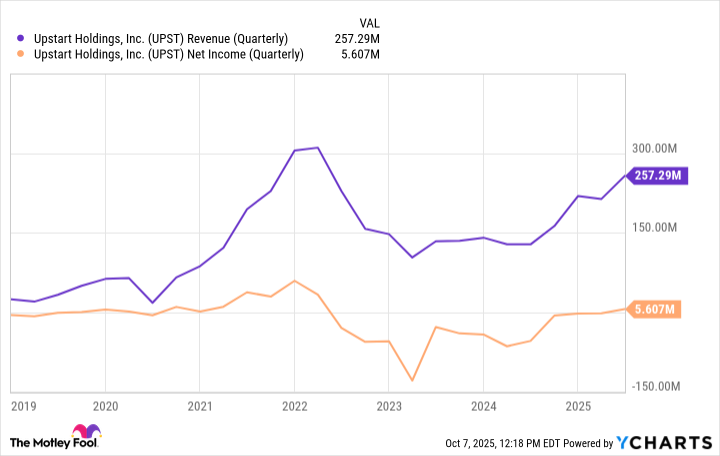

UPST Revenue (Quarterly) data by YCharts

With economic growth ramping up again, though, Upstart is catching more of a tailwind than it ever has as more and more lenders discover the strength of its artificial intelligence-powered approach to quantifying creditworthiness. The company's top line is on pace to improve by 66% this year, en route to a 27% improvement next year that's going to push Upstart well out of the red and into the black.

This same analyst community is decidedly bullish on the stock, too, by the way, sporting a consensus target of $77.57, which is more than 50% above the stock's present price. While that's only a 12-month target, it's certainly not a bad way to start out a new long-term position.