The Ultimate AI Stock Set to Explode - And It’s Not Nvidia or Broadcom

Forget the usual suspects - there's a hidden AI gem primed for liftoff.

The Real AI Powerhouse You've Been Missing

While everyone chases the same old names, one company quietly builds the infrastructure that makes modern AI possible. Their technology doesn't just compete - it redefines the playing field.

Why This Stock Defies Conventional Wisdom

Market analysts keep pushing the same tired recommendations while missing the actual innovation happening right under their noses. This company's growth trajectory makes traditional tech stocks look like they're moving in slow motion.

The Numbers Don't Lie - But Analysts Sometimes Do

Revenue multiples that would make your average fund manager nervous signal either massive overvaluation or unprecedented opportunity. Smart money says it's the latter.

Wall Street's obsession with quarterly earnings means they consistently miss the companies actually building the future. Meanwhile, this AI stock keeps solving problems nobody else even recognizes yet.

Image source: The Motley Fool.

The share of Arm chips is set to increase impressively

Arm is a British company that doesn't make any chips of its own. Instead, it is known for providing its intellectual property (IP), architecture, development tools, and associated software to chip designers who use it to design central processing units (CPUs), graphics processing units (GPUs), and microprocessors.

Arm receives an up-front licensing fee from customers that develop chips using its architecture. Importantly, the company also receives a royalty from the shipment of each chip that's made using its IP. So it can build a strong stream of revenue and profits in the long run if more companies adopt its architecture.

And that's exactly what's expected to happen. Market research firm IDC projects that sales of Arm-based AI accelerator chips deployed in servers could rise from $32 billion in 2024 to $103 billion in 2029. And sales of non-AI Arm-based chips in servers are expected to rise from $14 billion last year to $31 billion in 2029.

So, the size of the Arm-based server processor market is expected to almost triple over the next five years. Broadcom and Nvidia are going to play a key role in driving this market's growth, and both chipmakers have been using Arm's designs to manufacture their AI chips.

Nvidia, for example, has built its Grace server CPU using Arm's IP. The chip giant has integrated this CPU with its popular Blackwell AI GPUs to create a rack-scale platform for AI training and inference. These systems have been in terrific demand from hyperscalers as well as cloud infrastructure providers as they are being deployed to power AI factories.

According to Nvidia, an AI factory is "a specialized computing infrastructure designed to create value from data by managing the entire AI life cycle, from data ingestion to training, fine-tuning, and high-volume AI inference." The company says that every enterprise is going to need an AI factory for enabling AI reasoning, and that's a reason why the chip designer believes that another $3 trillion to $4 trillion is likely to be spent on AI infrastructure by 2030.

What this means is that Arm's royalty revenue is likely to keep heading higher in the long run as more AI data center chips are made using its architecture. More importantly, Arm's AI catalyst extends beyond data centers. For instance, the company is also on track to capitalize on the deployment of edge AI devices, another fast-growing space where the share of its processors is expected to increase.

And as the shipments of Arm-based processors increase, it should ideally see an expansion in its margins and profits as well.

Higher royalties should translate into robust earnings growth

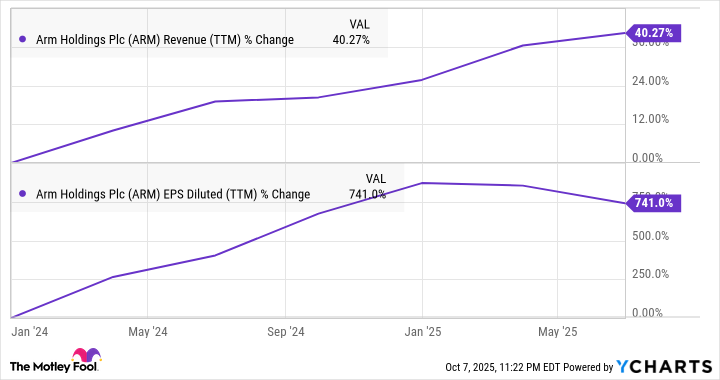

The company's earnings growth has substantially exceeded the improvement in its revenue in the past year and a half.

Data by YCharts; TTM = trailing 12 months.

The company's AI-capable Armv9 architecture, which has been witnessing healthy adoption of late thanks to its advanced computing performance and efficiency, reportedly carries double the royalty rate of the prior generation architecture. What's more, the full-stack compute subsystems (CSS) powered by Armv9 carry even higher royalty rates since they are prebuilt templates that help customers accelerate their chip development cycles.

Management said on the previous earnings conference call that its "first generation of CSS is now in market with five customers and is delivering double the royalty of Armv9." As such, there is a good chance that Arm will be able to maintain healthy earnings growth in the long run.

Analysts predict a 33% increase in Arm's earnings in the next fiscal year, which will be significantly higher than the 14% average earnings growth that theindex is expected to deliver. This trend of higher earnings growth is sustainable considering the points discussed above, which is why investors looking for a growth stock capable of winning big from AI should consider buying Arm before it steps on the gas.