2 Simple ETFs to Buy With $1,000 and Hold for a Lifetime

Forget timing the market—these two ETFs deliver lifetime wealth without the Wall Street circus.

The Set-and-Forget Strategy

With just $1,000, you can build a foundation that grows while you sleep. No stock picking, no panic selling, just steady compounding that makes traditional financial advisors look overpriced.

Why ETFs Beat Crypto Volatility

While crypto swings 20% before breakfast, these ETFs provide the boring-but-brilliant returns that actually build generational wealth. Perfect for investors who prefer their portfolio gains without the cardiac arrest.

The Lifetime Hold Play

Two funds, one simple strategy: buy once and watch decades of market growth work its magic. Because sometimes the smartest move in finance is doing absolutely nothing—except collecting those sweet, sweet dividends.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

The(VOO -0.87%) mirrors the(^GSPC -0.97%), which is the stock market's most followed index. The S&P 500 tracks 500 of America's largest and most influential companies. Although it only contains large-cap companies, it's often used to gauge the overall health of the U.S. stock market and economy.

Investing in VOO gives investors exposure to the trifecta: diversification, blue chip stocks, and low cost. Although VOO isn't as diversified as it historically has been due to the rise in tech valuations, it still manages to contain companies that cover every major U.S. sector.

The companies in the S&P 500 aren't just your average companies, either. Many of them are industry leaders that have stood the test of time. There are exceptions to the latter with newer companies being added to the index, but generally speaking, S&P 500 companies have proven businesses and strong track records.

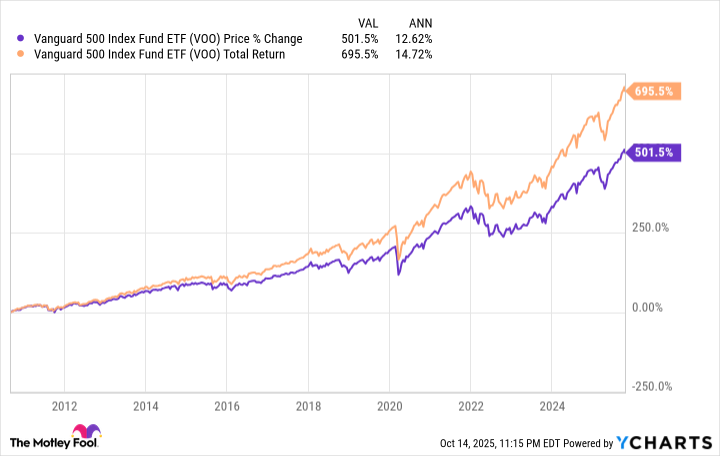

VOO has been a lucrative investment for investors willing to hold on to it for the long haul. Since its inception in 2010, the ETF has averaged over 12% annual returns (over 14% with dividends reinvested), and if the U.S. economy is going to continue in the same trajectory as it has been over the last few decades, there's no reason to believe these average returns should fluctuate much over a longer investment timeframe, preferably in decades.

VOO data by YCharts.

With a 0.03% expense ratio, VOO is also one of the cheapest ETFs you'll find on the market, regardless of type. That's only $0.15 per $500 invested.

2. Schwab U.S. Dividend Equity ETF

Although VOO pays a dividend, it isn't a dividend ETF. On the other hand, the(SCHD -0.97%) is. It's one of the stock market's most reliable dividend ETFs and can be a great option for investors looking for consistent income.

One of the best parts about SCHD is that it has fairly strict criteria to be included. A company must have consistent cash flow, a strong balance sheet, and at least 10 years of dividend payouts. This ensures you're investing in quality companies, rather than just those with a high dividend yield.

As an added bonus, SCHD includes Dividend Kings (a company with at least 50 straight years of dividend increases) like,,, and. That's a testament to the type of dependable companies it aims to include.

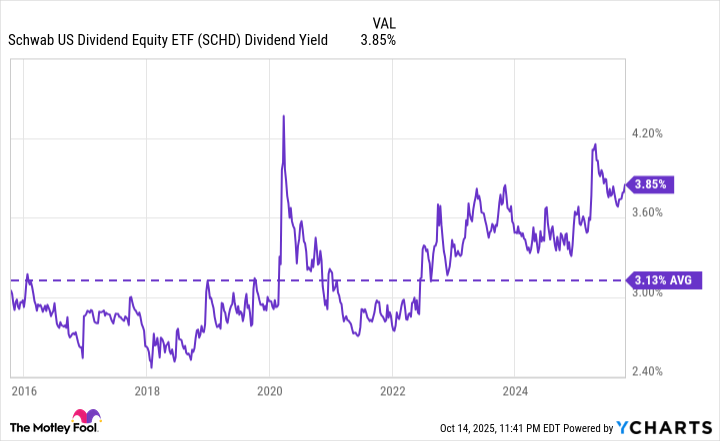

SCHD's current dividend yield is around 3.8%, slightly higher than its 3.1% average over the past decade. If we assume (emphasis on "assume") it maintains a 3.1% average, a $500 investment WOULD pay out around $15.50 annually. Of course, that's not life-changing money, but it adds up over time, especially when reinvested.

SCHD Dividend Yield data by YCharts.

SCHD is also a low-cost ETF choice, with only a 0.06% expense ratio. It might not have the high growth that we've seen from tech-heavy ETFs like VOO, but if you're looking for a long-term investment that can be a valuable part of your portfolio, SCHD checks that box.