This Crypto Asset Is Primed to Become the Next Dividend King of Digital Finance

Forget traditional stocks—this digital asset is rewriting the rules of passive income generation.

The Protocol That Prints Money

While Wall Street struggles with dividend cuts and shrinking yields, this blockchain protocol consistently distributes rewards to token holders. Its automated reward system bypasses traditional financial intermediaries—no board approvals, no quarterly uncertainties.

Tokenomics That Actually Work

The mechanism burns tokens with every transaction while redistributing percentage-based rewards directly to holders' wallets. It's like getting dividend payments that compound automatically—without the paperwork or the hedge fund managers taking their cut first.

Decentralized Finance's Answer to Passive Income

Traditional dividend investors chase 3-4% yields while this protocol delivers double-digit annual percentage returns through its staking mechanism. The best part? No waiting for ex-dividend dates or worrying about corporate earnings calls.

Because let's be honest—if traditional finance worked this efficiently, your broker wouldn't need that third vacation home.

The next consumer-focused Dividend King

In the consumer market, the next one on track to reach this point is(MCD 0.86%). The fast-food giant offered its first dividend in 1976 and has increased its payout every year since.

Its last increase, which occurred late last year, took its dividend to $7.08 per share, a 6% increase from the previous year. Shareholders who invest now will earn a dividend yield of about 2.3%, nearly double the 1.2% average for the. For longer-term shareholders, the yield is significantly higher due to the rising dividend.

Moreover, this is around the time when the company typically announces payout hikes. Assuming that trend holds, the upcoming increase will be the 49th, and another boost in the fall of 2026 WOULD make McDonald's a Dividend King.

Also, the payout appears sustainable. Over the trailing 12 months, the company distributed $4.66 billion to shareholders in the FORM of dividends. During that time, it generated $6.90 billion in free cash flow, leaving $2.24 billion for share repurchases or investments in its business.

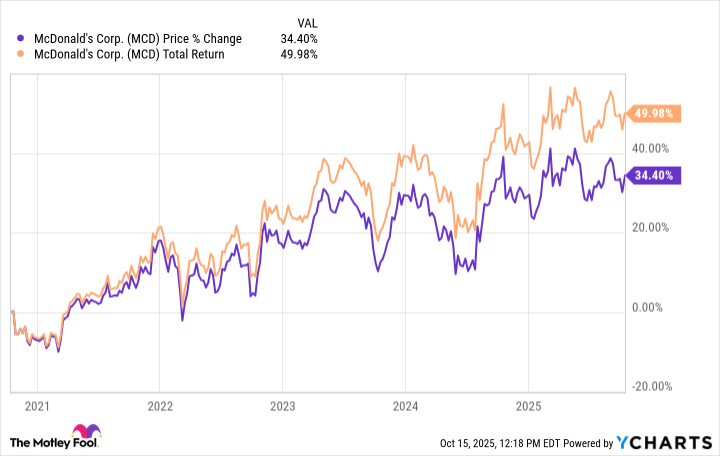

The dividend is a significant source of returns in owning McDonald's stock. Over the last five years, the share price has risen by about 35%. Thanks to the dividend, the total returns amounted to around 50% during that time.

MCD data by YCharts.

Still, the more conservative approach may come at a cost. Even though shareholders made significant gains during that time, the S&P 500 had a total return of 105%. McDonald's has far outperformed the index since 1990, boosting its longest-term shareholders, but the company's huge size may mean slower percentage growth from here.

How McDonald's does it

Dividend investors will also like that McDonald's business strategy leaves it in position to generate strong free cash flow. Just under 95% of the company's 44,000 locations are franchises. The company charges new franchisees an initial fee, as well as costs associated with building and launching the restaurant.

McDonald's owns these restaurant buildings, making the company one of the world's most notable landowners. It will then collect between 4% and 5% of sales in royalties and a 4% marketing fee, along with other annual fees.

Since many of these costs are fixed, the company is less affected by economic fluctuations that may impact sales. That has likely helped put it in position to hike its dividend even in some of the worst economies.

McDonald's as a Dividend King

McDonald's is on track to attain Dividend King status by late next year, and more importantly, it is in a strong position to hold it.

Its size may slow its growth in the future, which might make it a less desirable holding except for longer-term and income-focused investors.

Nonetheless, the company's franchise-focused business model boosts investors and brings a steady source of revenue, even in more challenging times. That should keep its free cash FLOW steady and allow it to afford its payout and future increases.

As long as McDonald's remains a desirable choice for franchise owners and customers, its attainment of Dividend King status should bolster the consumer discretionary stock's appeal to income investors.