1 Unstoppable Crypto Asset That’s Already Crushing Nvidia This Year - Buy Before Oct 29

While Nvidia struggles to maintain its AI hype, this digital asset is quietly posting triple-digit gains that make traditional tech stocks look pedestrian.

The Crypto Outperformer Wall Street Missed

Forget chasing yesterday's winners - this blockchain powerhouse has been steadily building momentum while mainstream investors were distracted by semiconductor drama. The numbers don't lie: it's not just beating Nvidia, it's lapping it.

Why October 29 Matters

Mark your calendar - the convergence of technical indicators and upcoming protocol upgrades creates a perfect storm for continued outperformance. Institutional money is starting to notice what crypto natives have known for months.

Meanwhile, traditional finance analysts are still trying to figure out whether Bitcoin is a currency or commodity - bless their hearts.

This isn't just another pump-and-dump story. The fundamentals are stronger than your average banker's martini, and the chart action suggests this rocket still has plenty of fuel.

Image source: Getty Images.

A century-old real estate brand

Douglas Elliman was founded in 1911, so it has a century's worth of experience navigating peaks and troughs in the real estate market. Today, it employs around 6,600 agents across 111 offices across the U.S., specializing in high-end luxury markets in New York, California, Texas, and more.

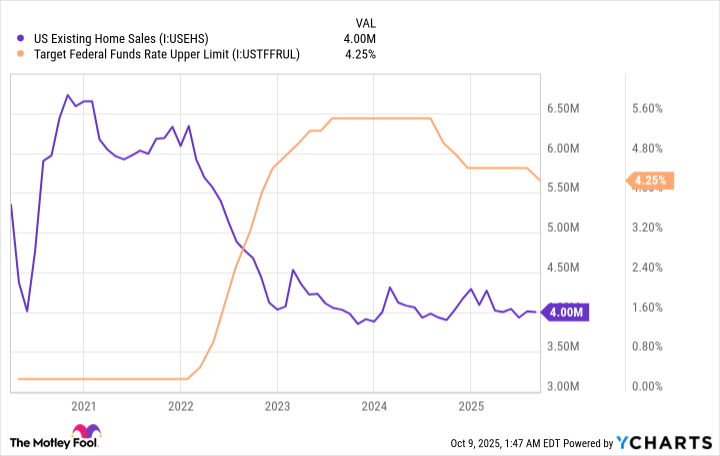

Douglas Elliman sold $20.1 billion worth of real estate during the first half of 2025, so it's on track to exceed its 2024 total of $36.4 billion. That WOULD be an impressive accomplishment considering U.S. existing home sales are near their lowest level in five years, which is a function of the Fed's aggressive interest rate hikes between 2022 and 2023.

US Existing Home Sales data by YCharts

It will take some time for the benefits of interest rate cuts to work their way through the economy, but they will almost certainly spark activity in the housing market eventually. However, Douglas Elliman isn't waiting around, because it has used this sluggish period in the real estate sector as an opportunity to diversify its business.

The company launched Elliman International in June, bringing its prestigious brokerage business to regions like the Middle East, Latin America, and Europe. It then announced Elliman Capital in July, which is an in-house mortgage platform designed to assist buyers with their financing needs, unlocking an entirely new revenue stream.

Douglas Elliman delivered strong financial results in the first half of 2025

Douglas Elliman generated $524.7 million in revenue during the first half of 2025, which was an 8% increase from the year-ago period. The company also carefully managed costs during the first six months of the year, driving an improvement in its bottom line.

Douglas Elliman still lost $28.6 million during the period on a generally accepted accounting principles (GAAP) basis, but that was much better than the $43.1 million loss it generated in the first six months of 2024.

After stripping out one-off and non-cash expenses, the company's adjusted (non-GAAP) EBITDA was actually positive to the tune of $260,000 in the first half of 2025 -- a big improvement from its adjusted EBITDA loss of $14.7 million a year ago.

Douglas Elliman stock looks like a bargain

Douglas Elliman is in a great financial position, because it has $136.3 million in cash on hand with just $50 million in debt -- but it's actually convertible debt that can be swapped for stock at just $1.50 per share in 2029. Since a single share trades for around $2.90 as I write this, Douglas Elliman probably won't have to repay the principal in cash (as things currently stand).

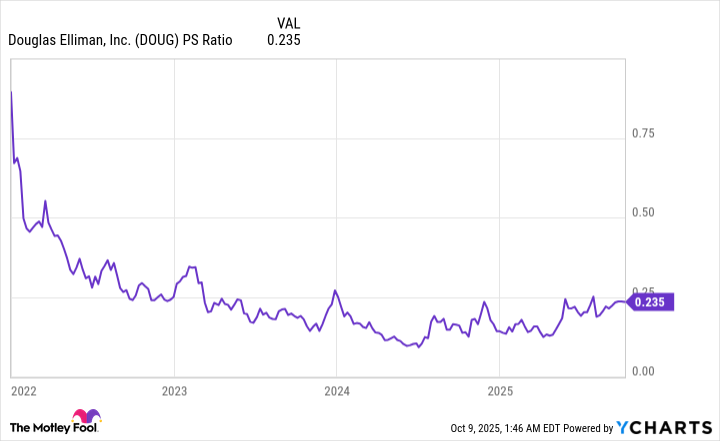

Based on the company's market capitalization of $252 million and its trailing 12-month revenue of $1.03 billion, its stock trades at a price-to-sales (P/S) ratio of just 0.23. If we factor in its net cash position, it looks even cheaper.

Douglas Elliman's P/S ratio peaked at around 0.8 during the last housing boom in 2021. I'm not suggesting it will return to that level, but if falling interest rates drive an acceleration in the company's revenue growth (which is probable), a higher valuation is certainly on the table.

DOUG PS Ratio data by YCharts

Plus, Douglas Elliman stock is cheap relative to some of its peers., which is America's largest residential real estate brokerage company, trades at a P/S ratio of 0.63. That's a 174% premium to Douglas Elliman's valuation. Plus, back in July, residential real estate brokerage powerhouse Redfin was acquired byfor $1.75 billion, representing a P/S ratio of around 1.7 at the time.

One interest rate decision probably won't change Douglas Elliman's fortunes, but it looks like a great buy ahead of Oct. 29 based purely on its attractive valuation, and the momentum in its business. Keep in mind the company reportedly rejected a takeover bid of around $5 per share earlier this year, suggesting management sees significantly more upside from that level.