Warren Buffett’s Vanguard Index Fund Pick Primed for 37% Surge in Just Over 1 Year, Wall Street Analyst Predicts

Buffett's Simple Bet Defies Market Complexity

The Oracle of Omaha's favorite Vanguard index fund could deliver staggering returns that outpace most active managers' wildest dreams. One Wall Street analyst projects a 37% explosion in value within barely more than a year - numbers that make hedge fund fees look particularly painful.

Index Fund Supremacy Confirmed

While financial advisors complicate portfolios with layers of products, Buffett's straightforward approach continues proving that sometimes the simplest vehicles drive the fastest returns. The projected 37% gain would represent one of the most efficient wealth-building strategies available to mainstream investors.

Wall Street's Reluctant Admission

Even traditional analysts can't ignore the math - when a 37% return appears achievable through a basic index fund, it raises uncomfortable questions about the entire financial advisory industrial complex. The timeline of just over one year adds salt to the wound for underperforming active managers.

Sometimes the best investment strategy involves ignoring most of what Wall Street sells you - and just listening to the guy who's been right for decades.

Image source: Getty Images.

A great way to invest in the broader U.S. economy

The S&P 500 is an index that tracks 500 of the largest and most influential U.S. companies. All 11 major sectors are represented in its components, and the companies in it account for about 80% of all the value in the U.S. stock market, so it's often viewed as a way to invest in the nation's economy. Below is how the weighting of the S&P 500 was divided by sector as of Aug. 31:

- Information technology: 33.5%

- Financials: 13.8%

- Consumer discretionary: 10.6%

- Communication services: 10%

- Healthcare: 9.1%

- Industrials: 8.5%

- Consumer staples: 5.2%

- Energy: 3%

- Utilities: 2.4%

- Real estate: 2%

- Materials: 1.9%

The tech sector makes up so much of the S&P 500 because the index is weighted by market caps. This means that larger companies account for larger fractions of the index, and as the artificial intelligence (AI) boom has sent many megacap tech stocks skyrocketing, they've come to account for an outsized share of the S&P 500's value.

There are a few S&P 500 ETFs that investors can choose from, but my go-to -- and one that Berkshire held in its portfolio until recently -- is the(VOO 0.56%) because of its low cost. Its 0.03% expense ratio means that investors will pay only $0.30 per year for each $1,000 they hold in the fund.

Why analysts think the S&P 500 could soar by 37%

At the time of this writing, the S&P 500's level is 6,552, while the Vanguard S&P 500 ETF's share price is just over $600. (Indexes don't have prices, but the ETFs that track them do.) Emanuel from Evercore ISI predicts that a bull-market bubble could lift the S&P 500 to 9,000 by the end of 2026. That 37% increase would put the VOO's price at close to $825.

The basis for this bullish bubble prediction is that AI adoption will continue to drive growing earnings for S&P 500 companies, which should improve investor sentiment. The more optimistic investor sentiment becomes, the more likely investors are to continue putting money into S&P 500 companies and pushing the index's valuation up.

A history of attractive returns

One thing remains true about the stock market: Nobody can reliably predict how stocks or ETFs will perform, particularly in the NEAR term. Not me, not you, not Buffett, and not any Wall Street analysts. However, an investment's past performance can provide insights into its potential -- especially when it has been consistent over the long term.

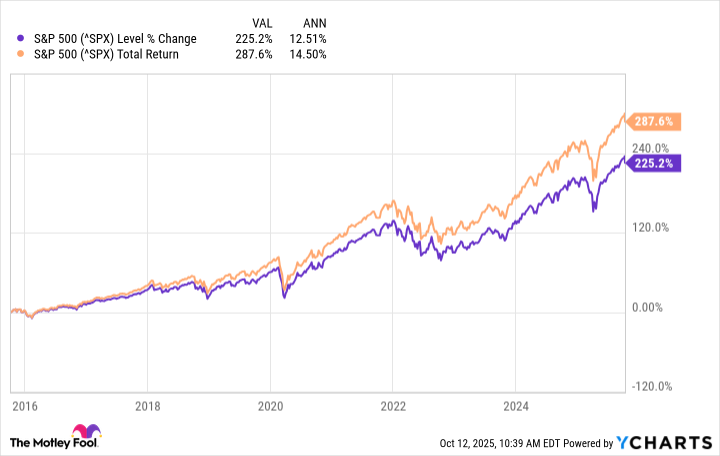

The S&P 500 has historically averaged annualized returns of around 10% over the long term. Over the past decade, its returns have been even more impressive, averaging 12.5% -- and 14.5% when including reinvested dividends.

^SPX data by YCharts

These returns are less than the predicted 37% gains over the 14 months or so, but they have still been impressive, and investing in S&P 500 index funds has made many investors some pretty good money over the years.

Regardless of whether the VOO hits Emanuel's ambitious target by the end of 2026, it's an investment that could be a staple holding in virtually any portfolio.