Vanguard ETF Primed for 39% Surge by 2026 - Wall Street’s Top Analyst Reveals Bullish Prediction

Wall Street's elite are placing their bets on one standout Vanguard ETF that could deliver massive returns before 2026 closes.

The 39% Growth Catalyst

Top-tier analysis points to specific market dynamics and sector rotations that position this particular fund for explosive growth. Traditional financial instruments are finally catching up to the innovation pace set by digital assets.

Why This Timing Matters

With institutional money flooding into strategic ETF positions, the convergence of traditional finance and forward-looking asset allocation creates a perfect storm for growth. Meanwhile, crypto continues to prove that decentralized finance doesn't wait for Wall Street's permission to innovate.

As one analyst quipped: 'Traditional finance always arrives late to the party - but at least they're finally showing up.' The question remains whether 39% will be enough to keep pace with crypto's regular triple-digit moves.

Image source: Getty Images.

Vanguard is one of the oldest and most trusted ETF managers, and invented the index fund, or a type of ETF that tracks an index like the(^GSPC 0.53%). While an S&P 500 index fund might be the Gold standard in ETFs, some Vanguard ETFs have outperformed the S&P 500, especially during the recent AI boom.

In fact, there's one Vanguard ETF that is expected to outperform over the next year, and one Wall Street analyst even sees it jumping 39%.

Meet the Vanguard Growth ETF

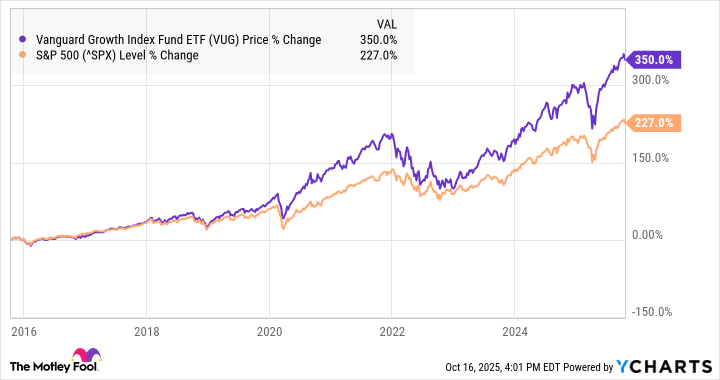

The(VUG 0.56%) has historically been a top performer on the market. As you can see from the chart below, the Vanguard Growth ETF has handily outperformed the S&P 500 over the last decade.

Data by YCharts.

As you can see, the VUG has typically outperformed the S&P 500 in bull markets, but underperformed in bear markets such as in 2022.

Over the last decade, that's proved to be a winning combination as stocks have soared. Wall Street expects that to continue over the next year as the average price target calls for the index to gain 15%, compared to just a 13% return for the.

What's in the Vanguard Growth ETF?

An ETF is only as good as its holdings, so it's important to understand what's in the Vanguard Growth ETF. Its top holdings are similar to what you'd find in the S&P 500, but with higher concentrations. The ETF, which tracks theIndex, holds 160 stocks, focusing on large-cap growth companies. Currently, 62% of the index is in the technology sector, and its top eight holdings can be classified as tech stocks. Those are, in order of allocation,,,,,,,, and.

Those eight stocks, which represent the "Magnificent Seven" in addition to Broadcom, make up close to 60% of the index.

Can the Vanguard Growth ETF jump 39% over the next year?

The Vanguard Growth ETF looks poised to be a winner, especially if the stock market continues to MOVE higher, but a 39% gain may be a stretch even for a fund that is stacked with the top-performing tech stocks.

The ETF jumped 46% in 2023, and then another 32% in 2024, and is up 16% year to date. The 46% gain in 2023 shows a 39% jump in a year can be done, but that was in the early stages of the AI boom when tech stocks were beaten down following the 2022 bear market.

Today, the VUG is significantly more expensive, trading at a price-to-earnings ratio of 41.

That, along with questions about an AI bubble and a weakening job market, means the fund is unlikely to jump 39% over the next year. However, given its track record and the strength of its top holdings, the VUG still looks like a buy for top investors.