The Smartest Crypto Growth Play You Can Grab for $30 Today

Crypto's sleeping giant awakens—and it won't cost you a fortune to ride the wave.

The $30 gateway to generational wealth

While traditional finance gurus debate stock picks, crypto's democratizing wealth creation one digital asset at a time. For less than the cost of a fancy coffee, you can position yourself in projects poised to disrupt everything from payments to decentralized infrastructure.

Micro-investments, macro-returns

Remember when Bitcoin traded for pennies? Today's emerging tokens offer that same explosive potential. Fractional ownership means your $30 buys meaningful exposure to protocols that could redefine entire industries.

Beyond the hype cycle

This isn't about chasing memecoins or overnight riches. It's about identifying fundamentally sound projects building real utility—the kind that survives market cycles and regulatory scrutiny.

Wall Street still doesn't get it, but your portfolio will. While they're busy over-engineering financial products, crypto keeps quietly minting the next generation of millionaires.

Why SoFi Technologies has performed well

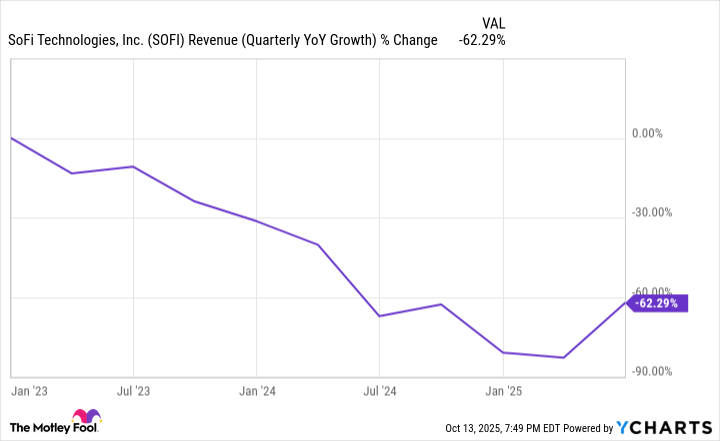

SoFi never had that much trouble expanding, even when its shares were declining. In fact, during the past three years, the company's top-line growth rate has declined, although it remains high.

SOFI Revenue (Quarterly YoY Growth) data by YCharts

But even though revenue is not growing as fast as it once was, SoFi's shares have gained significant traction since 2022. What gives? SoFi's revenue may have been growing at a good clip, but the company was unprofitable. And as interest rates increased, investors were selling off what seemed like speculative, unprofitable companies. Higher interest rates mean the cost of borrowing goes up, which can lead to lower consumer borrowing and spending. These dynamics tend to harm smaller companies with red ink on the bottom line the most. SoFi fit the bill. Or, so the argument went.

Image source: Getty Images.

However, the company has turned things around, swinging to profitability while still expanding. In the second quarter, revenue grew by 44% year over year to $858 million. SoFi's earnings per share soared by 700% to $0.08. Member growth was strong, clocking in at 34% year over year to 11.7 million, while product growth came in at 34% year over year to 17.1 million. Profitable growth is where it's at, and SoFi is providing plenty of that.

The ongoing paradigm shift in banking

Can SoFi keep beating the market? One major argument in favor of the company is that its business model is ideally adapted to modern needs, demands, and preferences, especially those of younger consumers. SoFi is an entirely online bank. That's a significant advantage because there are fewer high fixed costs. Now, some might argue that legacy banking giants are also providing online services. However, SoFi is a digital-first bank, a model that has become popular -- practically the norm -- across many industries.

The data shows that millennials and Gen-Z are substantially more likely than, say, baby boomers, to bank online. Here's the best part. Millennials are still entering their financial prime. Those in Gen Z, however, still have some distance to go before getting there. In other words, as these two groups age, start making more money, and seek out more loans to buy houses and other banking products, SoFi Technologies should benefit. It has become a leading, well-recognized online bank.

This could be an important tailwind for the next decade and even beyond. Now, there are reasons to be somewhat skeptical of the company's prospects. One of them is the company's relatively high reliance on riskier personal loans. That might be a problem in a recession because it exposes the company to significant default risk. Something else to be mindful of is valuation. SoFi's shares are trading at 47 times forward earnings, much higher than the 16.5 average for the financial sector.

At these levels, some of SoFi's success may already be baked into its share price. And any misstep could send the stock tumbling. Even with these potential issues in mind, SoFi Technologies' growing customer base and expanding pool of services make the stock attractive. The company's personal loan borrowers have a weighted average FICO score of 743 and an average income of $161,000. The average salary in the U.S. is less than half of that, and there tends to be an inverse relationship between income and default risk.

In other words, SoFi's clients are in much better financial health than the average, which helps mitigate its exposure to default risk. And even if it encounters some volatility in the short run due to its rich valuation, the company should perform well in the long run as it takes advantage of the evolving banking paradigm. In short, SoFi is an attractive growth stock to buy, especially with its shares trading for less than $30 apiece.