The Quantum Computing Stock Flying Under Wall Street’s Radar - Buy Before The Masses Wake Up

Quantum computing isn't just sci-fi anymore—it's the next trillion-dollar battlefield. While Wall Street chases yesterday's trends, one quantum play quietly builds the infrastructure for tomorrow's financial systems.

The Crypto Connection

Quantum-resistant blockchain protocols are becoming the holy grail. Forget current encryption standards—they'll crumble against quantum attacks. The smart money's positioning in companies developing quantum-safe cryptographic solutions that could render today's security obsolete.

Quantum Meets DeFi

Imagine decentralized finance processing millions of transactions simultaneously. Quantum algorithms could optimize trading strategies, risk assessment, and portfolio management in ways classical computers can't touch. The first mover advantage here could be staggering.

Timing The Quantum Leap

Wall Street analysts still treat quantum like theoretical physics—meanwhile, actual quantum computers are solving real financial modeling problems. Their skepticism creates the perfect entry window before quantum becomes mainstream finance's next buzzword.

Because nothing says 'forward-thinking' like betting on technology that might make today's entire financial infrastructure look like abacuses. The quantum revolution won't wait for traditional finance to catch up—will your portfolio?

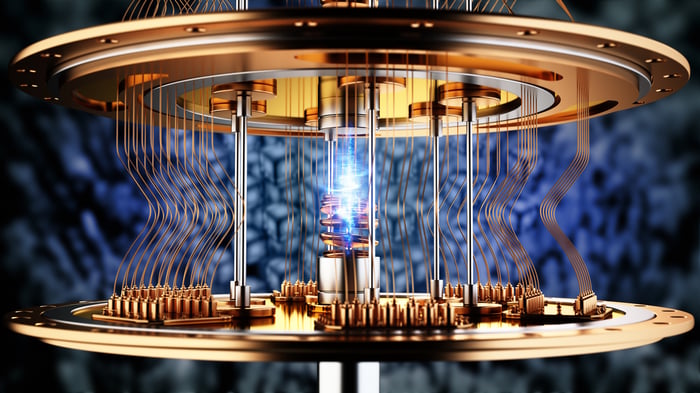

Image source: Getty Images.

Why IonQ is positioned to win

The power of quantum computing over traditional computing will lead to breakthroughs in the coming decades that are unimaginable today. IonQ has an advantage over its competitors with its trapped-ion process.

One of the drawbacks of quantum computing is that some methods of implementing the technology require near-absolute-zero temperatures for the qubits -- the units of information used in quantum computing -- to function. But IonQ's trapped-ion method can operate NEAR room temperature, and therefore speed up the company's ability to commercialize and scale its service.

IonQ has been working on this technology for 25 years, giving it a first-mover advantage in this burgeoning industry. It sells quantum computing hardware and other support services, in addition to its quantum-as-a-service platform. It offers its hardware through leading cloud service platforms, includingWeb Services,Azure, and's Google Cloud. Its revenue surged 67% year over year on a trailing 12-month basis to $52 million.

The company's early lead in commercializing quantum computing is a major advantage that could pay huge dividends for early investors.