Wall Street Pepe Concludes Solana Expansion - 5.2B WEPE Incinerated as Airdrop Countdown Begins

Massive token burn sets stage for what could be Solana's most anticipated distribution event

The Purge Complete

Wall Street Pepe just torched 5.2 billion WEPE tokens in a strategic move that's tightening supply while ramping up airdrop anticipation. The Solana expansion phase? Officially over. Now the real waiting game begins.

Supply Shock Strategy

That 5.2 billion token incineration isn't just a number—it's a calculated play to create scarcity before the free money starts flowing. Because nothing says 'healthy ecosystem' like burning billions before giving away what's left.

Airdrop Economics 101

Reduce circulating supply. Generate buzz. Distribute remaining tokens. It's the crypto equivalent of shrinking the pizza before slicing it—everyone gets a smaller piece but somehow feels richer for it.

The burn completes Wall Street Pepe's transition from expansion mode to reward distribution, proving once again that in crypto, sometimes the best way to create value is to literally set money on fire.

Image source: Getty Images.

Dell's growth is set to take off due to the AI server market's potential

(DELL -3.39%) is famous for its personal computers, workstations, and peripherals, but the company is also in the business of cloud computing infrastructure. Specifically, Dell's infrastructure solutions group (ISG) segment includes sales of storage, server, and networking equipment deployed in data centers.

This business has been gaining impressive traction thanks to the rapidly growing demand for AI servers. Dell's ISG revenue segment jumped by an impressive 30% year over year in the first six months of fiscal 2026 (ended on Aug. 1) to $27.1 billion. Sales of servers and networking equipment accounted for 71% of ISG revenue in the first half of FY26, with revenue increasing by 47% from the year-ago period.

At this pace, Dell's revenue from servers and networking equipment WOULD hit $40 billion in the ongoing fiscal year (considering that it generated $20 billion from this segment in the first half). That would translate into a 48% increase from the previous year. However, there is a good chance that Dell could end up doing better than that.

That's because the orders for Dell's AI servers are flowing in at a healthy clip. The company has shipped more AI servers in the first half of fiscal 2026 than in the entirety of fiscal 2025. It received $5.6 billion worth of new AI server orders last quarter, which brought its AI server order backlog to $11.7 billion.

The company is now confident in selling more than $20 billion worth of AI servers in the current year, which would be more than double the revenue it generated from this segment last year. Dell management's belief in the health of its AI server business can be attributed to the expansion of its customer base, as well as the hunger for AI servers capable of running powerful chips.

For instance, Dell is now shipping server racks capable of running's top-of-the-line AI chip systems to CoreWeave. Looking ahead, Dell's partnership with CoreWeave could turn out to be a major tailwind as CoreWeave has been winning new contracts for its AI compute capacity at a terrific pace.

CoreWeave had a revenue backlog of more than $30 billion at the end of Q2, up by 86% from the year-ago period. It has recently won multibillion-dollar contracts from OpenAI,, and Nvidia, which have taken its AI revenue backlog well past the $50 billion mark. This should encourage CoreWeave to invest in more AI capacity, which is exactly what the company has been doing.

In all, sales of servers equipped with AI accelerators are forecast to jump from $144 billion last year to $427 billion next year. That would translate into a compound annual growth rate of 24%. Dell is growing at a faster pace than the market right now, suggesting that its share of this space is improving. So Dell's revenue can get a massive long-term boost thanks to the huge opportunity in AI servers, and that could send its shares flying.

Why Dell can become a multibagger stock

Though Dell's AI business has been growing at a nice clip and the company has an additional AI-related opportunity in the FORM of generative AI PCs, it trades at just 21 times earnings. That's quite cheap considering that it reported a healthy year-over-year increase of 18% in its adjusted earnings in the first half of the year to $3.86 per share.

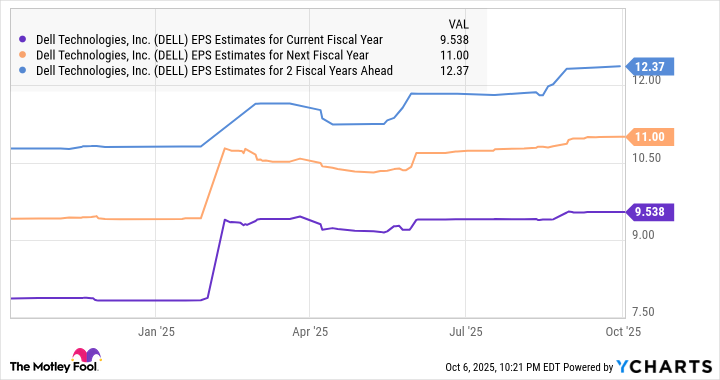

Analysts are projecting Dell's double-digit earnings growth to continue over the next couple of years as well, though don't be surprised to see it outpace their expectations.

DELL EPS Estimates for Current Fiscal Year data by YCharts

Assuming Dell manages to hit Wall Street's expectations of $12.37 per share in earnings after a couple of years and trades at 27 times earnings at that time (in line with the tech-heavyindex's forward earnings multiple), its stock price could hit $334. That would be almost 2.3 times Dell's current stock price, though there is a good chance that it could become a bigger multibagger on account of potentially faster earnings growth, which could lead the market to reward it with a premium valuation.