Nvidia’s Jensen Huang Drops Bombshell for Meta Investors—Is It Too Good to Be True?

Nvidia CEO Jensen Huang just sent shockwaves through Meta’s investor base—but is the hype justified? The tech titan’s latest comments have Wall Street scrambling, blending AI optimism with classic market theatrics.

Here’s why Meta bulls are celebrating… and why skeptics are rolling their eyes.

The AI Gold Rush 2.0

Huang’s bullish stance on next-gen AI infrastructure directly benefits Meta’s metaverse ambitions. With Nvidia’s chips powering the backbone of virtual worlds, Zuckerberg’s empire gets a stealth boost—on paper.

The Catch? Follow the Money

While GPU demand screams ‘moonshot,’ remember: every silicon boom creates bagholders. Meta’s track record of burning cash on unproven tech suggests this ‘good news’ might just be another excuse to sell the next earnings dip.

One thing’s certain—when tech CEOs talk, markets move. Whether that movement lasts longer than a crypto meme coin? That’s the real trillion-dollar question.

What did Huang just say about Meta?

In a video clip shared on social media, Huang shares his thoughts around Meta's recent hiring spree and the reported hundred-million-dollar signing bonuses.

Huang said that a team of roughly 150 researchers and appropriate funding could potentially go on to build a rival platform to OpenAI's ChatGPT. To back up his claim, he explained that several existing AI models that compete with ChatGPT were built by a team of similar size to what Zuckerberg is reportedly assembling through the creation of Meta Superintelligence Labs (MSL).

On the surface, this sounds like Meta just earned a vote of confidence from Nvidia, once referred to as the "godfather of AI." But is that really the case?

I think there might be more than meets the eye to Huang's comments.

Image source: Getty Images.

What Huang didn't say

As a private company, OpenAI is not required to publish its financials or operating metrics. However, according to reports from CNBC, OpenAI now has 3 million paying enterprise customers and $10 billion in annual recurring revenue (ARR). To put this into perspective, OpenAI's ARR was estimated to be around $5.5 billion last year.

Those numbers show the company has nearly doubled its ARR base in less than a year, underscoring OpenAI's ability to acquire customers and accelerate its growth trends despite intensified competition from other large language models (LLM) from Anthropic, DeepSeek, and Alphabet, for example.

These nuances matter because Meta Superintelligence Labs won't just need to launch something, it will need to prove that it can weather challenges across product execution, customer acquisition, and competing with incumbents with strong first-mover advantages.

Although Huang appears confident that more companies will introduce products that compete directly with OpenAI, I WOULD say that his comments fall short of an explicit endorsement of Meta, per se. Rather, I think he's more simply implying that Meta has been investing strategically in its quest to conquer the AI landscape.

Is Meta stock a buy now?

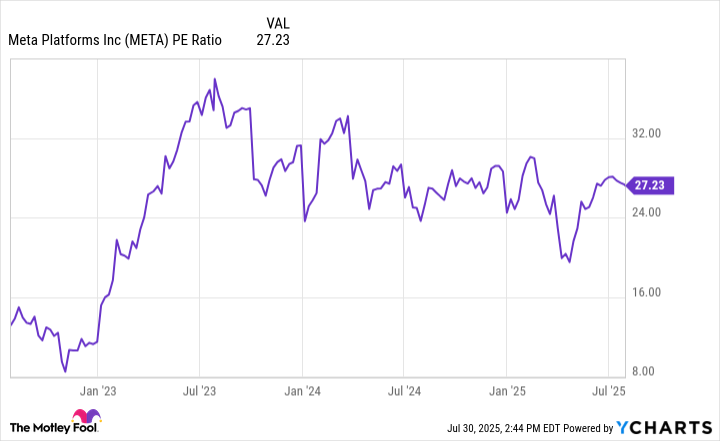

As the chart below illustrates, Meta experienced sizable expansion in its price-to-earnings ratio (P/E) a couple of years ago. During this period, management implemented significant cost reductions, particularly in the metaverse division. It made a strategic decision to reallocate these savings into AI initiatives.

META PE Ratio data by YCharts.

Given the trends above, I'd say that investors welcomed the shift from the metaverse to AI and began pricing in some of the upside. However, over the last 18 months, Meta's P/E levels have pulled back considerably.

In my eyes, this valuation reset suggests that investors may not fully appreciate the foundation that Zuckerberg and the management team laid a couple of years ago. In other words, the market may have prematurely bought up the stock, only to discount the long-term upside of the AI opportunity now.

With the creation of Meta Superintelligence Labs and a roster of all-star talent ready to build and launch new AI-powered services, Meta could be on the cusp of a massive transformation that remains discounted from a valuation standpoint.

At its current levels, I see Meta stock as a no-brainer buying opportunity at these prices as I think the company's upside from AI is largely discounted right now.